This post was originally published on this site

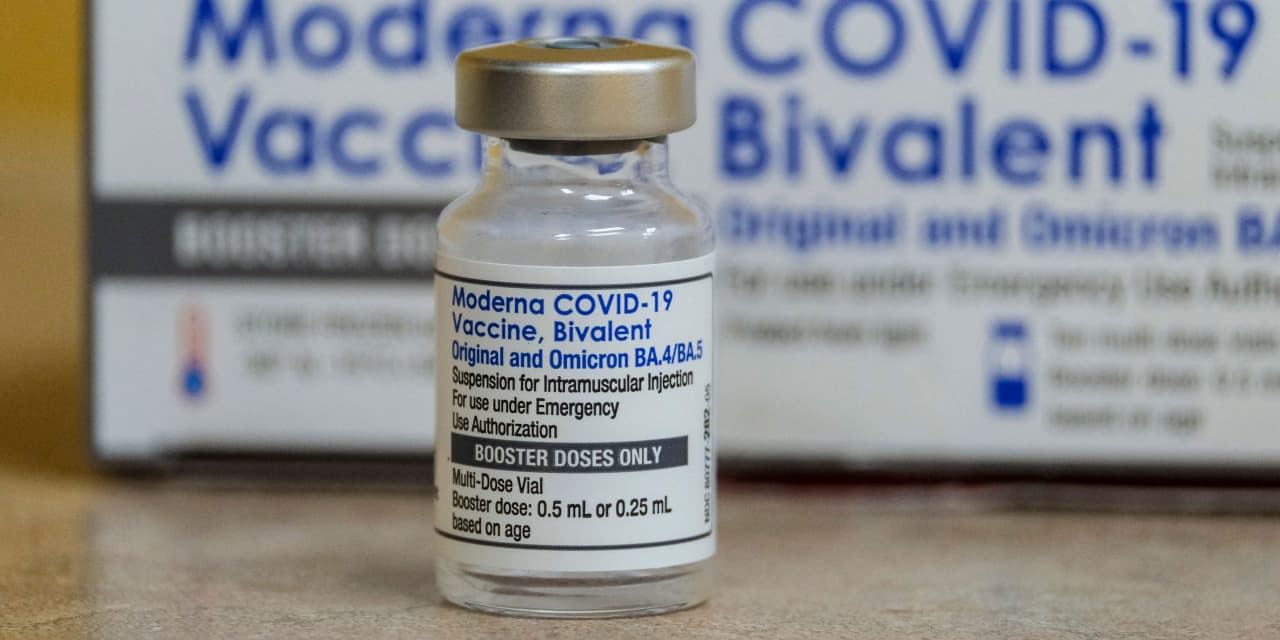

Moderna Inc.’s stock fell 7.5% Thursday after the company’s fourth-quarter earnings fell short of estimates amid a steep decline in sales of its COVID vaccine, Spikevax — which is the company’s sole product to have won regulatory approval.

Investors were further disappointed by the Cambridge, Mass.-based company’s

MRNA,

guidance for about $5 billion in COVID sales in 2023, which is almost $3 billion below the FactSet consensus of $7.9 billion.

The guidance is backloaded to the latter half of the year, with product sales in the first half expected to come to about $2 billion, also below the $3.2 billion forecast by FactSet analysts.

The company did say, however, that it expects additional COVID vaccine sales from key markets. On a call with analysts, Chief Commercial Officer Arpa Garay identified those as the U.S., the European Union, Japan, Australia and other countries in Asia and Latin America.

The company currently has advance purchase agreements from Canada, Kuwait, Switzerland, Taiwan and the U.K. It expects further sales from deferrals in 2022 contracts, Garay said, according to a FactSet transcript.

Investors weighing in on the numbers said it seems the COVID boost is fading for Moderna, hardly a surprise as the pandemic shifts to a new phase and President Joe Biden prepares to end the twin emergencies that gave the government special powers to manage it.

“Given the ongoing decline in Spikevax sales, our specialists continue to emphasize the ever increasing importance of Moderna’s pipeline, as underscored by the company’s plan to invest $4.5 billion in [research and development] in 2023, an increase of $1.2 billion from 2022,” said Lee Brown, global sector lead for healthcare at research firm Third Bridge, in comments he based on interviews with executives.

Moderna executives on the call highlighted that pipeline, which includes a plan to submit an application for regulatory approval for its vaccine against respiratory syncytial virus, or RSV, in adults sometime in the first half of the year.

“We’re also advancing a portfolio of next-generation programs against these viruses (COVID, RSV and flu), including mRNA-1283, which is a next-generation COVID-19 booster that is refrigerator stable,” Moderna’s president, Stephen Hoge, told analysts.

“We also have multiple next-generation flu programs, which seek to increase the breadth of coverage against influenza by adding additional antigens that are not present in currently available flu vaccines,” he said.

The company expects a Phase 3 flu vaccine interim efficacy analysis to be reviewed by an independent data and safety monitoring board before the end of the first quarter.

And in one development that analysts have cheered, the company is expecting to share a full data set for the cancer vaccine it is developing in combination with Merck’s

MRK,

Keytruda at an upcoming medical oncology meeting and in a peer-reviewed publication.

Now see: After IPO, Bausch + Lomb turns to an industry favorite to run the company

The therapy received breakthrough therapy designation from the Food and Drug Administration on Wednesday, which should help it through the regulatory process. The companies are expecting to launch multiple late-stage confirmatory studies for the therapy in 2023, starting with melanoma and then moving on to non-small-cell lung cancer, said Hoge.

“We are planning to explore additional indications for mRNA-4157 where we believe there’s a strong biologic rationale for immune-stimulating approaches,” he said.

Moderna posted net income of $1.465 billion, or $3.61 a share, for the fourth quarter, down from $4.868 billion, or $11.29 a share, in the year-earlier period. Revenue fell to $5.084 billion from $7.211 billion a year ago.

The FactSet consensus was for earnings per share of $4.60 and revenue of $5.017 billion.

Product sales fell 30% to $4.9 billion, due to lower sales volume and lower demand compared with the prior year.

Also: Pfizer’s COVID revenues have dropped off along with attention to the pandemic

For the full year, the company chalked up sales of $18.4 billion, a 4% increase over 2021. Cost of sales rose to 29% of product sales, up from 15% the previous year. That was mostly due to higher write-downs for excess and obsolete inventory related to COVID vaccines, unutilized manufacturing capacity and losses related to future purchase commitments for raw materials.

The stock has gained 7% in the last 12 months, while the S&P 500

SPX,

has fallen 6%.