This post was originally published on this site

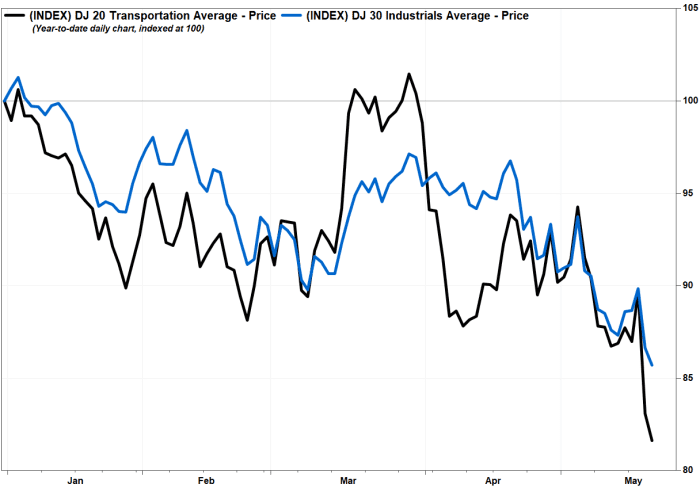

The Dow Jones Transportation Average took another deep dive Thursday, with the biggest drag shifting to the index’s railroad components after downgrades at Citigroup, which cited concerns over a deceleration of demand.

The Dow transports

DJT,

sank 213 points, or 1.6%, in afternoon trading toward a 14-month low. The index underperformed its sister index, the Dow Jones Industrial Average

DJIA,

which fell 258 points, or 0.8%.

Among the transports’ biggest losers, shares of Union Pacific Corp.

UNP,

dropped 3.8%, CSX Corp.

CSX,

slid 2.9% and Norfolk Southern Corp.

NSC,

sank 2.9%. The combined price declines of those stock accounted for about 100 points of the Dow transports’ decline.

All three railroad operators were downgraded to neutral from buy by Citigroup analyst Christian Wetherbee.

On Wednesday, when the Dow transports sank 7.4% while the Dow industrials slumped 3.6%, it was trucking stocks that acted as the anchor, as Target Corp.

TGT,

cited freight costs and supply chain disruptions for its big earnings miss.

FactSet, MarketWatch

Wetherbee said he had been bullish railroad stocks amid weakness in trucking to start the year, as Wall Street viewed the rails as a relative safe haven in the current environment of rising inflation and geopolitical uncertainty.

Don’t miss: CSX, Union Pacific earnings to show if railroads really offer relative reprise from turbulent transport sector.

Wetherbee said it’s that outperformance, plus Street expectations for earnings growth at the highest, that makes him believe rail-stock performance will be relatively limited going forward.

“We entered 2022 recommending the group and it has outperformed, but we believe a more selective/cautious approach is warranted given freight warning signs and persistent service issues, which could results in a delayed operational reaction to a true downturn,” Wetherbee wrote in a note to clients.

While he’s not fully baking a full recession into his estimates, he does believe consumer spending “pivots meaningfully” toward services, and away from goods, which would hurt goods haulers.

“For rails, volume flattens in 2023 and incremental margins decelerate along with pricing,” Wetherbee wrote.

Elsewhere in the Dow transports, Avis Budget Group Inc.’s stock

CAR,

slid 4.6% on Thursday, after diving 12.5% on Wednesday.

Among the transports gainers on Thursday, were the airline components. JetBlue Airways Corp.’s stock

JBLU,

led the pack with a 3.3% rally, after buyout target Spirit Airlines Inc.

SAVE,

surged its shareholders to reject the tender offer launched earlier this week.

Also, shares of Alaska Air Group Inc.

ALK,

gained 0.9% and Delta Air Lines Inc.

DAL,

rose 0.2%. Meanwhile, United Airlines Holdings Inc. stock

UAL,

eased 0.1%, American Airlines Group Inc.’s stock

AAL,

lost 0.7% and Southwest Airlines Co. shares

LUV,

shed 1.0%.