This post was originally published on this site

Happy Thursday! Another turbulent week in markets and single-country stock ETFs and funds focused on energy have been at the centerpiece of volatility over the past several sessions. Some funds, almost literally, went nuclear, while China internet pegged exchange-traded vehicles enjoyed a bounce. We’ll talk about some of that this week.

All this happened against the backdrop of the first interest-rate increase since 2018 by the Federal Reserve, with the promise of tighter policy on the horizon. Goodbye, easy-money days.

In any case, this may be my last week regularly handling ETF Wrap (Though, I might make an occasional guest appearance).

Please, send tips, or feedback, on Twitter to Christine Idzelis at @cidzelis and find Mark at @mdecambre or LinkedIn to tell us what you think.

Rosenbluth exits CFRA

Todd Rosenbluth has left CFRA to become director of research at ETF Trends, replacing Dave Nadig. Rosenbluth has been a vital contributor to ETF Wrap, while he served as head of mutual funds and ETFs at CFRA.

Nadig said he was “super excited” to have Rosenbluth on board.

The Fed and ETFs

On Wednesday, the Federal Reserve raised its benchmark interest rate by a quarter percentage point, as widely expected, and laid out plans for a more aggressive strategy of “ongoing increases” in the months ahead to combat high U.S. inflation.

Inflation is running at a 40-year peak, and Fed Chairman Jerome Powel has a tall task ahead of him. The Fed is shifting away from two years of easy-money policy that cushioned the economy during the pandemic.

The Fed now sees its policy rate hitting 1.9% by the end of this year, jumping to 2.8% in 2023 and staying at that level in 2024. Rates at 2.8% would start to soften economic growth, according to Fed calculations.

What does that mean for ETFs?

We’ve written a ton on the subject but a rising interest rate environment is one in which banks might flourish, due to their business models of borrowing short-term and lending out longer-term.

Analysts have pointed to the Financial Select Sector SPDR Fund

XLF,

and the SPDR S&P Regional Banking ETF

KRE,

and the SPDR Bank ETF

KBE,

as solid bets. All of those funds are up on the week thus far.

But it might be a tough slog for banks if the so-called yield curve inverts. Read more about that here.

Commodity ETFs shine

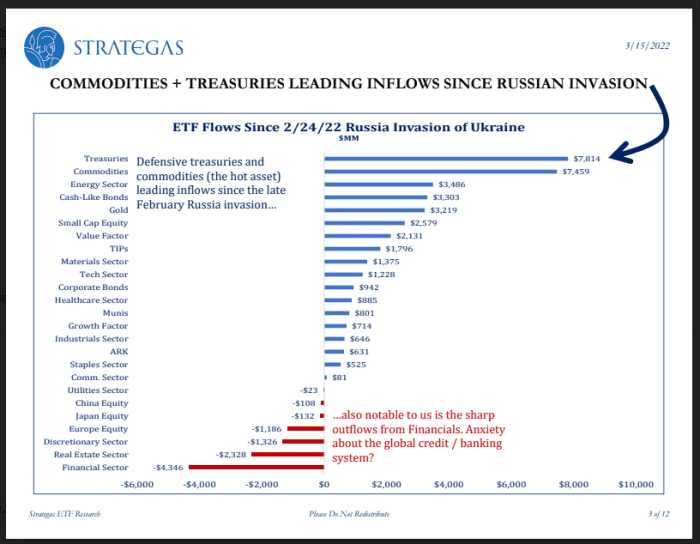

Commodity-pegged ETFs are enjoying a moment in the sun, with investment flows picking up steam, amid concerns that the Russia-Ukraine war will disrupt supplies and push prices even higher.

Strategas ETF Research

“The category has taken in the 2nd most inflows since the Russian Invasion of Ukraine (just behind treasuries), and we’d also note over the +$15 Bn inflows over

the last two months marks one of the stronger historical readings we can find,” Todd Sohn, researcher at Strategas writes.

ETFs going nuclear

Although the price of uranium has been on the rise, ETFs pegged to it haven’t done as well.

MarketWatch’s Myra Picache notes that uranium prices have gained about 40% since Russia’s invasion of Ukraine, touching levels the market hasn’t seen in more than a decade—even though the war has little immediate impact on global supplies of the fuel used to generate nuclear energy.

Prices of the radioactive element were at $59.75 a pound on March 10, according to data from nuclear-fuel consulting firm UxC, marking the richest levels since March 2011.

ETFs, on the other hand, were swooning this week. Chalk it up to a bit of breather after a run-up, the NorthShore Global Uranium Mining ETF was down substantially on the week, as was the Global X Uranium ETF. Both funds are higher for the month, and year to date period, up at least 5% on the month and at least 11% so far in 2022, respectively.

A good chunk of the interest in uranium is pegged to climate-change commitments, since nuclear power is a reliable power source that provides zero greenhouse gas emissions.

China ETFs’ very good day

The KraneShares CSI China Internet ETF soared Wednesday, notching its best daily gain in its history, as China vowed to support its economy.

A separate China-focused fund, the iShares MSCI China ETF

MCHI,

which has nearly $6 billion in assets, also soared on Wednesday to its best day on record, dating back to its inception in 2011.

The rally came as Beijing said it would work to stabilize Chinese stock markets and boost economic growth in the first quarter with “concrete actions,” according to state-run Xinhua News Agency.