This post was originally published on this site

Hello there, again! It is good to be back to walk you through this week’s ETF Wrap.

Send tips, or feedback, and find me on Twitter at @mdecambre to tell us what we need to be jumping on.

And sign up here for ETF Wrap.

The good…

| Top 5 gainers of the past week | %Performance |

|

AdvisorShares Pure US Cannabis MSOS, |

11.8 |

|

ProShares Bitcoin Strategy ETF BITO, |

7.7 |

|

iShares MSCI Global Gold Miners RING, |

7.4 |

|

VanEck Junior Gold Miners ETF GDXJ, |

7.3 |

|

ETFMG Prime Junior Silver Miners ETF SILJ, |

7.1 |

| Source: FactSet, through Wednesday, Nov. 10, excluding ETNs and leveraged products. Includes NYSE, Nasdaq and Cboe traded ETFs of $500 million or greater |

…and the bad

Goldman’s ARK Killers?

MarketWatch’s Christine Idzelis, who graciously looked after ETF Wrap last week, writes this week that Goldman Sachs Group

GS,

is launching three exchange-traded funds focused on secular growth trends, tilting into “themes of innovation and disruption.”

The Goldman Sachs Future Consumer Equity ETF GBUY, the Goldman Sachs Future Health Care Equity ETF GDOC, and the Goldman Sachs Future Real Estate and Infrastructure Equity ETF GREI, are actively managed and will trade on the New York Stock Exchange, according to a statement from the bank’s asset management group.

Katie Koch, co-head of the fundamental equity business at Goldman Sachs Asset Management, says the funds may help investors find bigger returns over the next decade, as the traditional portfolio comprising 60% stocks and 40% bonds is “very broken” and expected to produce smaller gains compared with the past 10 years.

The launch of the Goldman ETFs come as fund providers appear to be attempting to roll out challengers to Cathie Wood’s ARK Investment Manangement products, even as those ETFs face some headwinds.

Anti-Wood ETF hits

Speaking of Cathie Wood, on Tuesday, Tuttle Capital launched its actively managed short ARK ETF, which is known as Tuttle Capital Short Innovation ETF

SARK,

As we’ve reported before, the fund will track the inverse of the flagship Ark Innovation ETF

ARKK,

and will be managed by Matthew Tuttle, CEO and CIO of Tuttle Capital Management.

The anti-ARKK fund was down 0.7% on Thursday after a 2.9% gain on Wednesday, according to FactSet data. The fund charges an expense ratio of 0.75%, which translates to an annual cost of $7.50 for every $1,000 invested, which incidentally is the same expense ratio as Wood’s ARK Innovation.

How are ETFs being used?

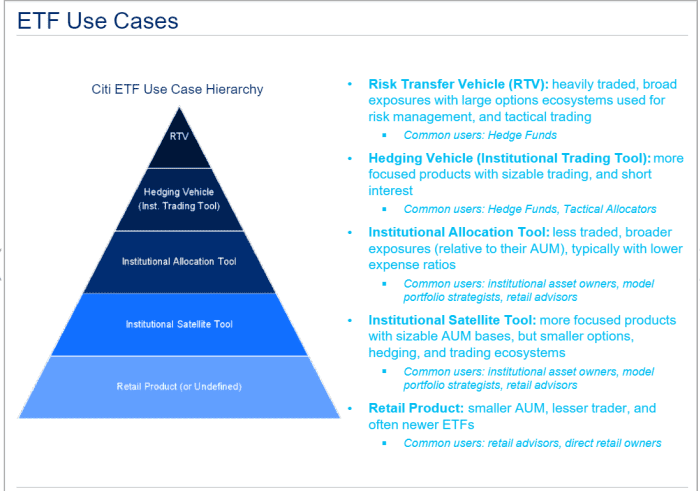

Citi researchers Scott Chronert and Drew Pettit offer a bullish outlook for ETFs, which have seen tremendous growth in 2021, as use cases for funds evolve.

The analysts say that the most common use for ETFs are unsurprisingly individual investors buying ETFs to get exposure to a broad basket of stocks, while institutions and hedge funds are increasingly using ETFs as hedging and tactical tools.

Citi Research

Green gold?

The folks at VanEck kicked off a so-called “green metals” ETF, which offers exposure to refiners, processors and recyclers of metals that are used in lower-carbon emission, or green, energy production.

The VanEck Green Metals ETF will trade on the NYSE’s Arca exchange and carries an expense ratio of 0.59%.

Its largest holdings include Freeport-McMoRan Inc.

FCX,

and Glencore PLC

GLEN,

as well as Ganfeng Lithium Co. Ltd.

002460,

Hartford goes semitransparent

Hartford Funds has launched a semitransparent ETF, the Hartford Large Cap Growth ETF, an actively managed vehicle that markets its first entry into the world of semitransparent ETFs, which combine features of mutual funds and the tax-efficiency of traditional ETFs.

Semitransparent ETFs allow portfolio managers to manage their assets while lowering the risk that their strategies won’t be copied or front-run in the open market. Hartford explains its offering thusly.

This ETF is different from traditional ETFs. Traditional ETFs tell the public what assets they hold each day. This ETF will not. This may create additional risks for your investment. For example: You may have to pay more money to trade the ETF’s shares. This ETF will provide less information to traders, who tend to charge more for trades when they have less information. The price you pay to buy ETF shares on an exchange may not match the value of the ETF’s portfolio. The same is true when you sell shares. These price differences may be greater for this ETF compared with other ETFs because it provides less information to traders. These additional risks may be even greater in bad or uncertain market conditions. The ETF will publish on its website each day a “Tracking Basket” designed to help trading in shares of the ETF.

In a press release, Vernon Meyer, chief investment officer at Hartford Funds, says the “new fund, which offers active equity management in an ETF wrapper, has the potential to be an attractive option for both financial professionals and investors.”

The fund will use the active equity ETF model created by Fidelity Investments.

Regulators started approving semitransparent ETFs back in 2019, with providers arguing they didn’t want competitors to be able to see the secret sauce to their performance. However, semitransparent ETFs, sometimes referred to as nontransparent ETFs, which offer some degree of secrecy for managers, have seen a relatively tepid start.

Read: What is a ‘nontransparent’ ETF, and why would anyone want to own one?

That could change, however, if more providers are willing to use the structure and investors are willing to give up some element of transparency, which has been one of the hallmarks of ETFs.

HFGO will trade on Cboe Global Markets Inc.

CBOE,

Cboe BZX Exchange, Inc. and will use the Russell 1000 Growth Index

RLG,

as its performance benchmark.

Is there a spot bitcoin ETF on the way?

CNBC’s Bob Pisani writes that the Securities and Exchange Commission has until Nov. 14 to decide if it will approve a proposed VanEck Bitcoin ETF that is a spot bitcoin proposal that is nearing a 240-day maximum review period by the regulator. The odds are looking dim for that spot ETF and Pisani makes the case that any ETF directly linked to bitcoin is a long way off.

Tell us what you think.

Meanwhile, ProShares Bitcoin Strategy ETF

BITO,

the first futures based bitcoin ETF, has seen its assets grow to $1.4 billion from $570 million when the fund made its debut around mid-October.

ESG gains traction

A recent note from the folks at DataTrek highlights that investing based on environmental, social and governance, or ESG, is gathering momentum. On top of that, a number are outperforming the benchmark S&P 500 index on a year-to-date basis, notes DataTrek’s Jessica Rabe.

The iShares MSCI USA ESG Select ETF

SUSA,

was up 26.5% in the year to date, the iShares ESG MSCI USA Leaders ETF

SUSL,

was up 28.25%, and the iShares MSCI KLD 400 Social ETF

DSI,

was up 28.5% so far in 2021. That compares with a 24% gain for the S&P 500 and a 17.6% gain for the Dow Jones Industrial Average

DJIA,

Rabe notes that on average, those funds, even factoring the iShares ESG Aware MSCI USA ETF

ESGU,

up 23.7%, are outperforming the S&P by more than 3 percentage points YTD.

Rabe cautions, however, that ESG isn’t the only reason why these funds are outperform and advises that investors pore over the composition of the funds, which can have heavy tech weightings. They also tend to own a lot of the same top names.

-

SUSA (iShares MSCI USA ESG):

Microsoft

MSFT,

+0.76% ,

Apple Inc

AAPL,

-0.06% .

, Alphabet Inc.

GOOGL,

+0.29% ,

Nvidia

NVDA,

+3.47% ,

Tesla

TSLA,

-0.53%

Total weight: 19.4 pct - SUSL (iShares ESG MSCI USA Leaders): MSFT, TSLA, GOOG/L, NVDA, Johnson & Johnson Total weight: 29.3 pct

-

DSI (iShares MSCI KLD 400 Social ETF):

MSFT, TSLA, GOOG/L, NVDA, Home Depot Inc.

HD,

-0.70%

Total weight: 27.8 pct -

ESGU (iShares ESG Aware MSCI USA):

MSFT, AAPL, Amazon.com Inc.

AMZN,

+0.28% ,

TSLA, GOOG/L Total weight: 21.9 pct