This post was originally published on this site

Rich and getting richer pretty much sums up Elon Musk, chief executive officer of both Tesla Inc. and privately held SpaceX.

According to Forbes’ real-time billionaire list, Musk remains just ahead of Amazon

AMZN,

CEO Jeff Bezos, with a fortune of $219.5 billion. While that’s some way from trillionaire status, Adam Jonas with Morgan Stanley entertains the notion with this thought: Musk may get there, but it won’t be because of his electric-car company.

“More than one client has told us if Elon Musk were to become the first trillionaire … it won’t be because of Tesla.

TSLA,

Others have said SpaceX may eventually be the most highly valued company in the world — in any industry,” Jonas said in a recent note.

Digging into the idea that SpaceX could drive the billions for Musk, the analyst said the biggest contributor to their $100 billion base case valuation for SpaceX is “the Starlink LEO [satellite communications] business, which has had a number of important milestones in recent months.”

And “what SpaceX is doing on the shores of South Texas is challenging any preconceived notion of what was possible and the time frame possible, in terms of rockets, launch vehicles and supporting infrastructure,” said Jonas and the team.

Read: Elon Musk says Starlink can do Wi-Fi on planes. These stocks are dropping.

Technological developments such as Starship, the fully reusable rocket SpaceX has been developing, “has the potential to transform investor expectations around the

space industry,” the analysts said. “As one client put it: ‘talking about space before Starship is like talking about the internet before Google.’”

SpaceX sent the first all-amateur crew — a billionaire and three pals — on an orbit the world last month.

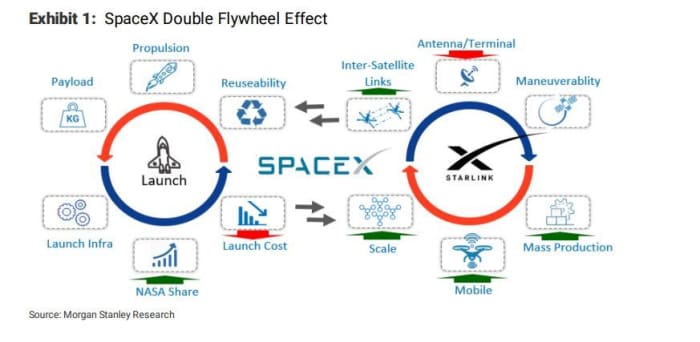

Jonas said SpaceX’s launch capabilities and Starlink are “inextricably linked whereby improvements in launch capacity/bandwidth (both in frequency and payload per flight) and cost of launch improve the economics and path to sale of Starlink’s LEO constellation.”

And Starlink’s commercial opportunity creates a “thriving ‘captive customer’” for that launch business. Here’s their chart on those inextricable links:

The Starlink constellation, said Jonas, is leading the low-earth orbit race on a few key fronts, such as a nationwide rollout expected this month, as announced by Musk, though he has also warned supply may fall short of demand.

The public beta trial that began a year ago has over 100,000 customers and began taking $99 preorder deposits in February with 500,000 to date.

SpaceX’s valuation got a bump earlier this month following a private share sale. It may become the highest valued company in the world, in any industry, Jonas said.

“As valuation hits an estimated ($100 billion), we wonder if anyone can catch them,” he said.

Claudia Assis in San Francisco contributed to this report