This post was originally published on this site

There is always uncertainty in the stock market, but the deflationary cycle that helped feed tremendous gains over the past several decades has ended. Two related strategies can give you downside protection while still capturing most of the upside potential of stocks.

The two strategies: 1. Selecting stocks of companies that have been increasing their regular dividend payouts rapidly. 2. Augmenting that dividend income through the use of covered call options.

Kevin Simpson of Capital Wealth Management in Naples, Fla., co-manages the $1.2 billion Amplify CWP Enhanced Dividend Income ETF

DIVO,

which is rated five stars (the highest) by Morningstar. The exchange traded fund tends to hold about 25 stocks and is actively managed.

During an interview, he explained how the ETF uses both strategies.

“Dividend growth — that’s the secret. That is the true hedge against inflation.”

With inflation at its highest point in decades, investors may be in for a years-long cycle of rising interest rates and other policy tightening by the Federal Reserve. With other challenges to companies, including supply shortages and increasing labor costs, the smooth path of rising profits will be challenged, which can lead to more volatility for stocks.

Selecting stocks for rising dividend income

Simpson emphasized that his main strategy is selecting blue-chip companies that he and his colleagues expect to continue raising dividends rapidly. The companies are screened for quality — management track record, earnings and cash flow growth and returns on equity.

Simpson called dividend growth “the true hedge against inflation.” For many investors, high inflation is a new phenomenon, and we’re at an early stage of the counter-cycle of rising interest rates that can create a difficult environment for the broader stock market.

Despite having “income” in its name, DIVO’s objective is to provide a total return competitive with the broader stock market, with lower volatility and an attractive monthly dividend. The annual dividend yield is 4.82%, according to FactSet.

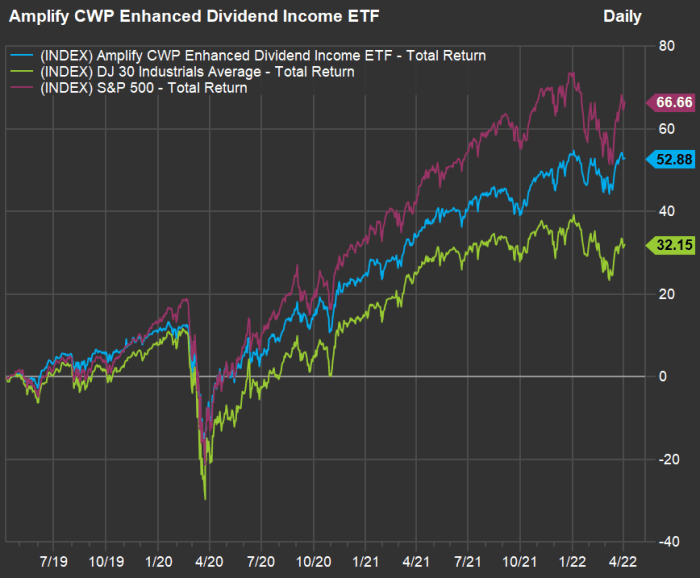

Simpson said the Dow Jones Industrial Average

DJIA,

is a fair benchmark for DIVO’s performance. Here’s a three-year chart showing how the ETF has performed against the Dow and the S&P 500

SPX,

all with dividends reinvested:

FactSet

The S&P 500 soared during the bull market and DIVO’s return was in the middle of the three, with less volatility. Simpson said the ETF is designed to capture 80% to 90% of the upside in a bull market, while only capturing 65% to 75% of a market downturn.

So DIVO can be a good match for long-term investors who wish to limit volatility while still participating in the stock market. And the monthly dividend can be used for income.

When discussing stock picks, Simpson said: “Every stock we own is selected not for how much its dividend yields, as how much it grows.” He and his associates consider large-cap companies’ rolling five-year compound annual growth rates (CAGR) for dividend payouts.

Here’s a list of the top 10 holdings of DIVO, with dividend payout CAGR for the past five years:

| Company | Ticker | Share of DIVO on April 5 | Current annual dividend rate | Annual dividend rate – five years ago | Five-year dividend CAGR | Current dividend yield |

| UnitedHealth Group Incorporated |

UNH, |

6.3% | $5.80 | $2.50 | 18% | 1.14% |

| Apple Inc. |

AAPL, |

5.5% | $0.88 | $0.57 | 9% | 0.49% |

| Visa Inc. Class A |

V, |

5.3% | $1.50 | $0.66 | 18% | 0.66% |

| Chevron Corp. |

CVX, |

5.3% | $5.68 | $4.32 | 6% | 3.46% |

| Microsoft Corp. |

MSFT, |

5.1% | $2.48 | $1.56 | 10% | 0.79% |

| McDonald’s Corp. |

MCD, |

5.1% | $5.52 | $3.76 | 8% | 2.24% |

| Procter & Gamble Co. |

PG, |

5.1% | $3.48 | $2.68 | 5% | 2.26% |

| Intercontinental Exchange Inc. |

ICE, |

4.9% | $1.52 | $0.80 | 14% | 1.16% |

| Marathon Petroleum Corp. |

MPC, |

4.2% | $2.32 | $1.44 | 10% | 2.73% |

| Deere & Co. |

DE, |

4.0% | $4.20 | $2.40 | 12% | 1.01% |

| Sources: Amplify ETFs, FactSet | ||||||

You can see that many of the current dividend yields are rather low. That brings us to the ETF’s second strategy.

Covered calls

A call option is a contract that allows an investor to buy a security at a particular price (called the strike price) until the option expires. A put option is the opposite, allowing the purchaser to sell a security at a specified price until the option expires.

A covered call option is one that you write when you already own a security. The strategy is used by stock investors to increase income and provide some downside protection.

“My strategy is a dividend-growth strategy that uses covered calls to harvest volatility. ”

Here’s a current example of a covered call option in the DIVO portfolio that Simpson described:

On March 31, DIVO sold a covered call on McDonald’s

MCD,

stock that expires April 14, with a strike price of $260. The stock closed at $247.28 on March 31. The premium received was 55 cents a share. The option was “5% out of the money,” because the strike price was that much higher than the closing price on March 31.

So if McDonald’s share prices rises above $260 before the option expires, Simpson will most likely be forced to sell it. He would give up any upside beyond $260. That’s the risk. But he gets to keep the 55-cents-a-share premium no matter what happens, and if the option expires without being exercised, he is free to write another option.

Annualized, the option premium is quite a bit of income relative to the share price — a yield of 5.80%.

This is what Simpson meant when he said that he uses covered call options to “harvest volatility.” The volatility in the market is necessary to get an attractive yield when writing the option. He said he will only consider writing a call option if he can get an annualized yield of at least 2% to 3%.

So DIVO typically only has a handful of option trades in place and shoots for its own dividend distribution yield of about 5%.

Simpson recently published a book, “Walk Toward Wealth,” in which he describes his dividend and covered-call strategies. The book is useful for novice investors, but also digs deeply into strategies for experienced investors. You can order the book here, and the ebook costs 99 cents.

For any fund that follows a covered-call strategy, volatility is limited because of the option premium income. But upside is also limited.

Covered call strategies for more income

All funds with covered-call strategies use option premiums to increase income. But some write more options than others, depending on their objectives.

DIVO, as described above, leans toward a long-term growth objective, with lower volatility than the broader stock indexes.

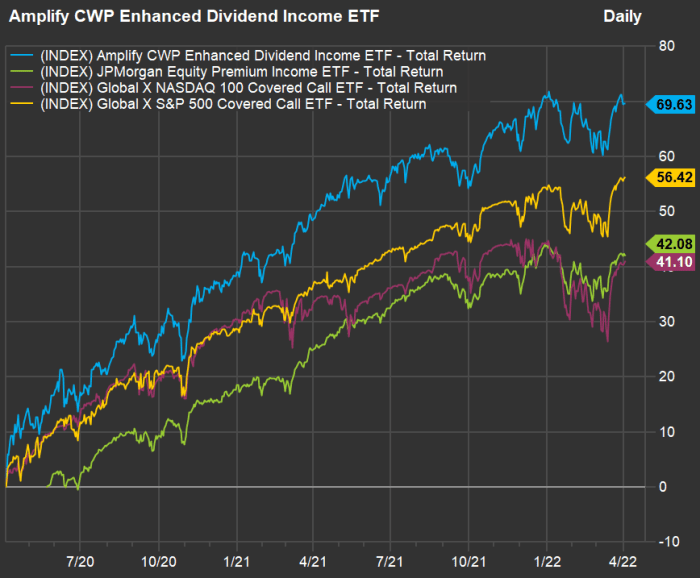

Here are three other ETFs that use covered calls to a greater extent. All pay monthly dividends:

-

The JPMorgan Equity Premium ETF

JEPI,

+0.49%

has a dividend yield of 7.66%. It was established in May 2020 but already has $8.8 billion in assets under management. Despite the higher dividend yield than DIVO, JEPI still has a long-term-growth objective. With a portfolio of 100 stocks, JEPI is more focused on the smaller end of large-cap U.S. stocks. -

The $7.1 billion Global X NASDAQ 100 Covered Call ETF

QYLD,

-0.19%

writes covered calls against the entire Nasdaq-100 Index

NDX,

-1.81% ,

which itself is tracked by the Invesco QQQ Trust

QQQ,

-1.81% .

QYLD is mainly an income play, with a dividend yield of 10.82%. Its share price will move with that of QQQ, but it gives up even more of the stock index’s upside than ETFs that are less focused on covered calls. For example, from a closing high on Feb. 19, 2020, through the pandemic closing bottom on March 16, 2020, when QQQ fell 29%, QYLD’s price dropped 26%. From there, QQQ’s price rose 85% through the end of 2020, while QYLD’s price rose 27%. Factoring in dividends, QYLD returned 20% for all of 2020, while QQQ returned 89%. So QQQ more than did its job. It maintained its high dividend and managed a total return during that year of high volatility of about double the dividend. But it gave up most of QQQ’s upside. This underscores the difference between an income-oriented stock-market investment and a growth investment. -

The $1.4 billion Global X S&P 500 Covered Call ETF

XYLD,

-0.24%

has the same strategy as QYLD, except that it is applied to the S&P 500. The dividend yield is 9.40%.

Global X also runs several other covered call ETFs following different index or hybrid growth and income strategies. The firm’s ETFs are listed here.

Since JEPI is less than three years old, here’s a two-year comparison of total returns for all four ETFs mentioned in this article, through April 4:

FactSet

Covered call ETFs can be a convenient way to reduce the volatility of your investment portfolio. It is important to tie your selections to your main investment objective of growth, income or a combination of both.

Don’t miss: These 10 dividend stocks with yields of at least 5% can help you take on stagflation or a recession