This post was originally published on this site

Screens displaying French President Emmanuel Macron as he addresses the nation during a televised interview from the Élysée Palace concerning the situation of COVID-19 in France, in Paris on October 14, 2020.

christophe archambault/Agence France-Presse/Getty Images

European stocks slumped on Thursday, with investors concerned about the impact of a second wave of coronavirus on the economy without any imminent stimulus to cushion the blow.

The Stoxx Europe 600 SXXP, -2.33% lost 2.2%, and the main regional indexes, the German DAX DAX, -3.04%, French CAC 40 PX1, -2.38% and U.K. FTSE 100 UKX, -2.39%, each dropped by at least 2%.

Decliners included airlines Deutsche Lufthansa LHA, -5.57%, International Airlines Group IAG, -4.03% and Air France-KLM AF, -3.03%, and hotel operators Whitbread WTB, -5.96%, Accor AC, -5.99% and InterContinental Hotels IHG, -3.12%.

Futures on the Dow Jones Industrial Average YM00, -0.98% fell 312 points.

“We now find ourselves in a scenario whereby the pandemic is back in center stage, while the prospects of a U.S. relief package this side of the presidential election seem very low. Dealers are dumping stocks for fear that economic activity will drop off because of the tighter restrictions in various parts of Europe,” said David Madden, market analyst at CMC Markets U.K.

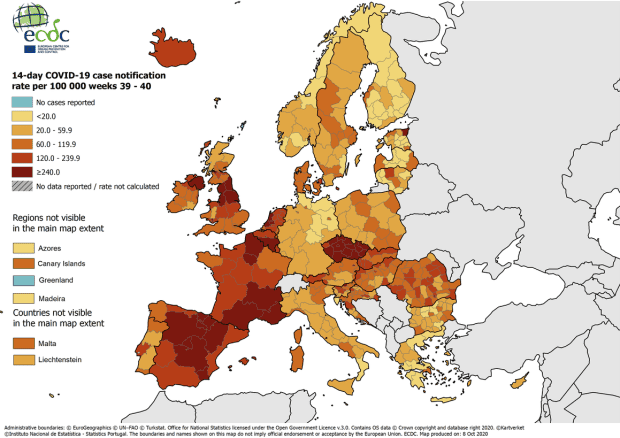

With coronavirus on the rise, France announced a new curfew in Paris and other major cities, as U.K. media speculate about imminent restrictions due to hit London.

Meanwhile, European leaders are meeting to discuss the coronavirus pandemic as well as trade talks with the U.K., where a trade deal with the European Union expires at the end of the year.

U.S. Treasury Secretary Steven Mnuchin said it is unlikely a stimulus deal will be reached before the election. “I’d say, at this point, getting something done before the election and executing on that would be difficult, just given where we are in the level of details, but we’re going to try to continue to work through these issues,” Mnuchin said.

The Republican-controlled U.S. Senate is planning a vote on a much smaller stimulus than even the White House has proposed.

Roche Holding ROG, -3.11% dropped 3%. The Swiss pharmaceutical said it still expects sales to grow in the low-to-mid-single digit range for the year, as third-quarter sales fell.

Ahead of its earnings report, oil giant Total FP, -3.72% dropped 4% as it reported negative refining margins in the third quarter, as well as selling natural gas for less than analysts had anticipated.