This post was originally published on this site

Evofem Biosciences (EVFM) had their big moment of FDA approval for a highly anticipated female contraceptive on Friday. Despite the news coming after hours on a Friday of a holiday weekend, shares were up over 60% in after-hours trading. The approval comes after being rejected by the FDA previously and years of clinical testing. Shares should see heavy volume and will could test double digits during the short trading week. The approval of the first non-hormonal contraceptive for women in decades is a big win for women around the world and shareholders of Evofem.

(Picture: Company Website)

(Picture: Company Website)

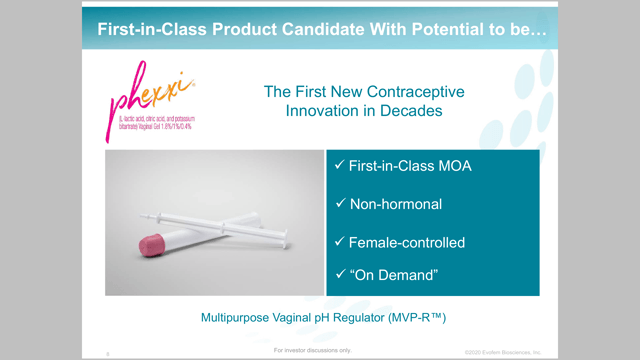

Phexxi, a non-hormonal vaginal gel, was approved by the FDA on Friday. Lisa Rarick, former FDA Division Director and Evofem board member had this to say, “During my 15-year career at the FDA, I participated in the review and approval of many sexual and reproductive health products, and I believe that Phexxi serves a true unmet need in contraception. Phexxi offers women protection and control – on their terms, and at their discretion – without the use of hormones.”

Evofem CEO Saunra Pelletier said, “Women now have access to a non-hormonal contraceptive option that they control, on their terms to be used ONLY when they need it”.

Phexxi is a vaginal gel that uses an on demand method and is the only hormone-free, female controlled prescription contraceptive gel. The gel, which can be administered an hour or less before intercourse, acts as a ph regulator to maintain a level between 3.5 and 4.5, an inhospitable environment for sperm.

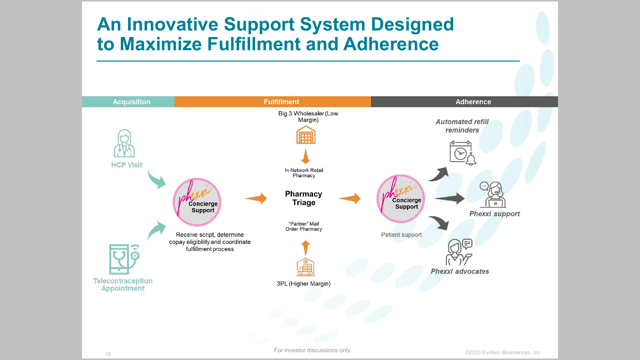

Evofem expects to launch Phexxi in September with a concierge experience to target patients and healthcare providers. A robust telemedicine program is expected from the company to make it as easy as possible for Evofem to gain market share. The telemedicine will speed and simplify the process. The concierge service will help customers determine insurance coverage, out of pocket costs, provide counseling support, send refill reminders, and even help get prescriptions delivered right to a customer’s door.

Pricing for a box of 12 gel capsules is expected to be $250 to $275. The company believes the gel will be covered under the Affordable Care Act as a method of birth control. This would mean the contraceptive would be free or cheap for many Americans. Evofem lists a possible coverage of 80 to 90% of women with ACA approval.

The Phase 3 trial called Ampower studied the results of 1400 women aged 18-35 across 115 U.S. centers. The gel met safety endpoints and pre-determined endpoints. More than 34,000 sexual acts were part of the study. There was low discontinuation rate during the trial (1.9%), which could be a strong sign that people who take a chance on Phexxi will stick around. Women who used Phexxi also said they saw a 45.5% increase in sexual satisfaction, compared to 16.9% from the placebo.

Company

Evofem is “passionately committed to addressing the changing needs of women everywhere”. The company is targeted contraceptives and sexually transmitted diseases. Over 85 million unintended pregnancies happen annually worldwide. More than one million STIs are acquired every day worldwide.

The team at Evofem has a history of developing and commercializing women’s health products. This includes products like Mirena, Plan B, One-Step, Yasmin, Nuvaring, Paragard, and Seasonique. Russ Barrans, the company’s Chief Commercial Officer, helped bring Mirena to market and was also credited with making Plan B an over the counter option for women post intercourse.

The company’s CEO has been profiled by several newspapers and magazines. This piece by Inc. highlights her rise as a non-profit leader, to talking executives into running a non-profit and profit company simultaneously. For investors looking at this company, it is well worth the read to see some of the drive behind the company’s CEO and her personal connection to women’s health.

Contraceptive Market

The contraceptive market in the United States is listed at $5.5 billion. (Reuters)This market is dominated by male condoms and birth control pills.

The only current non-hormonal contraceptive on the market is copper based intrauterine such as ParaGard. This device often comes with heavier bleeding and cramps.

WebMD has compiled a list of reasons some may choose not to use hormonal contraceptives, which includes: (WebMD)

- You have to remember to take the pill at the same time every day

- Need to see a doctor for prescriptions or procedure to insert the device

- Hormonal contraceptives don’t protect you from sexually transmitted diseases

- Risk for blood clots, breast cancer, mood swings, and weight gain

- May not have sex often enough to need ongoing birth control

- Concern of passing hormones to baby through breastfeeding

WebMD also lists alternative non-hormonal contraceptive options, which include: diaphragm, cervical cap, sponge, copper IUD, spermicide, and female condom. Of these, only the female condom prevents sexually transmitted diseases. The other options all come with plenty of side effects as well.

One of the decisions when considering contraceptives could be their effective rate against pregnancy. These rates depend on if the contraceptive is used correctly each time. For comparison sake, here are some of the effective rates of contraceptives:

- Condoms: 87%

- Hormonal pills: 93%

- IUDs: 99%

- Phexxi:87%. Worth noting that Evofem calls it 93.3% effective when used as directed.

Phexxi Opportunity

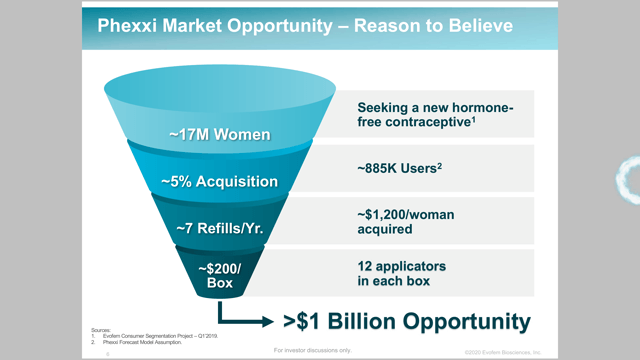

Evofem has done a good job during presentations laying out its target market and the opportunity placed in front of its now approved drug. The company believes it has potential for $1 billion from Phexxi annually.

Evofem says there are currently 47 million women at risk for pregnancy. It sees a target of 17 million of these women as potential customers. Nine million are self-identified beyond hormones and eight million are seeking or open to alternatives to hormonal contraceptives. The company models 885,000 customers based on 5% of this target market. The company believes each woman would average 7 refills a year, good for $1200 per woman based on $200 per box. This is how the company arrives at a $1 billion opportunity. Phexxi is under patent protection in the United States until 2033 and Europe until 2034.

One of the biggest questions is the market size for Phexxi. This will be heavily debated over the next couple months and really won’t be answered until the drug launches and we get some feedback. The other big question is insurance coverage. Evofem believes and is working on having Phexxi covered under the Affordable Care Act. The ACA mandates no out of pocket costs for one treatment per class in each class determined in the birth control guide for women by the FDA.

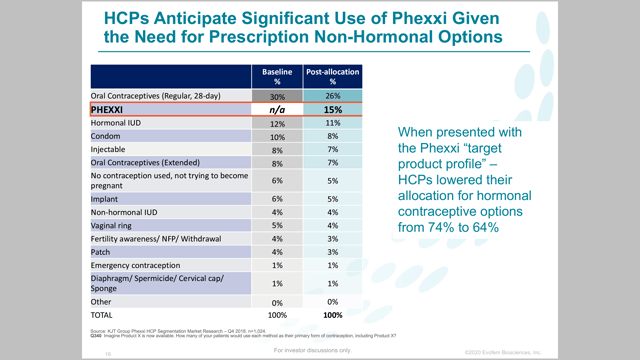

From the May presentation, Evofem listed a HCP targeted market share of 15%, compared to 26% for oral contraceptives, and 11% for IUDs.

Several analysts have weighed in on potential sales of Phexxi. HC Wainwright had an analyst predict $500 million in peak sales for Phexxi.

STIs

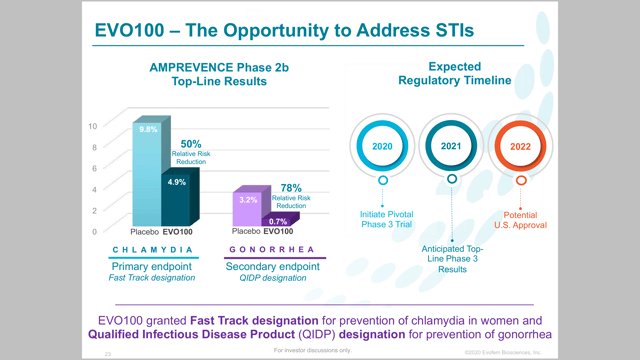

The other exciting this for Evofem is its trial addressing STIs. EVO100 is being evaluated for both chlamydia and gonorrhea in women. This would make EVO100 the first prescription for the prevention of chlamydia and gonorrhea. In December, the company presented top line data from a double blind placebo controlled study in Phase 2b. The result was a 50% relative risk reduction in chlamydia and a 78% risk reduction in gonorrhea.

In the Phase 2 study of people that had already been infected with chlamydia and gonorrhea, EVO100 saw infection rates of only 0.7% and 4.9% for gonorrhea and chlamydia respectively. The placebo saw infection rates of 3.2% for gonorrhea and 9.8% for chlamydia during the four month study.

STIs continue to rise and as mentioned above under the contraceptive segment, many of the options don’t protect sexual partners from the spread of STIs. Chlamydia and gonorrhea infections climbed in 2018 for the fifth consecutive year. There were 1.8 million cases of chlamydia and 580,000 cases of gonorrhea in the U.S. in 2018. Gonorrhea is also increasingly becoming antibiotic resistant, making it harder or impossible to treat, according to the CDC. There are currently no approved prescription therapies to prevent either of these targeted STIs in women.

Evofem is currently working towards an outlined plan for a Phase 3 trial. This treatment has received fast track designation, meaning a six month review when presented to the FDA. During its recent investor presentation, it laid out the following timeline for EVO100:

- 2020: Initiate Phase 3 trial

- 2021: Anticipated Top Line Phase 3 results

- 2022: Potential U.s Approval

Catalysts for Shareholders

One of the near catalysts for shareholders will be the insurance coverage for Phexxi. This is a key to possible market penetration.

Another catalyst will be the partnership potential for Phexxi outside the United States. The company will target Europe and will likely sign with a large partner, which could be a huge revenue source and catalyst for shareholders. It is worth noting that through its relationship with CEO Saundra Pelletier, the company agreed to give Phexxi away to some developed countries through her non-profit. This will cut down on some of the revenue potential outside of the United States.

The other big catalyst is more information on EVO100. I would expect more information on this prior to the September launch of Phexxi, giving investors another reason to get into shares of EVFM prior to September.

Valuing Evofem

One of the items I dug up while researching the contraceptive market was an interesting acquisition. Teva Pharmaceuticals sold its Paragard IUD business to Cooper Cos (COO). This came as Teva wanted to focus on its CNS and respiratory divisions, which could mean it didn’t even get the value it was looking for or settled on a decent offer. Cooper purchased the IUD business and a manufacturing facility for $1.1 billion. This came as Paragard had seen $168 million in revenue over the last 12 months prior to the purchase price.

Another company to watch through all of this is PDL Biopharma (PDLI). PDL invested in Evofem back in 2019 through two private placement deals that gave the company common stock and warrants. PDL invested in April and June, spending $80 million to acquire 13.33 million shares at $4.50 each. This gave PDL a stake of around 26%. Now, PDL just completed a distribution of the 13.33 million shares to its shareholders. PDL shareholders got .12 shares of EVFM for every PDLI share they owned, with additional cash making up the fractional payments. The important thing to consider here is through the two investments, PDL also acquired 3.3 million warrants exercisable at a price point of $6.38, good for seven years. Given the fact that EVFM shares headed north of $8 on Friday and could see double digits, these warrants have become more valuable. PDL is considering how to monetize the warrants for shareholders. I would expect that PDLI shares could see a little jump this week as a result.

Given the potential billion dollar opportunity from just Phexxi, I think this stock is still significantly undervalued even after Friday’s sharp gain after hours. The Phexxi approval could warrant a $500 million market capitalization if peak sales are anywhere in the $500 million to $1 billion range. Given the likelihood of insurance coverage, I think this drug should see strong market share potential. This is a huge approval for contraceptives and will target many women who aren’t currently using contraceptives or aren’t happy with their own.

The value of Phexxi could actually be the smaller story here. The EVO100 trial could be the real value here as STIs are a huge area that aren’t covered by many contraceptives. This extension of Phexxi to include the prevention of STIs could also make it the go to option for contraception.

If Evo100 can pass Phase 3 trials and be approved, Evofem should be a billion dollar company and will likely become a huge buyout candidate. In fact, you will see the name floated as a buyout candidate next week now thanks to the approval. I don’t think the odds of a buyout are very high here given the high approval odds were already well known for the drug.

Risks

Investing in Evofem Biosciences comes with many risks, given it is a small cap biotechnology company. There is slightly less risk since the company does have an approved product. FDA approval doesn’t guarantee success as many have failed to complete the ultimate goals of approval, marketing, and commercialization.

The biggest risk here, which we could see come out as early as this week is dilution. The company does not have a lot of cash on hand and will now need money to start ramping up production and marketing for the drug. Getting a drug through trials and approval is no cheap task and neither is ramping up production and selling the drug to consumers. At the end of the first quarter (March 31), Evofem had $10.3 million in cash. Since then the company has raised an additional $15 million in convertible notes and warrants and an additional $10 million at the investor’s discretion based on certain met conditions. In the first quarter, operating expenses were $19.2 million, an increase of 41% from the prior year, due to pre-commercialization efforts.

Given the fact that Evofem is delaying the launch of Phexxi until September, it has months to get by and will need to raise a significant amount of capital.

The other long-term risk is adoption. This won’t be hugely known until quarterly results after the September launch, but of course is something to watch. Approval of Phexxi does not guarantee commercial success.

Summary

Evofem will host a conference call early Tuesday morning to discuss the FDA approval. I wouldn’t expect a ton of new information for investors, although there will be a lot of potential new investors tuning in. The market size and revenue possibilities will likely be highlighted as will the insurance coverage possibility. I would expect it to be an overall positive conference and shares will likely keep their momentum going into the trading session.

Of course, any announcement of a stock offering could send shares down quickly and lose the momentum the FDA approval has built. The company will need to raise money at some point, but I would hope that it waits at least a week to make this announcement.

Shares have traded between $3.34 and $7.50 over the last 52 weeks. In after-hours trading, EVFM shares hit $8.05, gaining over 60% from their $4.99 Friday close. I would not be surprised to see shares hit $10 on Tuesday, gaining 100% from the original Friday price. Shares could be a heavy short candidate on Tuesday and could see pressure to keep moving up through every $1 rise. Be careful if you are considering buying this stock on Tuesday. It may be best to wait for any weakness to buy. I could see any of the potential catalysts mentioned above keeping shares in the double digits and pushing closer to a $15 price target by the end of 2020.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in EVFM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.