This post was originally published on this site

There’s nothing like sticker shock to make consumers rethink priorities, and interest in climate action may be one of those.

Assets under management in environmental, social and governance (ESG) exchange traded funds and mutual funds have grown sharply, coinciding with greater public demands to mitigate climate change.

But near-term crises can overshadow long-term threats, and Russia’s war against Ukraine kicked concerns about climate change off headlines, replaced by oil and gas shocks, and geopolitical worries.

Crude oil prices have topped $100 a barrel and retail gasoline prices jumped 20% in a week, leading President Biden to announce a release of oil from the Strategic Petroleum Reserve to take the edge off prices. European consumers will pay astronomical prices for energy since they are much more dependent on Russian oil supplies.

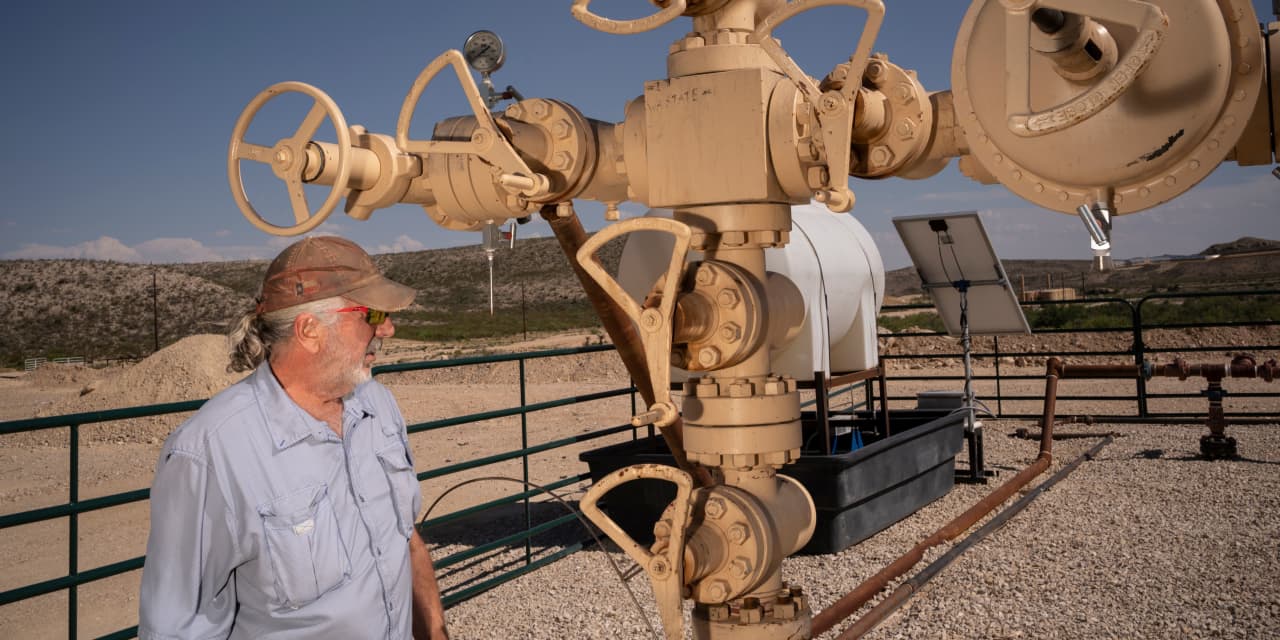

Fossil-fuel proponents are using the high prices to call for greater U.S. hydrocarbon production to ease prices on consumers in the short-term and secure domestic energy independence in the long-term. In Europe, Germany proposed Sunday to build two liquefied natural gas terminals to import U.S. natural gas, while also calling to speed up its transition to all renewable energy by 2035.

The acute need for energy supplies now has climate concerns taking a back seat, say several sustainable fund managers.

“I think probably the ‘drill, baby, drill’ mentality is back in the U.S.,” says Tony Tursich, co-portfolio manager at Calamos Global Sustainable Equities Fund.

Long-time ESG fund managers expect high prices will unleash greater oil production in the shorter term, but they all believe the push for renewable energy will continue in the long term and eventually could accelerate once supply chain bottlenecks for key industrial metals normalize. Russia’s war underscores that reliance on fossil fuels is a risk, they say.

“I think this the last gasp” for fossil-fuel production, says Cheryl Smith, a portfolio manager for the Green Century Balanced Fund.

Climate change may not be top of mind today, but memories of recent natural disasters linger in people’s minds, she says.

“I don’t think consumers have forgotten the last hurricane season; I don’t think they’ve forgotten the last flood season. And I think that they kind of see the vulnerability to that fossil-fuel production,” she says.

Smith points to the 1970s oil crisis, which led to significantly increased energy efficiency over the decades, one reason why she expects the Russian war to accelerate the transition to sustainable energy. Unlike fossil-fuel production that’s centralized in certain parts of the world and U.S., renewable energy is decentralized as wind and solar farms can be sited in more locations, another benefit.

Getting infrastructure built

Political will may demand a faster move to renewables, but logistics dictate the speed. Orders for clean-energy equipment were already high before the war started. As an example, Danish wind-turbine manufacturer Vestas

VWDRY,

is sold out of production through 2023, says Garvin Jabusch, chief investment officer at asset manager Green Alpha Advisors.

Key metals such as nickel for batteries in electric cars, and aluminum, used in a host of industrial products, were in short supply before Russia’s invasion, but given that the country is a significant producer of those metals, ramping up production outside of the country will take time. According to Natixis, it can take five to 10 years to develop a mine project and see the impact on supply. Nickel

JJN,

prices touched 11-year highs, with aluminum

JJU,

at all-time highs.

Read: Biden to bolster mineral supply chain for phones, EVs and wind power to help end foreign reliance

Near-term supply chain issues may hamper renewable infrastructure, but it shouldn’t be a long-term problem. Matt Breidert, senior portfolio manager at Ecofin, says there are opportunities on the aluminum side to build non-Russian capacity, with Alcoa

AA,

Norway’s Norsk Hydro

NHYDY,

and Century Aluminum

CENX,

among some of the top names. His firm owns Norsk Hydro, saying it produces some of the greenest aluminum products on the market because of its increased use of renewable energy to run smelters. Alcoa is a close second, he adds.

The high prices are already incentivizing producers, as Alcoa said in November it is restarting a long-idled smelter in Australia, with metal output to start by the third quarter of 2022.

For nickel, companies such as Australia’s BHP Group

BHP,

have an opportunity to expand, although Russia’s nickel output will be harder to replace, he says. However, even as battery growth continues to advance, the metal is starting to lose market share to lithium iron phosphate. That chemical combination already makes up 50% the market share of all the new EVs in China, led by Tesla

TSLA,

Natixis says while expanding mine supply might take years, metals have a key advantage over fossil fuels, and that’s recycling. The firm says secondary supply is becoming more important and metal produced from scrap has a considerably lower carbon footprint than primary output.

An emerging, but fast-growing, field of lithium and rare-earth recycling eventually could be a significant boom to the renewables sector, Jabush says. He owns Li-Cycle

LICY,

which can economically recycle lithium-ion batteries. Another recycling startup is privately held Redwood Materials, founded by JB Straubel, a Tesla co-founder.

Read: Better than recycling? These manufacturers are taking part in a ‘circular economy’

The tricky part to building clean-energy projects quickly is site permitting, Breidert says, while market design issues also impede faster implementation. For example, he says, the Biden administration announced an offshore wind auction in the U.S. last week that sold for a record price. That price gets tacked on to the cost to build the wind farm and eventually price of electricity.

“We should be giving these things out like lollipops,” he says.

Robert Klaber, portfolio manager and director of ESG research at asset manager Parnassus, says whether consumers turn back from their support to mitigate climate change, there are other ways governments can cushion the blow of high energy prices by offering incentives to adopt clean energy, including tax breaks and cash rebates for energy-saving products or other initiatives.

He doubts the current events will cause companies to move away from climate targets and initiatives, which are long-term commitments. Some companies may push out their targets by a few years if they have trouble meeting initial goals.

“Companies have spent the time, resources and money to develop these plans. I don’t think we’re going see them abandon them,” he says.

Investment ideas

Market action suggests investors want non-fossil fuel energy products, Tursich says, pointing to performance by chemical and materials companies that use non-petrochemical based ingredients such as lanolin, rapeseed oil and palm oil to create biosurfactants. Two examples are U.K.-based Croda International

COIHY,

and Netherlands-based DSM. Windfarm operators Orsted

ORSTED,

and Portugal’s EDP Renewables

EDRVF,

also rallied.

Read: These under-the-radar stocks fight climate change by reducing carbon emissions

Dan Abbasi, managing director at investment firm Douglass Winthrop Advisors, says energy security is an all-sector affair, and long-term he sees companies such as Siemens

SIEGY,

and Schneider Electric

SBGSY,

which create products to automate and optimize resource use to improve efficiency on industrial scale benefiting.

He also likes Generac Holdings

GNRC,

Long known for its fossil-fuel-powered backup energy-generating equipment, the company now offers solar and battery energy solutions available for commercial or residential use. He says backup-power supplies could be attractive for companies or homeowners looking for security, whether because of geopolitical concerns or extreme weather.

Abbasi doesn’t think people will abandon climate change pushes because of short-term energy shocks.

“People are actually pretty smart about this. They recognize it’s a problem; they recognize we need to do something about it,” he says.

More on MarketWatch:

This is what you’re getting wrong about ESG ratings

Can I beat the stock market with ESG investing? How to find the right fund for you