This post was originally published on this site

Royal Caribbean Group looks poised to report the first billion-dollar quarter since the pandemic, and may finally be confident enough about the post-pandemic outlook to provide long-term financial targets.

The Florida-based cruise operator is scheduled to report fourth-quarter results on Friday, before the opening bell.

The stock

RCL,

slumped 1.7% in afternoon trading Thursday ahead of the results. The day before the past six quarterly results, the stock had gained three times, including rising 0.9% the day before third-quarter results, and declined three times.

The 11 analysts that provided estimates to FactSet are expecting, on average, a per-share loss that narrows to $3.92 from $5.02 in the same period a year ago. That would mark the eighth-straight quarter of losses.

Revenue is expected to spike up to $1.04 billion, according to FactSet. That’s up from $457 million in the sequential third quarter, up from $34 million a year ago when cruising was halted and the most since the company reported $2.03 billion in revenue in the first quarter of 2020.

The company had reported wider-than-expected losses the past two quarters, and for five of the past seven quarters. It has also missed revenue forecasts for the past five quarters, and for eight of the past nine quarters. In comparison, rival Carnival Corp.

CCL,

has reported losses that were wider than forecast the past five quarters and has missed revenue projections the past seven quarters.

The question for investors is, does the cruise company have enough confidence in the outlook for cruising, amid lingering concerns over the impact of the COVID-19 pandemic, to provide long-term financial guidance for the first time in more than four years?

UBS analyst Robin Farley believes the answer is yes, which is a good sing for investors given that she said Royal Caribbean has a “strong history” of delivering on its long-term guidance.

“[W]e believe that they could give a 3-year outlook on Friday, which could be a positive sign of their visibility into longer-term demand despite the near-term omicron disruption,” Farley wrote in a note to clients.

That would follow more near-term guidance the company provided in its third-quarter report released in October, when it said it expects cash flow to be positive by the spring and that it should be profitable for full-year 2022.

Since then, Farley said her research suggests forward bookings are still down 65% to 70% from 2019, but are “picking up” over the start of January. In addition, she said cruise checks have shown a lower level of cancellations for near-term departures compared with two weeks ago.

In addition, even during the early-January weaker period, booking for 2023 were holding up, Farley said.

“RCL [Royal Caribbean] will have almost two weeks of additional data from wave season, which we believe may show a positive turning point for booking volumes, especially with recent travel sentiment improving,” Farley wrote.

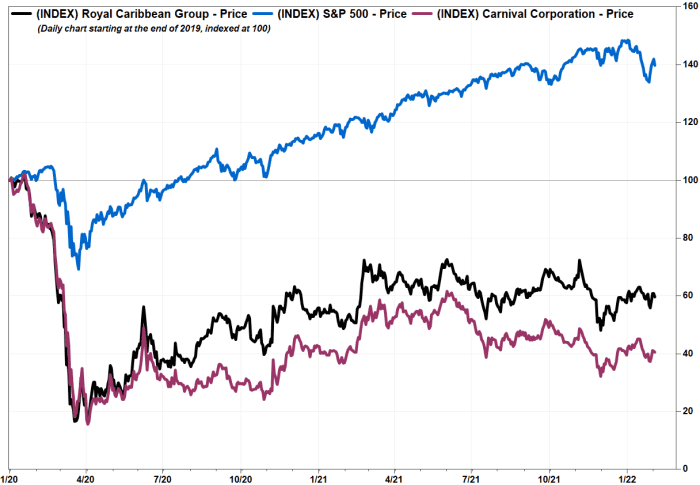

FactSet, MarketWatch

She noted that RCL could provide three-year targets for earnings per share without giving all of the specifics to get there, “as we’ve seen before,” because there is a “range of levers” such as price, volume and expense, that would contribute.

Royal Caribbean’s stock has lost 11.0% over the past three months, while Carnival shares have shed 11.0% and the S&P 500 index

SPX,

has declined 2.4%.