This post was originally published on this site

The start of what may be a stream of rising interest rates as the Federal Reserve fights high inflation has stock investors jittery, and rightly so.

The more bond yields rise, the more likely income-seeking investors will move money out of the stock market.

But this is also the part of the interest-rate and economic cycles during which banks’ profits rise. And bank stocks’ valuations to earnings have been declining. That sets up a potentially fruitful scenario.

In an interview, Sam Peters, a portfolio manager at ClearBridge Investments, outlined the case for buying bank stocks. ClearBridge is based in New York and has about $208 billion in assets under management. Peters co-manages the ClearBridge Value Trust

LMNVX,

and the ClearBridge All Cap Value Fund

SFVYX,

He is based in Baltimore.

Peters pointed to increasing loan demand, improving profitability as interest-rate spreads widen and a decline in bank stock valuations so far this year.

The Fed provides a tailwind

Let’s begin by looking at interest-rate spreads. Banks’ main funding source is deposits, and their best way of making money is by lending out the money. If a bank can’t make enough loans, it will buy bonds. The problem with bond portfolios in the current environment is that as interest rates rise, bonds’ market values decline, and resulting markdowns reduce banks’ profits.

But on the loan side, rising interest rates have benefits in a strong economy:

- Payments on loans with adjustable rates increase.

- Commercial loans, which tend to have relatively short maturities, are renewed at higher interest rates.

Meanwhile, in its fourth-quarter Banking Profile, the Federal Deposit Insurance Corp. said loan volume was growing across “most major loan types.” Looking ahead, Peters expects commercial borrowing to increase with the end of federal stimulus programs that propped up the economy during the coronavirus pandemic.

Banks keep deposit rates low

The Fed made its first move last week, increasing the target federal funds rate to a range of 0.25% to 0.50% from its previous target of zero to 0.25%.

You may have seen some headlines about a flat Treasury yield curve or even an inverted yield curve, as an advance signal that a recession is coming. It may even take an eventual recession to tamp down inflation sufficiently for the Fed to achieve its 2% target for price increases in the U.S.

At the end of business on March 23, the yield on 10-year U.S. Treasury notes

TMUBMUSD10Y,

was 2.32%, which was the same as the yield on three-year notes

TMUBMUSD03Y,

according to the Treasury Department’s daily yield curve. The curve was indeed inverted with yields of 2.34% on five-year notes

TMUBMUSD05Y,

and 2.37% on seven-year notes

TMUBMUSD07Y,

But for the banks, the situation is completely different.

In a world that continues to be awash with cash, banks don’t need to pay much for deposits. Peters said a good proxy for banks’ spread between their cost of deposits and loan rates is a comparison between yields on three-month Treasury bills

TMUBMUSD03M,

and two-year Treasury notes

TMUBMUSD05Y,

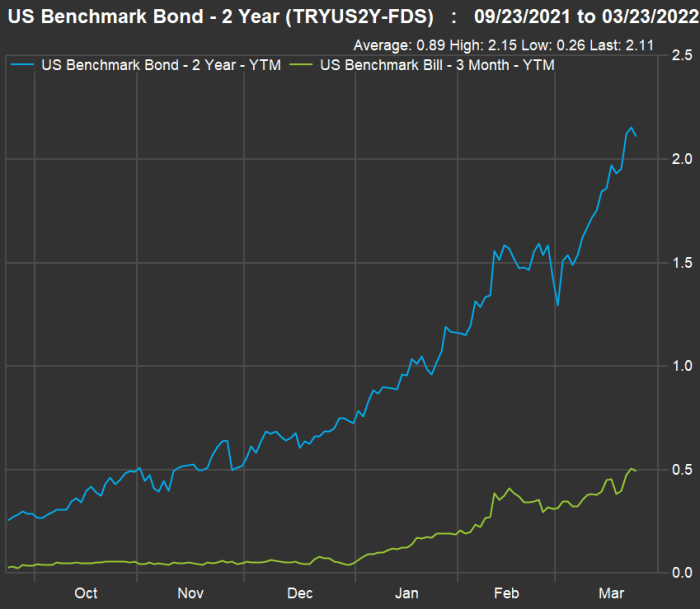

Here’s how those rates have moved over the past six months, according to data compiled by FactSet:

FactSet

At the end of March 23, the yield on two-year Treasury notes was 2.11%, while the yield on three-month T-bills was 0.50%. That’s a spread of 1.61%. Back on Sept. 23, the spread was only 0.23%, as the two-year yield was 0.26% and the three-month yield was a 0.03%.

Considering the current spread, the real situation is even better, as few banks are paying 0.50% for deposits.

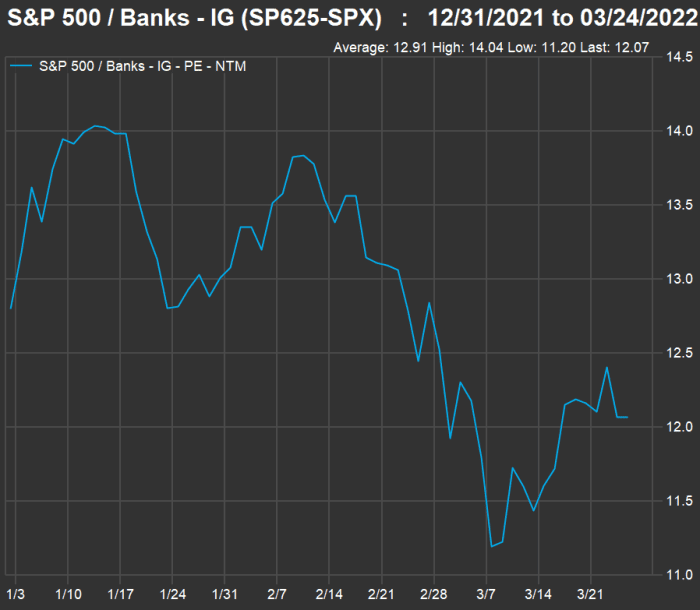

Bank valuations have declined this year

So far this year, stocks in the S&P 500 banking industry group have pulled back by a weighted 4.5%, compared with a 6.5% decline for the full S&P 500

SPX,

excluding dividends. Now take a look at this year-to-date chart showing the movement of the banks’ combined forward price-to-earnings ratio, based on earnings-per-share estimates among analysts polled by FactSet, for a rolling 12-month period:

FactSet

Two favored bank stocks

Now let’s review data for the two banks Peters discussed — Wells Fargo & Co.

WFC,

and Signature Bank of New York

SBNY,

To simplify, in the following table forward price-to-earnings ratios are based on consensus EPS estimates for 2022:

| Bank | Ticker | Price/ cons. 2022 EPS estimate – March 23 | Price/ cons. 2022 EPS estimate – Dec. 31, 2021 | Cons. 2022 EPS estimate – March 23 | Cons. EPS estimate – Dec. 31, 2021 | Change in 2022 EPS estimate |

| Wells Fargo & Co. |

WFC, |

12.9 | 12.8 | $3.97 | $3.75 | 6% |

| Signature Bank |

SBNY, |

15.0 | 18.6 | $19.94 | $17.41 | 15% |

| Source: FactSet | ||||||

You can click on the tickers for more about each bank.

Click here for Tomi Kilgore’s detailed guide to the wealth of information available for free on the MarketWatch quote page.

Wells Fargo’s stock has risen 7% during 2022, excluding dividends. But its forward P/E has increased only slightly to 12.9 as its 2022 consensus EPS estimate has risen 6%.

Here’s how the rest of the “big four” U.S. banking club compare:

| Bank | Ticker | Price/ cons. 2022 EPS estimate – March 23 | Price/cons. 2022 EPS estimate – Dec. 31, 2021 | Cons. 2022 EPS estimate – March 23 | Cons. EPS estimate – Dec. 31, 2021 | Change in 2022 EPS estimate |

| JPMorgan Chase & Co. |

JPM, |

12.4 | 13.1 | $11.26 | $12.05 | -7% |

| Bank of America Corp |

BAC, |

13.2 | 13.9 | $3.26 | $3.20 | 2% |

| Citigroup Inc. |

C, |

8.0 | 7.6 | $7.03 | $7.94 | -11% |

| Source: FactSet | ||||||

EPS estimates for 2022 have declined for JPMorgan Chase & Co.

JPM,

and Citigroup Inc.

C,

while increasing only 2% for Bank of America Corp.

BAC,

Citi’s P/E valuation remains very low, and the stock is the only one here trading below tangible book value, reflecting investors’ long-term discomfort with a company that has been in turnaround/restructuring mode for decades.

Leaving aside 2021, when banks’ earnings were inflated from the release of loan-loss reserves that turned out not to be needed during the pandemic, let’s take a look at EPS projections for the five banks mentioned above through 2024:

| Bank | Ticker | Cons. 2022 EPS estimate | Cons. 2023 EPS estimate | Cons. 2024 EPS estimate | Expected 2023 EPS increase | Expected 2024 EPS increase | Projected two-year EPS CAGR |

| Wells Fargo & Co. |

WFC, |

$3.97 | $4.90 | $5.71 | 24% | 17% | 20% |

| Signature Bank |

SBNY, |

$19.94 | $25.57 | $34.82 | 28% | 36% | 32% |

| JPMorgan Chase & Co. |

JPM, |

$11.26 | $12.62 | $14.04 | 12% | 11% | 12% |

| Bank of America Corp |

BAC, |

$3.26 | $3.84 | $4.35 | 18% | 13% | 15% |

| Citigroup Inc. |

C, |

$7.03 | $7.84 | $8.59 | 11% | 10% | 11% |

| Source: FactSet | |||||||

All five banks are expected to have their earnings per share increase at double-digit compound annual growth rates over the next two years. But those projections are much higher for Wells Fargo and Signature Bank.

Wells Fargo continues to operate under a regulatory consent order preventing it from increasing its total assets. The estimates reflect analysts’ expectations for the order to be lifted.

Peters described Wells Fargo as “incredibly asset-sensitive,” referring to a balance sheet featuring loans expected to reprice much more quickly than deposits, as interest rates rise.

He believes Signature Bank is also “extremely levered to this dynamic.”

While Peters favors Wells Fargo and Signature Bank, he holds shares of Bank of America in the ClearBridge Value Trust.

A stronger industry after the financial crisis

Peters stressed that the U.S. banking industry had learned hard lessons from its lending excesses during the housing boom that preceded the financial crisis of 2008 and said the Dodd-Frank bank reform legislation of 2010 had “worked” to strengthen the banks years before the pandemic.

While the Federal Reserve’s cycle of policy changes to combat inflation may eventually lead to a recession or difficult credit conditions for banks, Peters believes we are nowhere near that cycle and that stock investors may still have difficulty believing the banks are much safer than they were during the pre-2008 bubble.

“Right now it is all about short rates going up” and banks’ earnings increasing, he said. He added that although the industry’s loan quality now is very strong, over the long term, investors in bank stocks need to monitor credit.

Don’t miss: Stock market investors are in the danger zone. This all-weather investing strategy offers protection