This post was originally published on this site

Kroger Co. stock fell Thursday, even after the company posted better-than-expected third-quarter earnings and raised guidance, as investors looked ahead to potential headwinds expected in 2023.

The company

KR,

is also in the midst of a regulatory review of its planned merger with rival Albertsons Cos.

ACI,

and just this week, executives from both companies were grilled by lawmakers at a Senate hearing who seemed skeptical of their promise of lower prices for consumers.

“A lack of competition in the industry means higher prices and lower quality,” said Sen. Amy Klobuchar, D-Minn, in one comment that summed up the mood. “And yet this proposed merger, worth over $24 billion, combines the two largest grocery-store chains in the country.”

For more, see: Kroger-Albertsons merger deal seen leading to higher prices, less competition by lawmakers grilling CEOs

On a call with analysts, Kroger Chief Executive Rodney McMullen said there was no substantive update on the deal at this time, but that the two are still working on an integration plan.

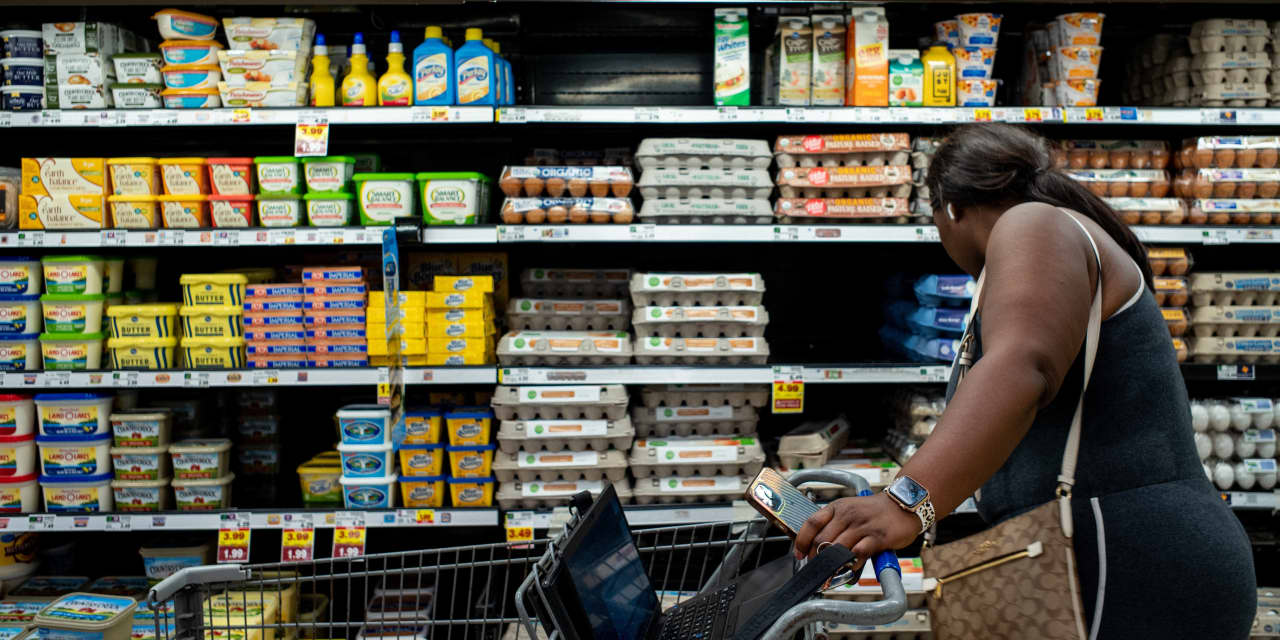

McMullen said inflation remains top-of-mind for its customers, who are clearly still cooking at home to avoid the cost of eating out and seeking fresh food for that purpose. The word inflation was featured 41 times on the company’s earnings call.

See: Target stock tumbles after ‘rapidly softening demand’ leads to another big profit miss

Customers are also taking advantage of discounts and loyalty program offerings, with digital coupon downloads up 32% from the third quarter of 2021. And the company’s private label brands, called “Our Brands,” performed strongly with same-store sales up 10.4% in the quarter.

“We anticipate these interactions will continue through the holidays with customers expected to realize more than $200 million in savings from our highly personalized digital offers,” he told analysts according to a FactSet transcript.

Kroger is expecting inflation to ease in the fourth quarter, partly as it overlaps with high inflation from last year. Inflation was more than 7% higher than a year ago in government data for October.

MKM Partners analyst Bill Kirk said “discretionary assortment problems” at Walmart

WMT,

have likely helped achieve rationality in consumer staples.

“Kroger has a large overlap with Walmart, with ~52% of stores sharing a ZIP Code,” Kirk wrote in a note to clients. “That said, we are seeing early signs that Walmart is getting more competitive in Food pricing and worry that Kroger’s fuel margin benefit will be a tough comparison in

FY23.”

MKM rates Kroger stock at neutral with a fair value estimate of $50 compared with its current price of just below $49.

Kroger posted net income of $398 million, or 55 cents a share, for the quarter, down from $483 million, or 64 cents a share, in the year-earlier period. Adjusted per-share earnings came to 88 cents, ahead of the 83 cent FactSet consensus.

Sales rose to $34.2 billion from $31.9 billion a year ago, also ahead of the $83.9 billion FactSet consensus. Same-store sales were up 6.9%, while FactSet was expecting a rise of 4.0%.

The company is now expecting full-year same-store sales to range from 5.1% to 5.3% and for EPS to range from $4.05 to $4.15.

The FactSet consensus is for a same-store sales rise of 4.5% and for EPS of $4.09.

Kroger shares rose premarket immediately after the numbers were released but later shed those gains to trade down about 0.8%. The stock is up 8% in the year to date, while the S&P 500

SPX,

has fallen 14%.

See also: Kroger and Albertsons say their merger will help lower food prices for struggling consumers. Not everyone is convinced.