This post was originally published on this site

We’re in a perfect storm for energy commodity prices, and not only because of the disruption caused by Russia’s invasion of Ukraine.

A long period of underinvestment in oil exploration and development of new supply sources for oil and natural gas is otherwise clamping down on supply. That is bad news for consumers who still rely on fossil fuels.

But there’s a silver lining for shareholders of the right companies, according to Sam Peters, a portfolio manager at ClearBridge Investments.

ClearBridge is based in Baltimore and has about $208 billion in assets under management. Peters co-manages the ClearBridge Value Trust

LMNVX,

and the ClearBridge All Cap Value Fund

SFVYX,

U.S. energy companies are, of course, benefitting from the rising oil prices, and their stocks have risen. But even before Russia began the buildup of armed forces that led to its invasion of Ukraine, “we were in a regime change for energy markets,” according to Peters.

During an interview, Peters said the transition from fossil fuels to green or sustainable/renewable energy would take several decades.

“Spending will go from $1 trillion a year on alternative energy to $4 trillion — that will be the largest spending cycle around,” he said.

But we’re still at a very early stage in the transition cycle. And the angst in Europe over its reliance on Russia to supply natural gas for winter heating is an example of how markets can be distorted when a long-term policy that people can easily agree on runs into shorter-term realities.

The need for fossil fuels during the multi-decade energy transition and the current environment of underinvestment point to an opportunity for investors right now, even though energy stocks have already risen so much.

For fossil fuels, Peters believes a focus reducing their own carbon emissions will give U.S. producers a long-term advantage.

Energy stock prices are still relatively low

FactSet

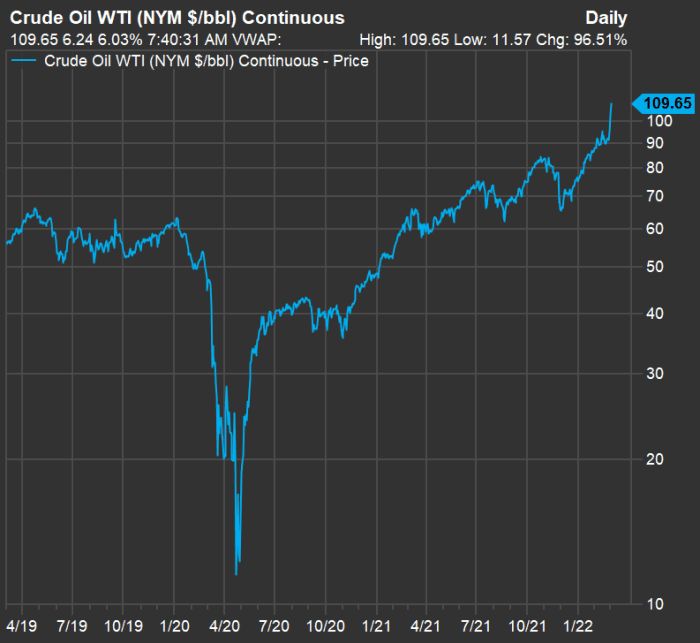

Above is a three-year chart showing the price movement for front contracts of West Texas Intermediate (WTI) crude oil

CL00,

WTI for April delivery

CL.1,

was trading for $109.71 a barrel early on March 2. That’s quite a recovery from the plunge early during the pandemic, but WTI was well below $70 through the second half of 2019.

The S&P 500 energy sector has risen 27.9% this year, and is the only sector of the S&P 500

SPX,

showing a gain for 2022 through March 1. During 2021, the energy sector rose 90%. But for three years, the energy sector is up only 10.6% — by far the worst among the 11 sectors of the S&P 500, despite the runup of oil prices.

Here’s a comparison of the forward price-to-earnings ratio (based on rolling consensus estimates among analysts polled by FactSet) for the S&P 500 energy sector and the full index:

| Sector or index | Current forward P/E | 10-year average forward P/E | Current valuation to 10-year average | Current valuation to S&P 500 | 10-year average valuation to S&P 500 |

| S&P 500 Energy | 17.01 | 18.54 | 92% | 82% | 96% |

| S&P 500 | 20.71 | 19.31 | 107% | ||

| Source: FactSet | |||||

Despite the oil and energy stock runup, the energy sector still trades relatively low to the full index and to its average valuation over the past 10 years.

Silver lining for investors

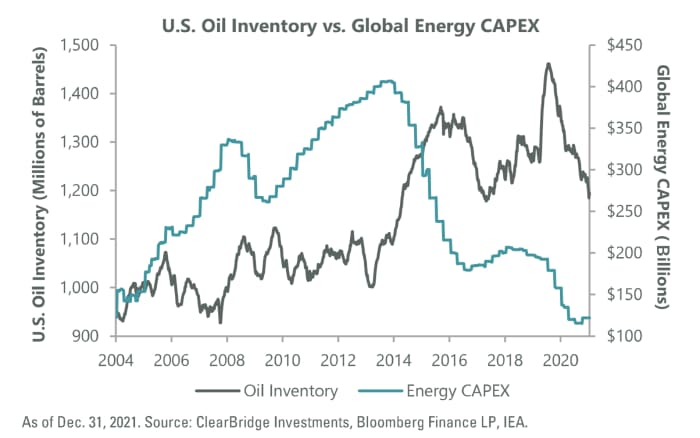

Peters shared this chart, showing the movement of estimated energy industry capital expenditures on oil exploration, source development and production against the level of U.S. inventories from 2004 through 2021:

On the left, the chart shows that capital expenditures had increased when supplies were low. On the right side of the chart, you can see a dramatic decline in capital expenditures when inventories began to decline.

Capital spending declined for more than one reason. In an environment of depressed prices (as you can see on the first chart above), oil producers had to pull back on investment if they were below break-even points where they were exploring. There have also been regulatory and legal hurdles with pipelines, and activist investors’ influence at some companies, especially Exxon Mobil Corp.

XOM,

to focus more on alternative energy sources while de-emphasizing oil exploration and supply development.

Oil producers’ boards of directors have also become more disciplined about spending, according to Peters. They don’t want to be burned again the next time oil prices plunge. Peters expects this discipline to continue, with increased cash flow being more likely to be paid out to shareholders than to be plowed into capital expenditures.

Peters sees a perfect setup for investors. Even if oil prices settled into a range of $75 to $80 a barrel, “you would get very high free cash flows in most of the U.S. energy production companies,” he said. A company’s free cash flow is its remaining cash flow after capital expenditures. It is money that can be used for expansion, to pay dividends, repurchase shares or other corporate purposes.

He believes it is likely for oil prices to remain high for some time, not only because of a possible disruption to Russia’s contribution to the world oil market, but because “OPEC is under-producing its quotas.”

Two energy stock picks for natural gas and oil

Here are two energy stocks Peters believes are especially attractive right now:

EQT Corp.

EQT,

produces natural gas and controls about 6% of the U.S. market, according to Peters. The stock closed at $24.42 on March 1. With a regular quarterly dividend of 50 cents a share, the dividend yield is 2.16%. Peters likes the stock because of its potential as the world natural-gas market goes through its own transition, with European countries look for additional sources to lower their reliance on Russia.

“EQT is going to generate over 100% of their current market cap in [free cash flow] over the next three or four years,” he said, which might mean dividend increases, special dividends and increased share buybacks (which lower the share count, raise earnings and cash flow per share and support higher stock prices).

EQT’s annual regular dividend rate of $2 a share seems well-covered. The consensus among analysts polled by FactSet is for free cash flow per share to total $2.94 in 2022, and to rise dramatically to $4.51 in 2023 and $5.60 in 2024. The company also has a $1 billion share buyback program in place, which is a large authorization relative to its market capitalization of $9.18 billion.

When discussing environmental impact, Peters said: “EQT will effectively have taken their carbon and methane emissions produced to zero in 2025.”

He added: “Russian natural gas is some of the dirtiest stuff, but EQT is producing some of the cleanest molecules around. And they are doing it cheaply and nobody seems to care. It’s incredible.”

The other energy stock Peters named was Pioneer Natural Resources Co.

PXD,

which is an oil producer and explorer. PXD closed at $240.47 on March 1 and pays a variable dividend. For example, for the first quarter, the company paid a dividend of $3.78 a share, which Pioneer said consisted of a 78-cent “base” dividend and a variable dividend of $3.00. The base dividend increased from 62 cents and the variable dividend was down slightly from $3.02 the previous quarter.

Peters said PXD is “drowning in free cash flow,” and that he expects a cash dividend yield of about 11% for 2022, “on top of paying down debt and buying back stock.” The company has a $2 billion share-repurchase program in place and its market cap is $58.4 billion.

Don’t miss: This new competitor to the ARK Innovation ETF focuses on disruptive companies but aims to reduce volatility