This post was originally published on this site

Harbor Capital Advisors of Chicago, which manages $62 billion in active strategies, is switching gears, having opened six exchange traded funds since September. The goal is to mitigate the type of volatility that has been disconcerting to investors who have invested in high-beta funds such as the the ARK Innovation ETF.

During an interview, Kristof Gleich, Harbor’s chief investment officer, discussed an approach that makes use of sub-advisers to bring different approaches to building “high-conviction” portfolios managed by Gleich’s team at Harbor, while also reducing volatility and risk.

Gleich focused on the Harbor Disruptive Innovation ETF

INNO,

which was established in December. The new ETF has only about $6 million in assets, but Harbor is running a total of $300 million under the same strategy, which also includes the Harbor Disruptive Innovation Fund

HIMGX,

Cathie Wood, CIO at Ark Invest, has famously followed a strategy of taking highly concentrated positions in stocks of companies she believes are primed for explosive growth through innovation of technology or business processes. The strategy led to class-leading returns for the Ark Innovation ETF

ARKK,

in 2020.

“If there is one thing we have learned about investing, it is that clients tend to bail at the worst time.”

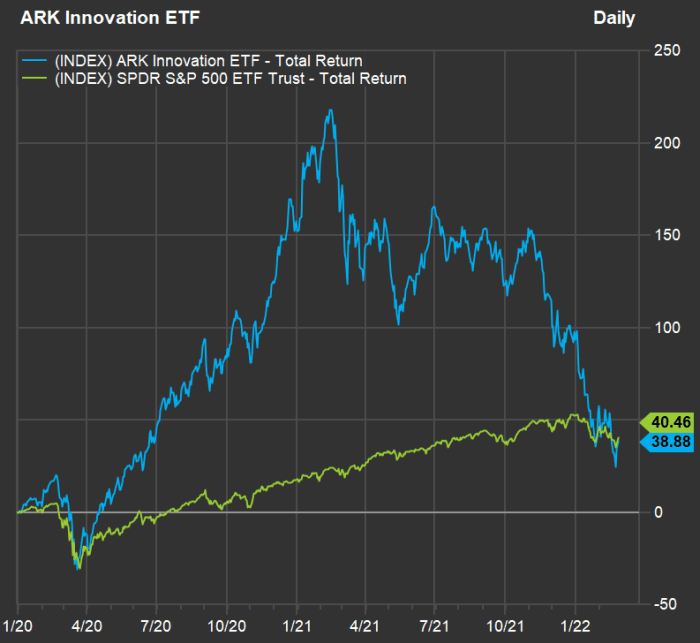

But some of the same stocks that performed so well early in the coronavirus pandemic crash-and-recovery cycle have since tumbled down to earth. Here’s a chart showing ARKK’s return and that of the SPDR S&P 500 ETF

SPY,

(which tracks the benchmark S&P 500 Index

SPX,

) from the end of 2019 through Feb. 25:

The ARK Innovation ETF soared 153% during 2020 but sank 23% in 2021.

FactSet

During 2020, ARKK returned 153% while SPY was up “only” 18%. Then in 2021, ARKK fell 23%, while SPY returned 29%. So far in 2022, through Feb. 25, ARKK has fallen another 28%, while SPY is down 8%. It would appear that SPY is shining, as the tortoise has beaten the hare. Then again, a period of only a bit more than two years isn’t very long for an active equity management strategy.

Wood insists that her strategy remains the right one for long-term investors looking to maximize growth by taking advantage of disruptive trends in technology and business. Gleich agrees that disruptive innovation isn’t going away, and even believes it is “becoming an asset class.”

When discussing how investors can react to the higher volatility of a concentrated investment strategy, Gleich said: “If there is one thing we have learned about investing, it is that clients tend to bail at the worst time.”

“As human beings, we are terribly wired as investors. We need to create systems to save ourselves from ourselves,” Gleich said, adding that in investing, “the only free lunch is diversification.”

Kristof Gleich, chief investment officer of Harbor Capital Advisors.

Harbor Capital Advisors

So Gleich is looking to improve investors’ returns by reducing volatility and hopefully mitigating investors’ tendencies to sell into declining markets. But he also seeks to build a balanced portfolio “focused on idiosyncratic returns.”

INNO is designed to hold between 90 and 100 stocks. It is co-managed by Gleich and Spenser Lerner using Harbor’s own “systematic and quantitative approaches” to asset allocation and risk management. But for the individual stock selections, the ETF’s managers rely on five other firms with varying specialties:

- 4BIO Partners LLP of London focuses on life sciences.

- Sands Capital Management LLC of Arlington, Va., takes a broad approach to identify disruptors.

- Westfield Capital Management Co. of Boston specializes in U.S. technology and health care.

- Tekne Capital Management LLC of New York has expertise in telecommunications, media and financial technology.

- NZS Capital LLC of Denver specializes in technology and communications, especially the continuing transition from analog to digital.

Gleich, a former global head of manager selection at JPMorgan Chase & Co., said “finding those brilliant money managers tends to be in our wheelhouse.”

One potential problem ETF managers face is linked to their own potential success. Any manager of a very large fund may find it difficult to take large enough concentrated positions in innovative companies to “move the needle.”

Gleich said Harbor has “a short list of other managers” it could bring into the INNO fold to broaden its holdings and exposure, and thus increase opportunity and reduce risk, if it were to grow very large.

Active ETFs

For investors, ETFs offer many advantages. They typically have lower expenses than traditional open-ended mutual funds, plus the ability to buy or sell shares at any time, when one can only buy or sell mutual fund shares at the end of a trading session. Until recently, nearly all ETFs tracked broad indexes (such SPY or the Invesco QQQ Trust

QQQ,

which tracks the Nasdaq-100 Index

NDX,

) or narrower indexes focused on market segments and designed to be tracked by ETFs. A feature of index funds is that investors can look at the entire portfolio every day.

Actively managed ETFs seek to offer investors the best of both worlds. Expenses will be higher than those of many index funds, but are still likely to be significantly lower than those of open-ended funds. INNO’s annual expenses are 0.75% of assets under management.

Gleich said Harbor expects to have 10 to 12 actively managed ETFs launched by the end of 2022. He also believes in full transparency, with the entire portfolios of the ETFs reported every day. (ARK’s ETFs do the same.) Some actively managed ETFs limit this visibility for competitive reasons.

Top holdings

The Harbor Disruptive Innovation ETF

INNO,

holds 95 stocks, with the top five holdings making up 19% of the portfolio and the top 10 holdings making up 31%. In contrast, the Ark Innovation ETF holds 37 stocks, with Tesla Inc.

TSLA,

alone making up 8% of the portfolio, the top five making up 33% of the portfolio and the top 10 making up 58%.

Here are INNO’s top 10 holdings:

| Company | Ticker | % of portfolio | Total return – 2022 through Feb. 25 | Total return – 12 months through Feb. 25 |

| Amazon.com Inc. | AMZN | 5.5% | -8% | 1% |

| Microsoft Corp. |

MSFT, |

4.7% | -11% | 31% |

| Lam Research Corp. |

LRCX, |

3.2% | -20% | 6% |

| Ball Corp. |

BLL, |

2.8% | -6% | 6% |

| Salesforce.com Inc. |

CRM, |

2.7% | -18% | -10% |

| ServiceNow Inc. |

NOW, |

2.6% | -11% | 10% |

| Microchip Technology Inc. |

MCHP, |

2.6% | -17% | -1% |

| Alphabet Inc. Class C |

GOOG, |

2.5% | -7% | 32% |

| Block Inc. Class A |

SQ, |

2.4% | -26% | -47% |

| T-Mobile US Inc. |

TMUS, |

2.1% | 8% | 4% |

| Sources: Harbor Capital Advisors, FactSet | ||||

You can click on the tickers for more about each company.

Click here Tomi Kilgore’s detailed guide to the wealth of information available for free on the MarketWatch quote page.

And here are ARKK’s top 10 holdings.

| Company | Ticker | % of portfolio | Total return – 2022 through Feb. 25 | Total return – 12 months through Feb. 25 |

| Tesla Inc. |

TSLA, |

8.4% | -8% | 1% |

| Roku Inc. Class A |

ROKU, |

6.7% | -11% | 31% |

| Teladoc Health Inc. |

TDOC, |

6.7% | -20% | 6% |

| Zoom Video Communications Inc. Class A |

ZM, |

6.2% | -6% | 6% |

| Exact Sciences Corp. |

EXAS, |

5.4% | -18% | -10% |

| Coinbase Global Inc. Class A |

COIN, |

5.4% | -11% | 10% |

| Unity Software Inc. |

U, |

5.0% | -17% | -1% |

| Block Inc. Class A |

SQ, |

5.0% | -7% | 32% |

| Intellia Therapeutics Inc. |

NTLA, |

4.7% | -26% | -47% |

| Twilio Inc. Class A |

TWLO, |

4.2% | 8% | 4% |

| Sources: Ark Invest, FactSet | ||||

Don’t miss: As Russia moves into Ukraine, here are the oil stocks that might benefit the most