This post was originally published on this site

As the stock market has rallied over the past two weeks, shares of chip makers have followed suit. But semiconductor stocks as a group are trading at a discount to the benchmark S&P 500 and are expected to increase sales and earnings more quickly through 2023.

On March 29, Micron Technology Inc.

MU,

reported results for its fiscal second quarter ended March 3. The company’s sales for the quarter were up 25% from a year earlier. Earnings came in at $2 a share, up from 53 cents.

This is a stock that traded for 7.4 times the consensus earnings estimate for the next 12 months among analysts polled by FactSet, at the close on March 29. That is an incredibly low price-to-earnings (P/E) ratio.

Read: Micron stock rises as data-center growth drives earnings

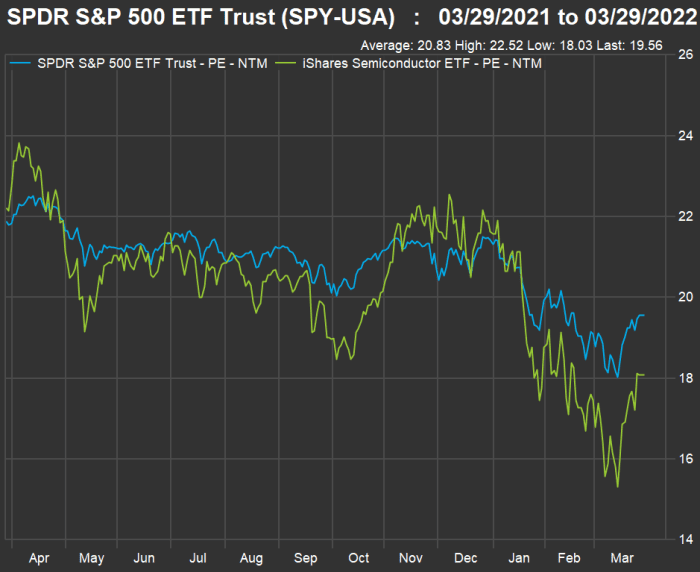

Here’s a chart showing the movement over the past year of forward price-to-earnings ratios (based on rolling 12-month earnings estimates) for the SPDR S&P 500 ETF

SPY,

and the $9.6 billion iShares Semiconductor ETF

SOXX,

which holds the 30 largest U.S.-listed companies (including American depositary receipts for non-U.S. companies) that make computer chips or provide equipment or services used to make them:

FactSet

It’s one thing to say that semiconductor stocks are trading relatively low by this traditional measure. But the group’s low valuation is underscored by how much more rapidly it is expected to increase sales and earnings.

Here are calendar-year consensus estimates for sales and earnings per share for SOXX and SPY through 2023, with expected compound annual growth rates (CAGR).

First, sales per share:

| ETF | Ticker | Sales per share – 2021 | Estimated revenue per share – 2022 | Estimated revenue per share – 2023 | Two-year estimated sales CAGR |

| iShares Semiconductor ETF | SOXX | $76.84 | $90.52 | $98.21 | 13.1% |

| SPDR S&P 500 ETF Trust |

SPY, |

$150.77 | $163.98 | $172.84 | 7.1% |

| Source: FactSet | |||||

And now earnings per share:

| ETF | Ticker | EPS – 2021 | Estimated EPS – 2022 | Estimated EPS – 2023 | Two-year estimated EPS CAGR |

| iShares Semiconductor ETF | SOXX | $18.55 | $26.21 | $29.21 | 25.5% |

| SPDR S&P 500 ETF Trust |

SPY, |

$18.79 | $22.11 | $24.33 | 13.8% |

| Source: FactSet | |||||

The CAGR estimates are impressive all around, but significantly higher for the semiconductor group.

Cap-weighted semiconductor ETF

The iShares Semiconductor ETF uses a modified weighting by market capitalization, limiting the top five holdings to 8% of the portfolio each, with other holdings limited to 4%. The portfolio is reconstituted annually and rebalanced quarterly.

SPY is directly weighted by market capitalization, as is the S&P 500

SPX,

Within SOXX, some of the stocks trade at high price-to-earnings ratios. These include Nvidia Corp.

NVDA,

and Advanced Micro Devices Inc.

AMD,

which are expected to continue to grow rapidly.

Here are 10 largest holdings of SOXX, with expected two-year sales and earnings CAGR, based on consensus estimates for calendar years 2021 through 2023:

| Company | Ticker | Forward P/E | Two-year estimated sales CAGR | Two-year estimated EPS CAGR | % of SOXX portfolio |

| Broadcom Inc. |

AVGO, |

17.3 | 10.1% | 15.7% | 9.9% |

| Advanced Micro Devices, Inc. |

AMD, |

29.8 | 21.1% | 30.4% | 8.6% |

| Qualcomm Inc |

QCOM, |

13.1 | 13.6% | 16.6% | 7.6% |

| NVIDIA Corporation |

NVDA, |

48.5 | 24.5% | 24.4% | 7.4% |

| Intel Corp. |

INTC, |

15.0 | 1.9% | -18.4% | 6.6% |

| Marvell Technology, Inc. |

MRVL, |

31.4 | 27.9% | 37.1% | 4.5% |

| Texas Instruments Inc. |

TXN, |

20.7 | 6.2% | 6.2% | 4.2% |

| Applied Materials, Inc. |

AMAT, |

16.1 | 11.2% | 15.5% | 4.0% |

| Micron Technology, Inc. |

MU, |

7.4 | 18.7% | 34.5% | 4.0% |

| Analog Devices, Inc. |

ADI, |

19.6 | 22.6% | 16.3% | 4.0% |

| Source: FactSet | |||||

Some of the 2021 numbers that underlie the CAGR are estimates, because several of the companies have fiscal years that don’t match calendar years or even calendar quarters.

Click on the tickers for more about each company.

Click here to read Tomi Kilgore’s detailed guide to the wealth of information available for free on the MarketWatch quote page.

Don’t miss: These 10 dividend stocks with yields of at least 5% can help you take on stagflation or a recession