This post was originally published on this site

The inflation storm is still battering American families, and there’s no quick end in sight.

Since March, when inflation really began to heat up, the consumer price index (CPI) has risen at an 8% annual rate, the highest in more than 40 years. Over the past two months, prices are up at a 10.8% annual rate.

Prices increases are now broad-based, with only a few items dropping in price.

Breaking news: U.S. inflation rate swells to 39-year high of 6.8% as Americans pay higher prices for almost everything

Everything may be more expensive, but some prices are going up faster than others, and some prices mean more to us than others, because they are a bigger part of our budget. (It goes without saying that every family is different; these numbers are averages for American families.)

In this analysis, I’m examining where the inflation is coming from, and where it isn’t.

Four items in the family budget

Over the past 12 months, prices have risen 6.8%, the largest gain since 1982. The bulk of the gains have been in four big items in the typical family’s budget: Energy, shelter, vehicles and food. These four items represent about 61% of consumer purchases, but account for 81% of the inflation we’ve experienced over the past 12 months.

Energy prices were the biggest contributor to inflation. Even though energy takes less than 8% of the typical family budget, it accounted for about 30% of the inflation. The good news: Global energy supply and demand seem to be getting back into balance. Energy traders expect crude petroleum prices

QMF24,

to fall about 15% over the next two years.

Motor vehicles accounted for about 20% of the inflation over the past 12 months, even though they too represent only about 8% of consumer purchases. New vehicle prices have jumped 11.1% in the past year, while used car and truck prices are up 31.4%. In the year before the pandemic (and the year before that and the year before that), new and used vehicle prices were roughly unchanged after adjusting for quality improvements.

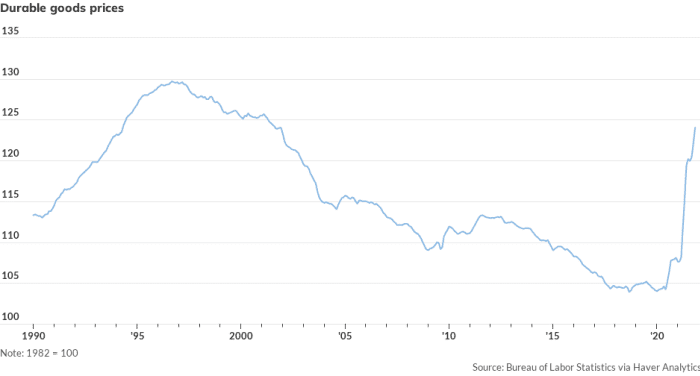

Prices of durable goods have soared since the pandemic after falling steadily for decades.

MarketWatch

Sea change in durables

But it’s not just new and used vehicles that have gotten more expensive. The sea change has been in the price of durable goods, which are defined as physical commodities designed to last three years or longer. Think of trucks, washing machines, TVs and furniture.

Because consumers flush with emergency cash payments from the government were deprived of access to many of their favorite services (such as travel and recreation), demand soared for goods, especially those that make their homes more inviting, their commutes safer and their lives more fun. Unfortunately, at the same time, the pandemic crimped supplies of finished goods and vital parts. You can guess what happened: Prices of durable goods skyrocketed.

In the past year, durable goods prices are up 14.9%, the largest increase since American manufacturers went on a war footing in 1942. To show how extraordinary the price increases are, you should note that prices of durables fell nearly 20% between 1996 and the start of the pandemic in March 2020.

The low inflation of the 2000s and 2010s was built on a foundation of steady deflation in durable-goods prices. But that was then. Durable goods, which represent about 12% of consumer spending, accounted for 24% of the inflation over the past 12 months.

All told, prices of commodities (including both durables and nondurable goods such as food, gasoline and clothing) rose 11.9% over the past year. They contributed about two-thirds of inflation but just 39% of spending.

Services, which represent about 61% of consumer purchases, are up a much smaller 3.8%, contributing just over one-third of inflation in the past 12 months. But that’s nearly twice as high as the Federal Reserve’s inflation target of 2%.

Shelter and food

Shelter is by far the biggest part of services spending, accounting for about one-third of the consumer budget. Homeownership costs and rents (together the government calls them “rent of shelter”) have begun accelerating, a delayed reaction to the historic gains in home prices since the pandemic began.

Over the past 12 months, rent of shelter has risen 3.9%, contributing about one-fifth of the inflation we’ve seen. Over the past three months, however, shelter prices are up at a 5.5% annual rate, the highest since 1990 and a major concern for the Federal Reserve. Shelter prices are very sticky and carry a big weight in the CPI.

Food prices, by contrast, are very flexible. Because consumers buy food all the time, they notice when prices go up. Grocery prices have risen 6.4% in the past year, and have soared at a 12.7% pace over the past three months.

Prices for food purchased for consumption away from home have risen 5.8% in the past 12 months, with restaurant and fast-food meals rising at the fastest pace on record. Everyone knows food costs a lot more than it used to.

Food represents about 14% of consumer purchases, split almost evenly between food purchased for home consumption and food consumed away from home. Food accounted for about 13% of inflation in the past 12 months. For all the attention food prices get, food is actually punching below its weight in terms of inflation.

Where inflation isn’t

The inflation news isn’t universally bad. Several items that people used to worry a lot about in the past have been rather tame recently.

Health care, for instance, was a major preoccupation in the decade before Obamacare was enacted in 2010. But over the past year, despite a terrible health emergency, medical-care prices are up just 1.7%. Prescription drug prices are down 0.3% and health-insurance prices are down 3.8% due to increased government subsidies.

College tuition, which rose at a 6.7% annual rate in the 2000s and 3.4% in the 2010s, is up just 1.9% in the past year.

Every storm cloud has a silver lining, I suppose. But the storm clouds are still gathering.

Rex Nutting is a MarketWatch columnist who has covered economics for more than 25 years.

More on the CPI

Americans pay the price for high inflation each time they go to the grocery store

Highest U.S. inflation in nearly 40 years will force Federal Reserve’s hand