This post was originally published on this site

If you think U.S. interest rates will continue climbing, the best bond-investing strategy may be to buy and hold.

That doesn’t make sense on the surface, since bonds decline in value as interest rates rise. But few bond-fund managers can outperform a simple buy-and-hold approach. This is true even during periods in which the overwhelming consensus among bond experts is that interest rates will rise.

Take last year, for example. The 10-year Treasury yield

TNX,

TMUBMUSD10Y,

at the beginning of 2021 stood at 0.92%, and there was widespread certainty that interest rates had nowhere to go but up. Sure enough, the 10-year Treasury yield ended 2021 at 1.51%. Yet a large proportion of actively managed bond mutual funds in 2021 still failed to do as well as a straight buy-and-hold strategy.

This is surprising because beating a bond-index benchmark should be relatively easy when rates are rising. All a fund manager needs to do, within the range of durations it’s allowed to invest in, is keep its duration as short as possible.

Consider funds in the short-term U.S. government bond category, which encompasses funds whose average duration falls between about one- and three years. An actively managed fund in this category could have beaten its benchmark simply by keeping its average duration at or near the one-year end of that range. Nevertheless, according to S&P Global’s SPIVA scoreboards, 73.68% of the actively managed funds in this category lagged their benchmark in 2021.

The proportion trailing a buy-and-hold strategy isn’t this low in every calendar year. But over longer periods of time the number of actively managed funds lagging a buy-and-hold approach becomes almost overwhelmingly high.

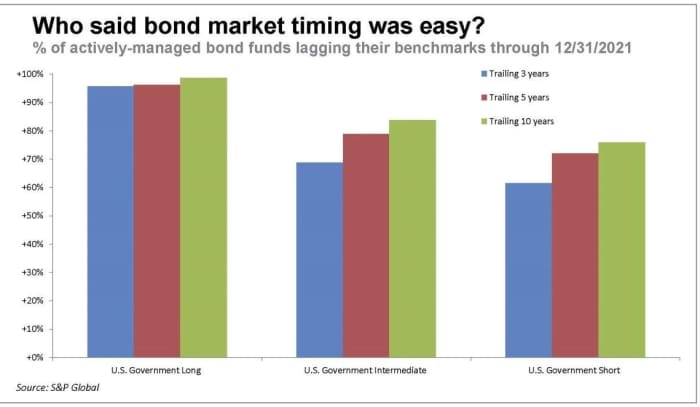

This is illustrated in the chart above, which reports the proportion of various categories of actively managed U.S. government bond funds that lagged their benchmarks through the end of last year. At the 10-year horizon, the percentages range from 76% to 99%.

Short-term bond timing

The struggle that bond funds had last year should give pause to those who believe that bond-market timing is relatively easy, especially during periods of rising rates. Further evidence comes from the Hulbert Financial Digest’s (HFD) tracking of bond market timers, which has found that extremely few of them beat a buy-and-hold investor over the long term.

For purposes of this tracking, the HFD assumed that each of 88 separate bond strategies could choose between just two investments: a bond-market index fund and a money market fund. As a result of this tracking methodology, the only source of differences in their returns would be their managers’ decisions about when and by how much to shift allocations between the market and cash. Just five of these 88 strategies — 5.7% — beat buy-and-hold over the periods for which the HFD has performance data.

Volatility — a market-timer’s best friend

There’s another reason why you should be dubious of claims that bond-market timing should be relatively easy: The bond market is not very volatile, and successful market timing depends on market volatility.

Consider the relative volatilities of the stock-, gold- and bond markets. As judged by the standard deviation of monthly returns over the past four decades, the bond market is 66% less volatile than the stock market and 68% less volatile than the gold market. So to that extent successful market timing will be even less likely in the bond market than in either the stock or gold arenas.

The bottom line? Unless you have good reason to believe you can beat the overwhelming odds stacked against you, simply pick your target bond allocation and then stick with it through thick and thin.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

Also read: The yield curve is speeding toward inversion — here’s what investors need to know