This post was originally published on this site

Elevator Pitch

Essent Group Ltd. (ESNT) is a private mortgage insurer boasting a net margin and ROE that are some of the best in the industry, yet its P/E of 5.58 and Fwd P/E of 6.47 are 7.3% and 11.5% below the industry median. Most of its valuation multiples are at record lows since early 2014. The company has experience navigating difficult economic periods (like 2008), and its capital and liquidity positioning appear especially solid. Investor sentiment is starting to recover remarkably, and price momentum is strong. This could be an attractive time for value investors to buy the dip.

Fundamentals and Valuation

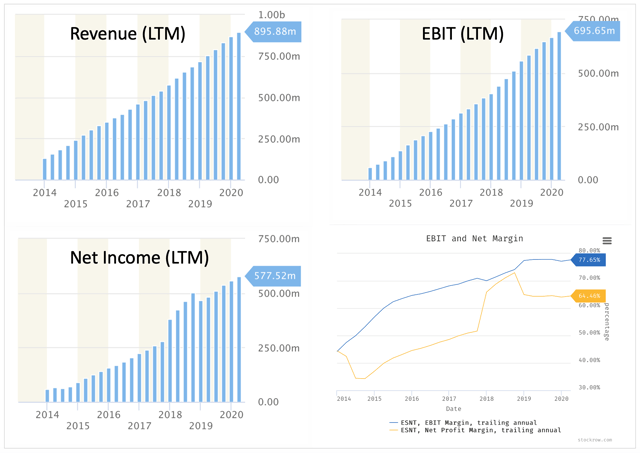

Essent’s net margin of 64% is the highest in the mortgage finance industry, according to Finviz. Additionally, its ROE of 20.6% ranks third highest, and its ROA of 15.7% ranks second highest. Revenues, operating income, and net income (LTM) have experienced remarkable growth since 2014. Margins have improved substantially since then as well, with net and EBIT margins up 45% and 75% since then, respectively, according to data from Stockrow (see below).

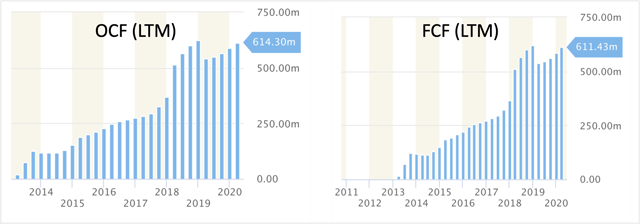

Cash flows look impressive as well, with OCF and FCF (LTM) at near-record highs.

Cash flows look impressive as well, with OCF and FCF (LTM) at near-record highs.

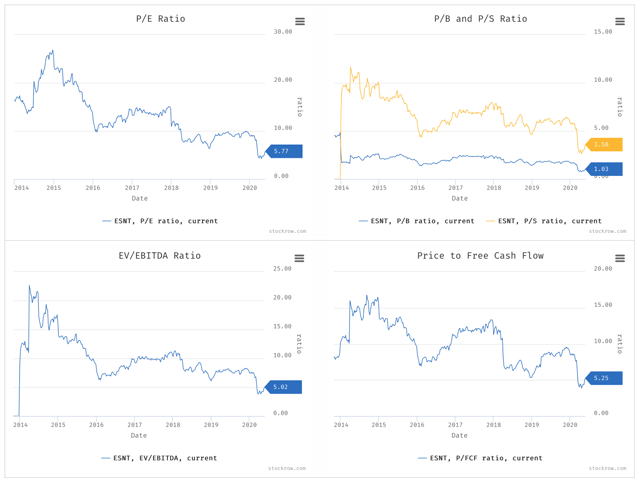

Meanwhile, valuation multiples look attractive. Essent’s P/E of 5.58 and Fwd P/E of 6.47 are 7.3% and 11.5% below the industry median, respectively. Its PEG is currently 0.82. And since early 2014, P/E, P/B, P/S, P/FCF, and EV/EBITDA are all at or near record lows (see below).

Meanwhile, valuation multiples look attractive. Essent’s P/E of 5.58 and Fwd P/E of 6.47 are 7.3% and 11.5% below the industry median, respectively. Its PEG is currently 0.82. And since early 2014, P/E, P/B, P/S, P/FCF, and EV/EBITDA are all at or near record lows (see below).

Essent had a strong Q1 2020. As the company highlighted in its news release on May 8:

Essent had a strong Q1 2020. As the company highlighted in its news release on May 8:

- Insurance in force rose 15.6% YoY to $165.6 billion

- Net insurance written rose 22.7% YoY to $13.5 billion

- Net premiums earned rose 16.1% YoY to $206.5 million

- Quarterly EPS rose 16.9% YoY to $1.52 per diluted share

Management believes it is poised well for the COVID-19 crisis. As it explains on the latest earnings call:

Our business model is well suited to navigate this challenging environment. At March 31, we have $3.1 billion of GAAP capital and access to $1.7 billion of excess of loss reinsurance, and our liquidity is strong. During the quarter, we generated $163 million of operating cash flow and have $280 million of cash and investments at holdco, after drawing $200 million on our revolver.

While we do not have any immediate capital needs in our operating businesses, we believe that drawing on the facility was prudent in light of the worsening economy.

…given the A rating at Moody’s, A rating at A.M. Best, we feel comfortable that we could raise additional capital should we need it.

At March 31, our PMIERs sufficiency ratio is the strongest in the industry at 200%, with $1.2 billion of excess required assets. On the business front, industry NIW has been robust during the first quarter and continued through April for both refi and purchase mortgages.

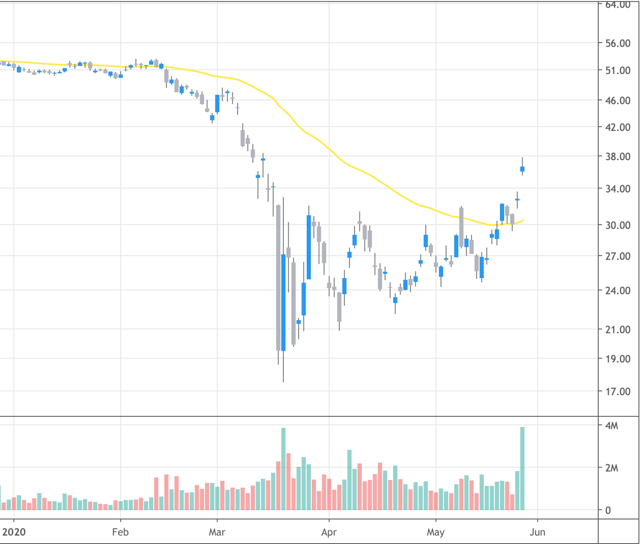

Despite the high levels of economic uncertainty, investor sentiment has turned remarkably bullish on Essent. Shares recently broke above the 50-day moving average, and on May 27 gapped up more than 10% on strong volume, breaking above its wedge-like consolidation pattern.

Finally, it’s interesting to note that some “smart money” appears interested. RenTech founder Jim Simons owned 1.03 million shares as of 3/31/20.

Finally, it’s interesting to note that some “smart money” appears interested. RenTech founder Jim Simons owned 1.03 million shares as of 3/31/20.

Bottom Line

Essent’s stock looks cheap on a historical basis, while the company’s net margin and ROE are some of the best in the industry. Its liquidity and capital positioning appear strong, and management is experienced navigating difficult economic environments, including the 2008 financial crisis. And despite expectations of a challenging Q2 2020, investor sentiment has improved remarkably, with shares breaking out on strong volume. Now may be an opportune time for value investors to buy a solid business for a reasonable price while momentum is strong.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in ESNT over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.