This post was originally published on this site

Shopify had a blowout fourth quarter, with sales rising 41% from a year earlier, the company reported Wednesday.

Sales are the main objective of a company working at the forefront of the shift to ecommerce. But Shopify’s stock fell as much as 19%, even after company reported results that came ahead of analysts’ expectations for revenue and earnings.

Read: Shopify sees a sales slowdown in the first half of 2022. The stock is sinking.

The above headline from Barron’s spells out the problem in this market environment for any highly valued tech stock: Even in a growing economy with better-than-expected retail sales, if a company’s own sales outlook for the months ahead disappoint investors, the stock can crash.

While we cannot predict which highly valued ecommerce companies might be next to disappoint investors, we can look ahead to see which are expected to increase sales the most quickly. A list of these expected rapid-growers derived from the holdings of three ecommerce exchange-traded funds is below.

A high valuation in a touchy market

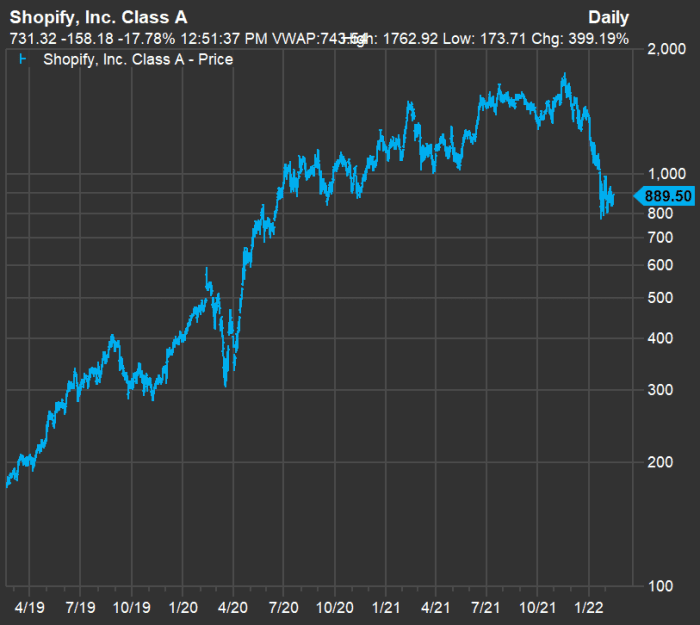

Here’s a three-year price chart for Shopify Inc.

SHOP,

through the close on Feb. 15 — that is, before the company announced its fourth-quarter results:

FactSet

The stock was up fivefold for three years before Shopify put out its fourth-quarter results. And the stock was trading for 14.5 times the consensus forward sales estimate among analysts polled by FactSet. That’s a very high valuation when compared with a price/sales valuation of 2.6 for the S&P 500

SPX,

and 2.9 for a venerable internet services highflyer such as Amazon.com Inc.

AMZN,

Investors were paying through the nose for Shopify’s stock. Then again, the stock had traded as high as 47.1 times the consensus forward sales estimate in July 2020.

Three ecommerce ETFs

In order to come up with a list of ecommerce stocks for a screen, we looked at three ETFs focusing on this industry group:

-

The ProShares Online Retail ETF

ONLN,

-2.02%

has $581 million in assets under management and holds 39 stocks. It is heavily concentrated, with Amazon making up 25% of the portfolio and Alibaba Group Holding Ltd.

BABA,

-0.54%

the second-largest holding at 13.6%. The third-largest holding is eBay Inc.

EBAY,

-3.80% ,

at 4.5%. -

The Amplify Online Retail ETF

IBUY,

-2.55%

has $475 million in assets, holds 79 stocks. The individual stocks are equal-weighted within the portfolio, which itself is 70% weighted to the U.S. According to FactSet, this approach “keeps giants [such as] Amazon from dominating the basket, but also introduces a bias to smaller and possibly more risky firms.” -

The Global X E-Commerce ETF

EBIZ,

-2.46%

has $151 million in assets. It holds 40 stocks and has a modified weighting by market capitalization. Its top five holdings make up 13.1% of the portfolio. Expedia Group Inc.

EXPE,

+0.88%

is the largest holding, at 6.7%, followed by Booking Holdings Inc.

BKNG,

+2.58%

at 6.4% and JD.com Inc.

JD,

-1.09%

at 5.5%.

Leaving the ETFs in size order, here are projected compound annual growth rates (CAGR) for sales per share through 2023, based on consensus estimates among analysts polled by FactSet:

| ETF | Ticker | Two-year estimated sales CAGR | Estimated revenue per share – 2021 | Estimated revenue per share – 2022 | Estimated revenue per share – 2023 |

| ProShares Online Retail ETF |

ONLN, |

7.9% | $34.50 | $37.39 | $40.19 |

| Amplify Online Retail ETF |

IBUY, |

12.3% | $49.79 | $56.60 | $62.74 |

| Global X E-Commerce ETF |

EBIZ, |

10.0% | $16.60 | $18.35 | $20.09 |

| Source: FactSet | |||||

Ecommerce stock screen

Together, the three ETFs hold 78 stocks. Among those, 63 are covered by at least five analysts polled by FactSet for estimates, ratings and price targets.

Here are the 15 companies analysts expect to achieve the highest sales CAGR through calendar 2023. The consensus sales estimates are in millions of U.S. dollars.

| Company | Ticker | Country | Two-year estimated sales CAGR | Estimated sales – 2021 | Estimated sales – 2022 | Estimated sales – 2023 |

| Ozon Holdings PLC ADR |

OZON, |

Cyprus | 59.8% | 2,349 | $4,017 | $5,998 |

| Global-e Online Ltd. |

GLBE, |

Israel | 53.0% | $240 | $367 | $563 |

| Dada Nexus Ltd. ADR | DADA-US | China | 52.6% | $1,105 | $1,686 | $2,573 |

| Sea Ltd. (Singapore) ADR Class A |

SE, |

Singapore | 41.4% | $9,656 | $14,251 | $19,299 |

| Jumia Technologies AG ADR |

JMIA, |

Germany | 39.8% | $170 | $227 | $332 |

| Uber Technologies Inc. |

UBER, |

U.S. | 38.7% | $17,560 | $27,430 | $33,769 |

| Shopify Inc. Class A |

SHOP, |

Canada | 34.0% | $4,573 | $6,093 | $8,214 |

| MercadoLibre Inc. | MELI-US | Uruguay | 33.6% | $6,971 | $9,352 | $12,443 |

| TripAdvisor Inc. |

TRIP, |

U.S. | 32.5% | $909 | $1,373 | $1,595 |

| Trip.com Group Ltd. ADR |

TCOM, |

China | 31.2% | $3,088 | $3,869 | $5,319 |

| FIGS, Inc. Class A |

FIGS, |

United States | 30.9% | $419 | $547 | $717 |

| Pinduoduo, Inc. Sponsored ADR Class A |

PDD, |

China | 30.8% | $15,388 | $20,251 | $26,320 |

| Booking Holdings Inc. |

BKNG, |

United States | 30.2% | $10,838 | $15,722 | $18,384 |

| Carvana Co. Class A |

CVNA, |

United States | 29.6% | $12,575 | $16,488 | $21,134 |

| Source: FactSet | ||||||

You can click on the tickers for more about each company.

Then read Tomi Kilgore’s detailed guide to the wealth of information available for free on the MarketWatch quote page.

Leaving the list in the same order, here’s a summary of analysts’ opinions about the stocks:

| Company | Ticker | Share “buy” ratings | Share neutral ratings | Share “sell” ratings | Closing price – Feb. 15 | Cons. Price target | Implied 12-month upside potential |

| Ozon Holdings PLC ADR | OZON-US | 57% | 36% | 7% | $22.23 | $41.41 | 86% |

| Global-e Online Ltd. |

GLBE, |

100% | 0% | 0% | $39.42 | $72.44 | 84% |

| Dada Nexus Ltd. ADR |

DADA, |

92% | 8% | 0% | $10.85 | $35.61 | 228% |

| Sea Ltd. (Singapore) ADR Class A |

SE, |

96% | 4% | 0% | $149.55 | $320.59 | 114% |

| Jumia Technologies AG ADR |

JMIA, |

14% | 72% | 14% | $9.70 | $18.88 | 95% |

| Uber Technologies Inc. |

UBER, |

90% | 10% | 0% | $37.09 | $62.67 | 69% |

| Shopify Inc. Class A |

SHOP, |

51% | 46% | 3% | $889.50 | $1,484.62 | 67% |

| MercadoLibre Inc. |

MELI, |

83% | 17% | 0% | $1,170.30 | $1,789.86 | 53% |

| TripAdvisor Inc. |

TRIP, |

26% | 53% | 21% | $30.07 | $35.80 | 19% |

| Trip.com Group Ltd. ADR |

TCOM, |

79% | 15% | 6% | $30.42 | $31.97 | 5% |

| FIGS Inc. Class A |

FIGS, |

73% | 27% | 0% | $19.40 | $36.36 | 87% |

| Pinduoduo, Inc. Sponsored ADR Class A |

PDD, |

76% | 22% | 2% | $61.23 | $99.21 | 62% |

| Booking Holdings Inc. |

BKNG, |

56% | 41% | 3% | $2,635.16 | $2,739.52 | 4% |

| Carvana Co. Class A |

CVNA, |

60% | 36% | 4% | $142.50 | $290.74 | 104% |

| Souce: FactSet | |||||||

Don’t miss: Apple is Berkshire’s largest stock holding, but Buffett and Co. own a bigger share of these companies