This post was originally published on this site

Happy Thursday! I’m back and the markets are worked up about brewing tensions between Russia and Ukraine. We talked to Bloomberg analyst Eric Balchunas about how investors may be positioning for the possibility of a military conflict in Europe and the implications for the broader market.

Meanwhile, bond funds are getting a shellacking of a different sort, as investors try to sniff out the Federal Reserve’s inflation-management tactics. Balchunas says outflows in fixed-income funds have thus far been “orderly” but says investors should be watching that space, which could holder a bigger potential to rattle markets.

In any case, send tips, or feedback, and find me on Twitter at @mdecambre or LinkedIn to tell us what you think are important topics for ETF Wrap.

The good

| Top 5 gainers of the past week | %Performance |

|

SPDR S&P Metals & Mining ETF XME, |

5.1 |

|

ETFMG Prime Junior Silver Miners SILJ, |

4.8 |

|

VanEck Junior Gold Miners ETF GDXJ, |

3.6 |

| iShares MSCI Brazil ETF | 3.4 |

|

Global X Silver Miners ETF SIL, |

3.3 |

| Source: FactSet, through Wednesday, Feb. 16, excluding ETNs and leveraged products. Includes NYSE, Nasdaq and Cboe traded ETFs of $500 million or greater |

…and the bad

| Top 5 decliners of the past week | %Performance |

|

Real Estate Select Sector SPDR Fund XLRE, |

-4.7 |

|

Pacer Benchmark Data & Infrastructure Real Estate SCTR ETF SRVR, |

-4,5 |

|

iShares Cohen & Steers REIT ETF ICF, |

-4.4 |

|

iShares MSCI Sweden ETF EWD, |

-4.0 |

|

iShares U.S. Utilities ETF IDU, |

-3.8 |

| Source: FactSet |

ETFs for a war footing?

We caught up with Bloomberg’s Balchunas on Thursday morning, as a tenuous détente (if you can even call it that) was crumbling between Ukraine and Russia. An invasion by Moscow of Kyiv seemed imminent, with President Joe Biden telling reporters on the White House lawn that the likelihood of a Russian invasion was “very high” and could happen in the next “several days.”

With the threat of war looming, the Bloomberg analyst said that investors have been predominantly expressing their views on the possible impact to the market via the VanEck Russia ETF

RSX,

which holds some $1.4 billion in assets, and had been seeing some heavy volume last week, which has since cooled, he said.

“The volume in this ETF will tell you how serious people are taking this,” Balchunas told MarketWatch, referring to Ukraine-Russia tensions.

He said that the ETF isn’t ordinarily used by mom and pop investors and instead tends to be used by traders to hedge their exposures to emerging markets.

“Single-country ETFs have a strong correlation with geopolitics,” he said.

We’ve discussed the VanEck Russia ETF before in ETFWrap. It has an expense ratio of 0.67%, which translates to an annual cost of $6.70 for every $1,000 invested and the Bloomberg analyst says it is far more popular than its counterpart, the iShares MSCI Russia ETF

ERUS,

which carries a 0.59% expense ratio.

Both are up so far this week. The iShares fund has gained 3.9%, while RSX, referring to the ticker symbol for the VanEck ETF, has gained 4.9% thus far this week. They are both down so far in 2022, with RSX down 8.7% versus a decline of 8% for iShares.

Energy funds

Beyond the single-country funds, the Energy Select Sector SPDR Fund

XLE,

could also draw trading volumes as investors position around the potential for the conflict near Ukraine to influence energy prices. A military clash could result in the blocking of natural gas supplies

NG00,

to Europe from a Russia-to-Germany pipeline known as Nord Stream 2 and through other pipelines. Construction of the pipeline has been completed, but it is not yet operating.

Reports have suggested that Europe has become more dependent on Russian energy.

The Energy Select ETF is down 2.7% for the week but has climbed over 23% in the year to date. A couple of natural-gas focused ETFs, also were punchy, with the United States Natural Gas Fund

UNG,

up 13% on the week and 27% in the year to date. Neither of those funds provides a clearer view of the impact that tensions in Russia would have on Europe but analysts say that the search for so-called replacement fuels could ripple through segments of the energy complex.

Panic on the bond floor?

Balchunas had more to say on fixed income. “There is no where to hide and it is a little alarming,” he told Wrap.

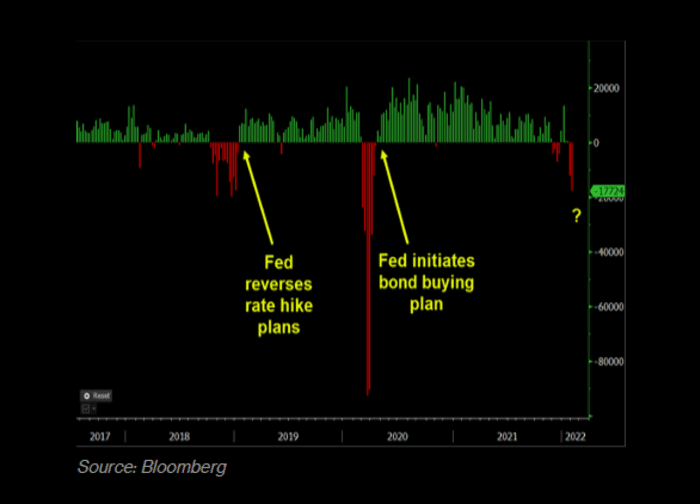

The analyst, referencing a recent article he wrote for Bloomberg, says that bond mutual funds have now “experienced two consecutive weeks of outflows totaling $30 billion, with exchange-traded funds adding an additional $10 billion.”

Losses in ETF land reflect some of the negative sentiment emanating from the bond market as investors position for a regime of higher rates and tighter policy from the Federal Reserve to battle inflation. Rising inflation is bad for bonds as it erodes fixed values but higher interest rates also mean that investors will be less inclined to buy existing bonds as they wait for richer yields to come.

Those factors are delivering a gut punch to fixed-income funds.

“Fixed-income is supposed to be a hedge against volatile markets but so far it hasn’t been,” Balchunas said.

Balchunas said the Fed has been accommodative over the past 10 years but the regime change to higher interest rates means that there isn’t safety in fixed-income at the moment. He said that so far outflows have been relatively orderly but warned that if “people’s mentality starts to change,” problems could rise.

“The shock value would be high,” he said.

Bloomberg

He said that if a large, prominent bond mutual fund starts halting investor redemptions, which he thinks is a real possibility, though there aren’t any signs that that is imminent now, it could ripple through markets. Here’s what he wrote in Bloomberg News on Wednesday:

This is already taking place; the most liquid bond ETFs — HYG, LQD and TLT, for example — are experiencing billions of dollars in outflows already this year. Mom-and-pop investors aren’t selling these ETFs; they are professional money managers. Once they sell all their ETFs and the outflows continue, they will have to sell actual bonds, which will lower prices and result in negative returns, which will spark more outflows which will force them to sell more bonds which will lower prices and their returns. You get the idea. This downward spiral would start to dry up liquidity in the bond market and could ultimately lead to the fund having to halt redemptions. Panic would ensue.

The iShares 20+ Year Treasury Bond ETF

TLT,

was down so far on the week and off 7.7% thus far in 2022. The iShares iBoxx $ High Yield Corporate Bond ETF

HYG,

is up 0.3% so far on the week, but down 4.7% on the year, and the iShares iBoxx $ Investment Grade Corporate Bond ETF

LQD,

was off 1.1% in the week and down nearly 7% in 2022 so far.

Fidelity grows green

MarketWatch’s Christine Idzelis writes that Fidelity Investments is offering four new funds focused on environmental, social and governance criteria, including three mutual funds and an exchange-traded fund.

The Fidelity Sustainable International Equity Fund (FSYRX), Fidelity Sustainable Emerging Markets Equity Fund (FSYJX), Fidelity Sustainable Multi-Asset Fund (FYMRX), and Fidelity Sustainable High Yield ETF FSYD, will target companies with strong ESG ratings, Idzelis reported on Thursday.

“We’re constantly monitoring where companies are relative to another on their ESG journey,” Pam Holding, co-head of equity and head of sustainable investing at Fidelity, was quoted as saying. “These are actively managed strategies.”

For the record, as of Tuesday’s close, the Dow Jones Industrial Average

DJIA,

year-to-date is down 1404.03 points or 3.86%. The S&P500 index

SPX,

is down 291.17 points or 6.11%, and the Nasdaq Composite

COMP,

is down 1520.88 points or 9.72%.