This post was originally published on this site

It’s always embarrassing to learn stuff about U.S. retirement policy from foreign correspondents, but that happens sometimes.

On June 3, 2020, the U.S. Department of Labor (DOL) issued an information letter opening up the opportunity for private-equity investments in 401(k) plans. The letter only addresses private-equity investments in target date, target risk, or balanced funds, and does not specifically authorize making private-equity investments available on a stand-alone basis. Nevertheless, it seems like an imprudent move by the DOL on several fronts.

Read: The private-equity crowd wants your 401(k) money — yikes!

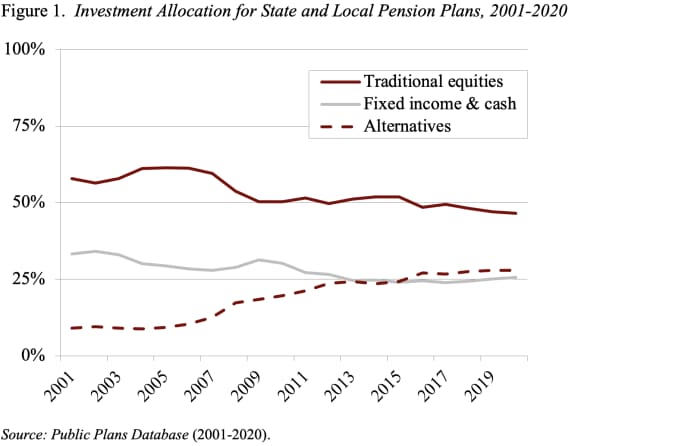

First, it is not clear that movement into alternative investments will improve the performance of target-date funds. Since the financial crisis, public pensions have moved a significant portion of their portfolios into investments outside of traditional equities, bonds, and cash (see Figure 1). In a study a few years ago, we found that the shift toward alternatives had not increased investment returns in our sample of 160 public plans.

The analysis involved a series of regression equations. The first related the average after-fee portfolio returns to the percentage of the portfolio invested in alternatives and some control variables. The results showed that holding an additional 10% of the portfolio in alternatives reduces the after-fee return by between 30-45 basis points compared to investing in equities. The second equation related the average portfolio returns to holdings in the four major alternative asset classes: private equity, hedge funds, real estate, and commodities. None of the other four asset classes had a statistically significant positive effect on returns. A final set of equations showed that alternatives did not reduce volatility. In short, alternatives have not improved returns in state and local pension plans.

Read: Private equity in your 401(k) — risk and opportunity

The second argument against allowing private equity into 401(k) target-date funds is that it lets the camel put his nose under the tent to offer private equity as a stand-alone investment. Private equity is a totally inappropriate investment for the average 401(k) participant. Participants should be investing in low-fee instruments that they understand, like stocks and bonds. Private equity is incomprehensible to most people, and although fees are generally well hidden, they must be large. If not, why would Pantheon Ventures (U.S.) LP and Partners Group (USA), Inc. have petitioned the DOL to open up this lucrative market.

Nontransparent high-fee investments do not belong in tax-supported retirement savings plans.

In short, the new administration should take a close look at the June 3, 2020 letter and perhaps rethink the decision to allow private equity anywhere near 401(k) plans.