This post was originally published on this site

Source: techcrunch.com

Investment Thesis

As Facebook’s (NASDAQ:FB) ARPU (average revenue per user) in its core Facebook and Instagram properties reaches maturity over the coming 3-5 years, the company and its leader must look elsewhere for growth. With this in mind, Zuckerberg and co. have been strategically building new channels through which the company will be able to fuel growth in the future.

And these are not just your everyday growth initiatives (as Facebook dates or Facebook’s version of Zoom (NASDAQ:ZM) might be). These initiatives could revolutionize, for example, the global payments industry.

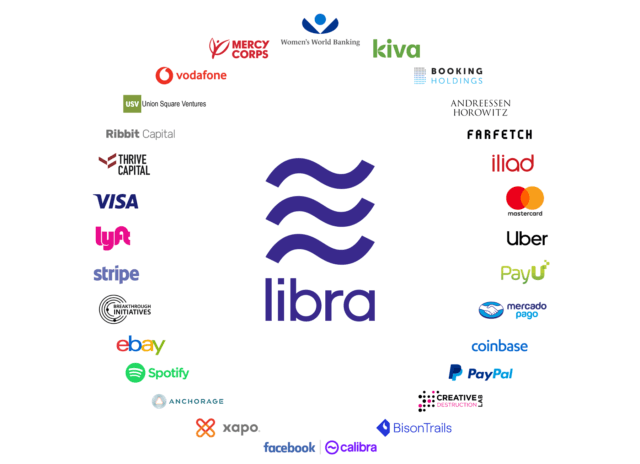

To put today’s investment thesis succinctly, Facebook could engineer a global payments network, such that users verify themselves via their Facebook profiles, which thereby logs them into their digital wallets (Calibra Wallet), which will be coupled with a communications platform, i.e., WhatsApp, where users will have the ability to transact in Facebook’s digital currency, Libra.

Now, if you haven’t heard of Libra, here’s a quick video to introduce you to the digital currency plan Facebook recently (in the last year or so) introduced:

Source: YouTube

As you watched above, Facebook’s Libra could revolutionize the way global payments are transacted. For many of us in 1st world countries, it’s not immediately apparent what this could do for billions of people. To this end, we will explore the immediate opportunity Facebook could capture via the rapidly growing remittances market, in the center of which Facebook and its WhatsApp property operate.

A Captive Audience Awaits

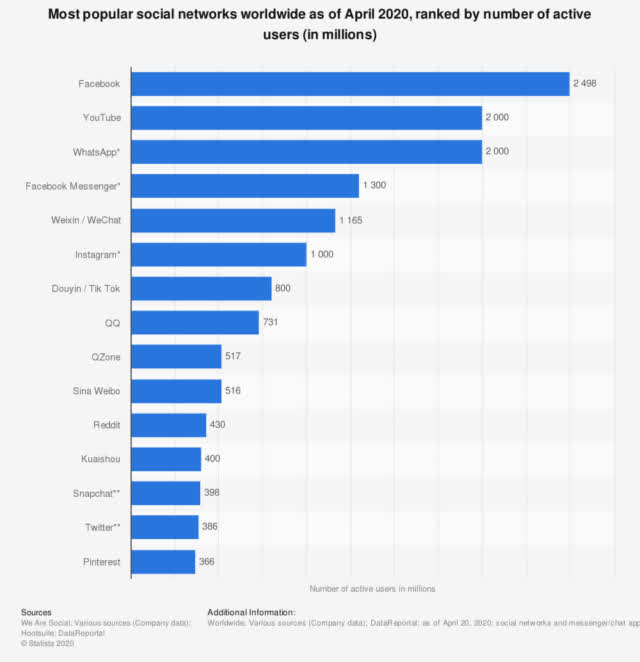

Now, anyone can create a payments app. There are countless of them out there, i.e., Venmo (PYPL), Zelle, Cash App (SQ), FB Messenger, Apple Cash (AAPL), etc. But none of these companies (aside from Facebook) currently have billions of users operating on 1-2 apps daily for a variety of reasons (whether for communication or for community).

Source: sproutsocial.com

As the above chart illustrates, Facebook owns 4 out of the 7 most popular social networks in the world, which provides fertile ground for its global payments system to blossom.

This is what separates Facebook from the countless competitors in this space, many of whom would fall by the wayside, should Facebook decide to truly execute this vision.

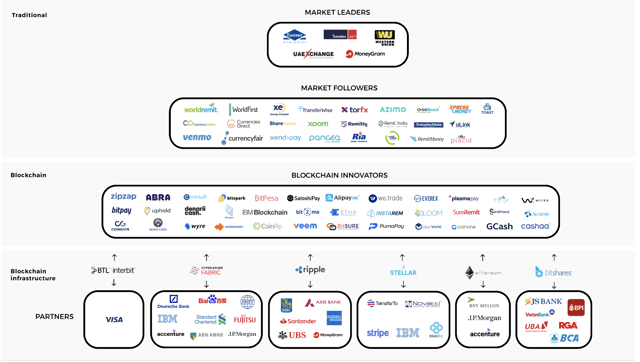

Source: Blockdata

As can be seen above, there are already many participants leveraging blockchain/digital currencies to capitalize on the rapidly growing remittance market.

But Facebook’s moat lies in the following…

The WhatsApp Wallet (Calibra Wallet)

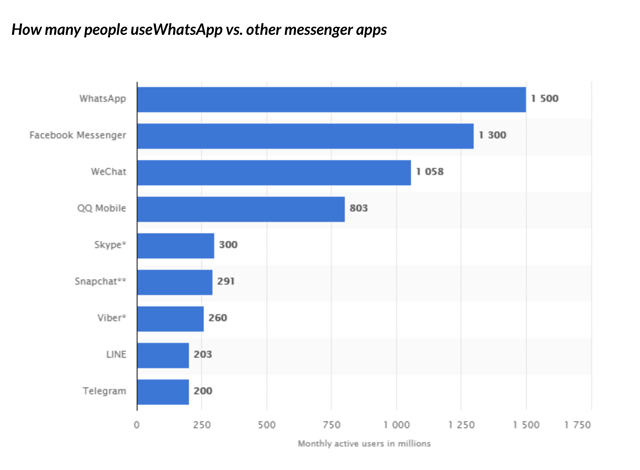

WhatsApp was acquired by Facebook in February of 2014 for $19B and is a messaging app that allows people to communicate internationally without a specific international plan, which can be prohibitively expensive. The app is used by over 2 billion people in approximately 180 countries. Moreover, approximately 1 billion people use the app daily.

As can be seen below, WhatsApp is the most popular messaging app on earth. Though these numbers are somewhat outdated, the picture of dominance has not changed.

In 2018, WhatsApp Pay was released as a beta version in India, but it will be released to all of India by the end of this May. This release will be complemented by Facebook’s investment in Reliance Jio, which is currently developing a super app, the likes of which might be similar to WeChat.

The Multi-Trillion Dollar Remittance Opportunity

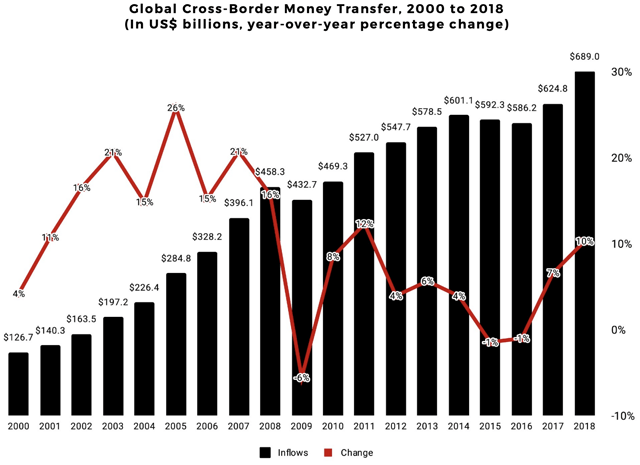

As the world continues to globalize (and it will despite momentary setbacks a la COVID-19), the remittance market will continue to soar higher. I view this as the primary and immediate opportunity for Facebook’s payment network (Libra) to capture. I believe that Facebook, Oculus, and Libra could become much more, but I will discuss that in the next section. For now, let’s focus on the remittance opportunity.

As can be seen below, cross-border money transfer continues to rocket higher.

Source: Blockdata

Remittances have increased at a 12% CAGR since 2000 and are expected to surpass $1.4 trillion by 2025. Now, Facebook could capture three-fourths of the remittances market by 2030, which would about to likely a couple trillion dollars; however, due to the lack of fees charged by Libra, Facebook wouldn’t necessarily be raking in the dough as Western Union (NYSE:WU) does currently. Facebook would charge next to nothing for users to transact via Libra, but this would ensure users of WhatsApp/Calibra Wallet would be trapped in the Facebook ecosystem.

Users would be more inclined to consume content on Facebook, as they’d likely be required to register simultaneously for Facebook and WhatsApp/Calibra in order to take advantage of the coming super app.

Moreover, as the ecosystem becomes more and more sticky (stickier than its current state), Facebook would find new ways to monetize its users.

Reliance Jio: Further Evidence Of The Coming SuperApp

The Reliance Industries competes for the title of India’s largest private sector company, and its Jio Platforms is a telecommunication network in India that has captured 32% of the Indian market as of the first month of 2020.

Recently, Facebook bought a 9.9% stake in Reliance’s Jio Platforms and will be able to reach almost all current mobile users in India through one of their communication channels, i.e., WhatsApp or FB Messenger. Facebook already has a large market in India, and this will continue to increase as the country further develops.

I have little doubt that Facebook plans to use India as a testing ground for the creation of a super app, after which it will release it to more and more major markets, including the U.S. (though this will almost certainly come with massive government backlash, as it could disintermediate many inefficient, albeit entrenched, interests who might shout monopoly).

A Virtual Marketplace Created By Oculus

Now, this is a vision that’s a bit further out, but nevertheless attainable.

Imagine this:

In the future, Facebook will leverage its Oculus system to enable users to put on the Oculus headset and enter a virtual marketplace or virtual city. In this virtual reality, users will be able to meet and greet with all of their friends through virtual experiences. Transactions will occur in Libra, which will be neatly linked via Facebook/WhatsApp/Calibra Wallet.

This may sound farfetched, but I think we can all agree Zuckerberg isn’t just haphazardly purchasing companies and purchasing stakes in companies.

Far from it. The man knows exactly what he’s creating, and it’s only a matter of time (and an assurance that governments don’t destroy his vision) before it comes to fruition.

So, What Is Oculus Exactly?

Oculus is a virtual reality system that allows users to experience a variety of realities through a headset. Facebook acquired the company in 2016 for $2 billion, and I believe that the acquisition will prove to be just as fruitful as Instagram or soon-to-be WhatsApp. Whether you want to go on a virtual roller coaster, go to a virtual museum, or have a virtual meeting with a group of clients, you will be able to have those experiences with Oculus.

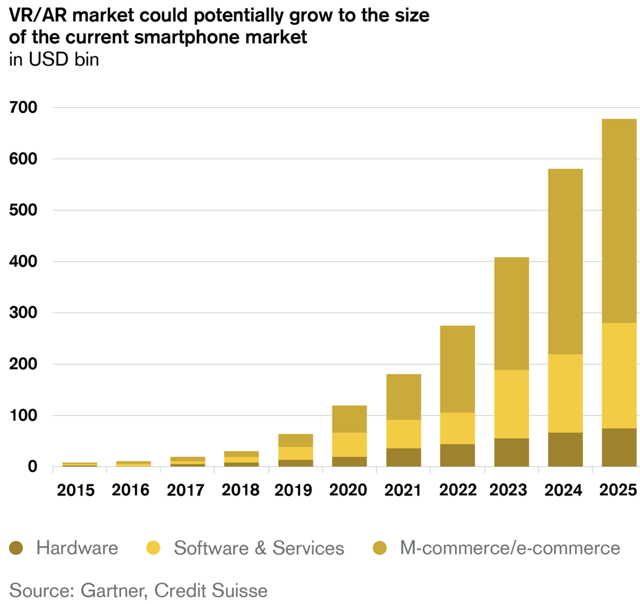

Source: credit-suisse.com

Whether Facebook executes the vision I set forth in the previous paragraphs may prove to be completely immaterial as the above graph illustrates.

Whether Facebook leverages Oculus to enhance Facebook Groups or Facebook Meetings for business or Facebook Marketplace, and the list goes on and on, is yet to be seen.

Furthermore, Oculus may simply perform only as a gaming unit, or a combination of a gaming unit and a productivity tool, as a computer performs.

We can’t be entirely sure how Oculus and VR will be monetized, but with Zuckerberg at the helm, and the government at bay, the opportunity is truly immense, and it could mean that Facebook is truly just getting started.

L.A. Stevens Valuation Model

To determine a fair value for Facebook’s stock, we will employ my proprietary valuation model. Here’s what it entails:

- Traditional discounted cash flow Model using free cash flow to equity discounted by our (as shareholders) cost of capital.

- Discounted cash flow model including the effects of buybacks.

- Normalizing valuation for future growth prospects at the end of the 10 years (3a.). Then, using today’s share price and the projected share price at the end of 10 years, we arrive at a CAGR. If this beats the market by enough of a margin, we invest. If not, we wait for a better entry point.

Now, let’s check out the results!

Assumptions:

|

Assumption |

Value |

|

Free cash flow per share |

$8.1 |

|

Free cash flow per share growth rate |

15% |

|

Terminal growth rate |

2% |

|

Years of elevated growth |

10 |

|

Total years to stimulate |

100 |

|

Discount Rate (Our “Next Best Alternative”) |

9.8% |

And here are the results!

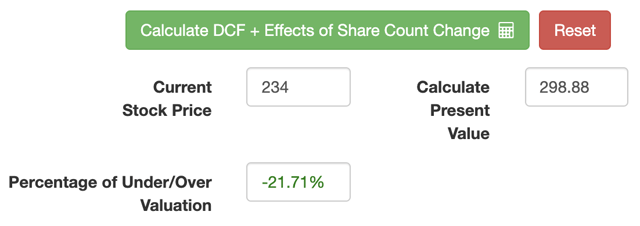

Source: L.A. Stevens Valuation Model

Notably, I chose 15% annualized growth in FCF to equity per share. Now, some of you might be thinking: “That’s awfully optimistic.”

And, honestly, I might be inclined to agree with you, were it not for the enormous free cash flow the company is presently generating and its ability to generate an ROI on this cash with Facebook’s visionary founder at the helm.

Furthermore, if Facebook were to simply take its cash hoard and the future free cash flows it generated over the next 10 years, and with that money, buy back a large portion of its float, it would create a scenario such that FCF to equity per share would grow at ~15% even if actual growth was in the high single digits or low double digits (i.e., 10-12%).

Therefore, I chose 15% and went light on the reduction in shares outstanding (using an assumption of a reduction of only 10%).

Of course, a DCF answers whether a stock is under or overvalued presently, but it gives us nothing with respect to what we can expect as future returns. For that, we must employ step 3 of the model.

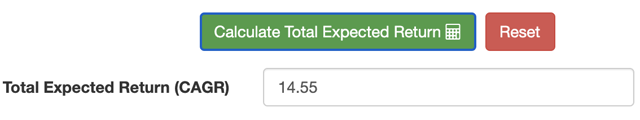

And here are the results!

Source: L.A. Stevens Valuation Model

Therefore, if one were to buy at $235, they could expect approximately 15% annualized returns, which is well in excess of our hurdle rate, i.e., the rate of return of the S&P 500 Index Fund.

For this reason, I rate Facebook a buy at $235 and below.

Concluding Remarks

Facebook still has room to grow its present core platforms, i.e., Facebook and Instagram, which will fuel free cash flow per share growth over the coming five years.

But that will be the easy part. Facebook is currently marshaling its resources, or perhaps arraying its forces if you will, such that it soon will embark on its latest campaign to conquer the social media space.

I have often discussed the “digitization of reality”, and there might be no better company out there positioned to create this digital reality than Facebook.

As always, thanks for reading; remember to follow for more, and happy investing!

Beating the Market: Education, Returns, and Community

Did you find our analysis compelling? Would you like more in-depth, institutional quality analysis, alongside many more incredible, potentially market-beating opportunities?

At Beating the Market (my Marketplace Service), we find dividend payers, high-growth stocks, and a mixture of the two. My stock picks will not only help you achieve your financial goals, but also, they often beat the market.

So start your free two-week trial today to begin beating the market and achieving your financial goals!

Disclosure: I am/we are long FB, AAPL, ZM, GOOG. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.