This post was originally published on this site

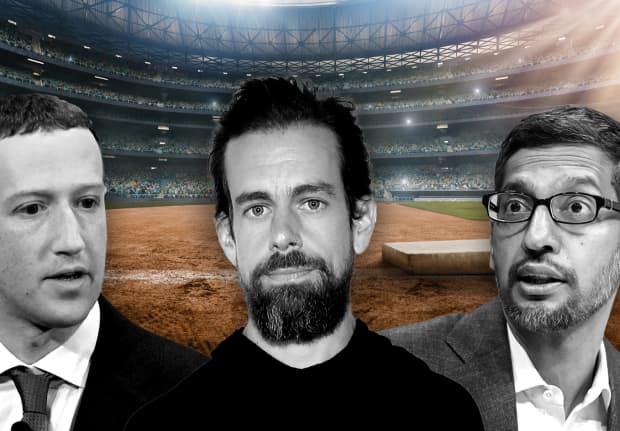

Facebook Inc. Chief Executive Mark Zuckerberg, Twitter Inc. CEO Jack Dorsey and Alphabet Inc. CEO Sundar Pichai, left to right, will testify in front of a Senate subcommittee Wednesday and announce earnings Thursday.

MarketWatch photo illustration/Getty Images|, iStockphoto

Three months ago, Big Tech’s biggest names traipsed into a Congressional hearing to be berated by politicians for their business dominance, then paraded in front of Wall Street a day later to be cheered for their financial dominance.

Somebody must have enjoyed that, because it is about to happen all over again.

On Wednesday, the chief executives of Alphabet Inc.’s Google GOOGL, +1.63% GOOG, +1.58%, Facebook Inc. FB, +2.39% and Twitter Inc. TWTR, +0.31% will testify in front of a U.S. Senate Commerce subcommittee hearing titled, “Does Section 230’s Sweeping Immunity Enable Big Tech Bad Behavior?”

For an encore, all three of those companies will reveal calendar third-quarter earnings Thursday afternoon, along with Big Tech compatriots Apple Inc. AAPL, -0.61% and Amazon.com Inc. AMZN, +0.88%

The House hearing in July was focused on antitrust, and led to a scathing report that sought large-scale remedies to the power of Big Tech. Since then, Google has been officially charged with misusing monopoly power by the Justice Department, and Facebook is expected to face similar charges by the Federal Trade Commission in the coming weeks.

For more: After charges against Google, road map to antitrust changes contains many potential routes

In Wednesday’s hearing, the focus will be on how tech’s largest companies decide what content users can post on their platforms. D.C. politicians have threatened one of the few important laws they have managed to pass on the internet since it has existed, Section 230 of the Communications Decency Act, which became law in President Bill Clinton’s second term and largely protects online platforms from legal retribution for user-generated content.

Full Alphabet preview: Antitrust charges cast long shadow over Google

Google Chief Executive Sundar Pichai and Facebook’s Mark Zuckerberg will be repeat guests from last quarter’s hearing, while Twitter CEO Jack Dorsey will join them this time instead of Apple’s Tim Cook and Amazon’s Jeff Bezos. The next day, the three internet companies are expected to report three months of profit totaling more than $13 billion, though Twitter doesn’t add much to that total.

Full Facebook preview: Cleaning up content has been focus before elections

While the hearing/earnings doubleheader will lead to a lot of headlines, it is far from the only game in town in the week ahead, the busiest week of the U.S. third quarter earnings reporting season. Earnings are expected from more than 35% of the S&P 500 index SPX, +0.34%, 179 companies, and exactly a third of the 30 Dow Jones Industrial Average DJIA, -0.09% components.

Those hopping between earnings conference calls will have their hands full, especially Thursday, when 67 companies report results and 70 host conference calls. Those 70 companies total about 27% of the S&P 500 by market capitalization, according to Dow Jones Market Data.

Here’s what to watch for in the coming week.

Tech titans

Twitter, Facebook and Alphabet are pretty big names in tech, but they are overshadowed by three tech companies that are worth more than $5 trillion combined: Microsoft Corp. MSFT, +0.62%, Apple and Amazon.

Cloud based computing service remains the big story for Microsoft as the company helps power increasingly important digital functions during the remote world of COVID-19. “In many cases we are seeing enterprises accelerate their digital transformation and cloud strategy with Microsoft by six to 12 months as the prospects of a heavy remote workforce for the foreseeable future now looks in the cards with this COVID-19 backdrop,” Wedbush analyst Daniel Ives wrote ahead of the company’s Tuesday afternoon report.

Investors will most likely have to rely on more qualitative clues to figure out the iPhone 12’s early performance, since Apple had not yet introduced its new phone lineup by the time its fiscal fourth quarter wrapped up. Investors would typically use forecasts as a proxy for expected sales, but Apple has held off on issuing traditional financial guidance during the past two reports, citing pandemic-related uncertainties.

Full Apple preview: Apple earnings will be missing the star of the show

With Amazon, the focus will be on what to expect for the year-end holidays. The COVID-19 crisis could push even more holiday shopping online this year, but that puts more pressure on Amazon to make sure its fulfillment capacity is in order. This year’s holiday quarter also features a double whammy for Amazon, as the company pushed its Prime Day back to October, potentially pushing even more profit into the fourth quarter.

Apple and Amazon report Thursday afternoon.

Big week for the Dow

A third of the Dow Jones Industrial Average is set to report, with 3M Co. MMM, -0.53%, Caterpillar Inc. CAT, -0.02%, and Merck & Co. Inc. MRK, +0.78% kicking things off Tuesday morning and Microsoft bringing up the rear that afternoon. Amgen Inc. AMGN, -0.36%, and Boeing Co. BA, -1.01% report Wednesday morning, with Visa Inc. V, +0.01% on deck for the afternoon. Apple is the only Dow member on the Thursday docket with its after-hours numbers, while Honeywell International Inc. HON, -0.74% and Chevron Corp. CVX, -1.13% round out the week with their Friday morning results.

Highlights in the Dow slate include Merck, which could discuss expectations for its COVID-19 vaccine candidate, and Boeing, which already disclosed third-quarter commercial airplane deliveries that were less than half of the company’s year-earlier total. Jefferies analyst Sheila Kahyaoglu noted that the company has seen one “baby step” of progress after European authorities deemed its 737 MAX jet safe to fly.

“The recert of the 737 MAX officially starts the process which could see Boeing work off ~$16 billion of inventory tied to finished MAXs,” she wrote. “This is likely a source of cash through 2023.”

Chipping away

After rival Intel Corp. INTC, -10.57% showed that it continues to stumble through manufacturing woes, investors will see Tuesday afternoon how Advanced Micro Devices Inc. AMD, +3.19% has been able to capitalize. “We believe AMD is taking high-end notebook and desktop market share and their progress made in cloud server share should steadily manifest in enterprise,” Cowen & Co. analyst Matthew Ramsay wrote after Intel’s report.

Full AMD preview: Gain expected from Intel’s pain yet again

Fellow chip company Western Digital Corp. WDC, -2.84% reports Wednesday afternoon, just about a month after announcing a reorganization that will separate the flash and hard-disk-drive businesses into their own units. Some analysts see this as a hopeful sign that WDC may formally split the two parts of the business down the line, a move that could “unlock stock value,” per Baird analyst Tristan Gerra. Executives may face questions on that prospect during the conference call.