This post was originally published on this site

Natural gas prices were rising in Europe again on Friday, following a respite this week from a promise by Russian President Vladimir Putin to boost supplies to the continent. Stocks in Europe fell, though gains for energy stocks bucked that trend.

European natural gas futures — based on benchmark November Title Transfer Facility (TTF) futures in the Netherlands — rose 6% to 103 euros per megawatt hour (MWh) from 96 euros on Thursday. Prices jumped more than 30% earlier this week, then dramatically swung lower after Putin’s offer to supply gas to Europe well above its contractual commitments.

U.K. natural gas futures climbed 6% to 269 pence a therm. The contract had jumped as much as 38% earlier in the week before dropping sharply on Putin’s comments.

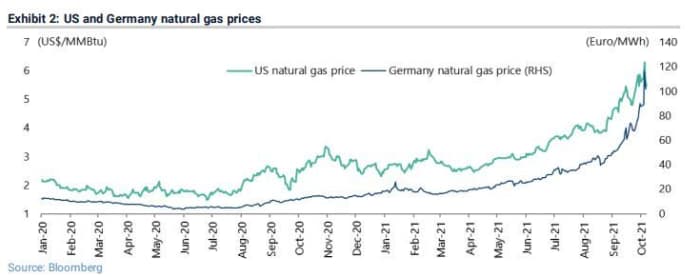

“Natural gas prices in American and Germany have soared by 126% and 459% so far this year (see Exhibit 2) while the Dutch gas price was up 748% as of yesterday’s peak before Putin triggered a 37% decline,” said Christopher Wood, global head of equity strategy at Jefferies, in his weekly GREED & fear note to investors.

Jefferies/Bloomberg

“Russia will clearly want to see progress on the new Nord Stream 2 pipeline if it is to supply gas to Europe significantly beyond its contractual commitments,” he said.

Russia has been accused by withholding on gas supplies as it awaits approval of the controversial Nord Stream 2 pipeline. Europe and U.K. natural gas prices have been rising for weeks as winter approaches, following a colder spring, outages of some gas fields and rising Asian demand.

The biggest gaining sector in Europe was energy, as U.S.

CL00,

and Brent crude

BRN00,

futures prices rose 1% each. Oil gained rose Thursday after the Energy Department reportedly said it has no plans to release crude from its Strategic Petroleum Reserve.

Shares of BP

BP,

BP,

climbed 2.3% and Royal Dutch Shell

RDS.A,

RDSA,

gained 1.5%. Shares of Italian electricity and gas provider Enel

ENEL,

rose 1%.

The Stoxx Europe 600 index

SXXP,

meanwhile, slipped 0.3% to 457.30, as markets await U.S. payrolls data. The German DAX

DAX,

and French CAC 40

PX1,

were also modestly lower, while the FTSE 100

UKX,

was modestly up.

Bond yields were also on the rise, with that of the 10-year German bund

TMBMKDE-10Y,

up 3 basis points to -0.150. The yield on the 10-year Treasury

TMUBMUSD10Y,

was up 3 basis points to 1.596%.

In the wake of rising yields, which can be a negative for fast-growing companies, technology was the worst performing sector in Europe. Shares of chip group STMicroelectronics

STM,

STM,

down 2%, along with chip equipment maker ASML Holding

ASML,

ASML,

off 1%, and business software group SAP

SAP,

SAP,

down 0.7%.

The downside in Europe was led by Zur Rose Group

ROSE,

which slumped 6% after Berenberg analysts cut the e-pharmacy company to hold, saying its long-term growth outlook was priced into the 75% jump in shares seen this year.

“We leave our estimates unchanged, but we think there is the potential for headwinds from a delay to the mandatory introduction of eRx in Germany, which could affect Zur Rose’s near-term earnings and cash position,” said a team of analysts led by Gerhard Orgonas.