This post was originally published on this site

Investors will soon find out if shares of railroad operators can continue to offer some relative safety within a transportation sector that has suffered in recent weeks due to concerns that a freight recession was on the horizon.

Florida-based CSX Corp.

CSX,

is scheduled to report first-quarter results after Wednesday’s closing bell, while Nebraska-based Union Pacific Corp.’s

UNP,

report is slated to be released before Thursday’s open.

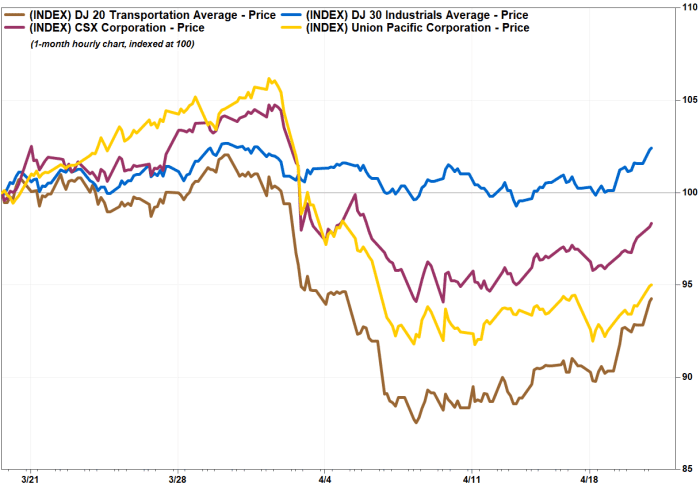

Even with the Dow Jones Transportation Average

DJT,

up 1.6% in morning trading Wednesday, and up 4.4% the past two days, the index was still down 6.4% over the past month, while its sister index, the Dow Jones Industrial Average

DJIA,

has gained 1.2%.

The transports’ underperformance underscored the fear that rapidly deteriorating market conditions — shipping rates have dropped as rising prices led to increased capacity but also decreased demand — will trigger a freight recession.

But some Wall Street analysts believe trucking companies will bear the brunt of these challenges, while railroad operators will be relatively insulated. The recent earnings report from Greenbrier Companies Inc.

GBX,

the Oregon-based maker of railroad freight cars, supported that belief, and even provided hope that rails may actually benefit from the current macro environment, including the war in Ukraine.

Shares of CSX and Union Pacific outperformed the Dow transports the past month, but underperformed the Dow industrials, with CSX down 2.1% and Union Pacific losing 4.9%.

FactSet, MarketWatch

Cowen analyst Jason Seidl said in recent research note that while first-quarter earnings reports from trucking companies won’t likely produce enough answers for investors, with many management teams expected to express uncertainty over their outlooks, he views “the rail sector as the safest way to play the space given current economic/geopolitical conditions.” Read earnings story on J.B. Hunt Transports Services Inc.

Evercore ISI’s Jonathan Chappell suggested that rail operators could provide relatively upbeat guidance amid a recent tailwind of volume growth momentum.

“The quarter is less than two weeks old, but after a 1Q with repetitive volume shortfalls and questions regarding service reliability and appropriate labor resourcing, the positive carload momentum of the last two weeks has been a favorable shift, and the [year-over-year] comparables only get easier as the year progresses,” Chappell wrote in a note to clients last week.

That doesn’t mean Chappell believes it will be a smooth ride for the rails, as his research indicates that volumes for the larger rail operators declined 4.6% in the latest week, including a 6.2% drop for Union Pacific and a 0.5% decline for CSX.

Meanwhile, Greenbrier said in its earnings report last week, in which revenue more than doubled to beat expectations by a wide margin, that inflation in commodities markets, which might hurt trucking margins by raising fuel costs, have traditionally been leading indicators for an expansion in rail freight.

In addition, the company said that while the war in Ukraine was a tragedy, it was expected to create tremendous opportunities for the transportation by rail of bulk commodities, such as fertilizer, grains, crushed rock and petroleum products.

On Wednesday, railcar leasing company GATX Corp.

GATX,

reported first-quarter profit that more than doubled to beat expectations by a wide margin, although revenue came up a bit shy.

“Conditions continue to strengthen across our global railcar leasing markets despite increased economic uncertainty due to the war in Ukraine,” GATX Chief Executive Brian Kenney said. “As the number of idle railcars in the industry continues to decline, the pace of lease rate increases from the prior quarter accelerated for most car types.”

That may bode well for the upcoming results from CSX and Union Pacific.

What’s expected from CSX

Analysts surveyed by FactSet are expecting, on average, earnings per share of 37 cents, up from 31 cents in the same period a year ago.

The FactSet consensus for revenue is $3.31 billion, which implies 17.7% growth from last year.

What might help with how investors react to the results is that Wall Street’s sell-side analysts have lowered the earnings bar in recent months. At the end of January, the FactSet consensus for EPS was 40 cents and for revenue was $3.36 billion.

The buy-side appears to be a bit more optimistic. The EPS consensus from Estimize, a crowdsourcing platform that gathers estimates from buy-side analysts, hedge-fund managers, company executives, academics and others, is 39 cents, while the revenue consensus is $3.37 billion.

In CSX’s fourth quarter report, released after the Jan. 20 close, CSX beat both EPS and revenue expectations, but the stock still fell 3.2% the day, to extend the 4.1% loss suffered in the week leading up to the report.

With the stock up 0.5% in morning trading Wednesday, it has gained 3.1% in the past week.

What’s expected from Union Pacific

The FactSet consensus for EPS is $2.56, which is up from $2.00 a year ago. The consensus has increased in recent months, from $2.50 at the end of January.

The FactSet revenue consensus is $5.71 billion, up from $5.58 billion at the end of January, and implying 14.1% growth from a year ago.

The average estimates compiled by Estimize are higher, at $2.61 for EPS and at $5.82 billion for revenue.

Union Pacific has beat both the EPS and revenue consensus for the past three quarters, and the stock has gained an average of 1.2% the day of those earnings reports.

The stock is up 1.3% in morning trading, and has gained 1.5% the past week.