This post was originally published on this site

“De-dollarization” may be an unwieldy 2023 buzzword in financial markets, but that didn’t stop the U.S. currency from extending a significant bounce in August.

The question is whether that momentum can continue.

The ICE U.S. Dollar Index

DXY,

a measure of the currency against six major rivals, including the euro

EURUSD,

and Japanese yen

USDJPY,

slumped to a 15-month low in mid-July before bouncing by around 4%, according to FactSet. It’s on track for an August rise of around 1.6%. That’s enough for the index to turn positive for 2023, with a year-to-date gain of 0.4%.

Check out: Why Washington and Wall Street are worried about the ‘de-dollarization’ threat

What changed? A solid run of strong U.S. economic data — figures that left the U.S. economy looking stronger than its rivals — gets the credit.

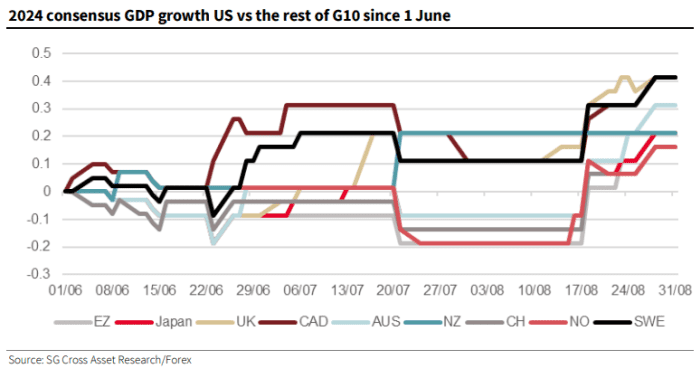

“FX returns over the past month appear to have been affected significantly by how 2024 GDP (gross domestic product) growth expectations have evolved in the last quarter, and we expect this trend to continue,” said strategists Kit Juckes and Olivier Korber of Société Générale, in a Thursday note.

“The U.S. was the only G-10 economy to see upward revisions to growth forecasts, and that helped the dollar outperform the rest of the G-10 currencies this month,” they wrote (see chart below). G-10 is foreign-exchange trader language for 10 of the world’s most heavily traded — and liquid — currencies.

Société Générale

The chart shows the changes in relative GDP forecasts since the end of

May, the analysts said, noting that it’s the move since the end of July that is “striking” — showing U.S. forecasts up versus all the others.

“That took the dollar higher, but are the upward revisions to U.S. growth overoptimistic?” they asked.

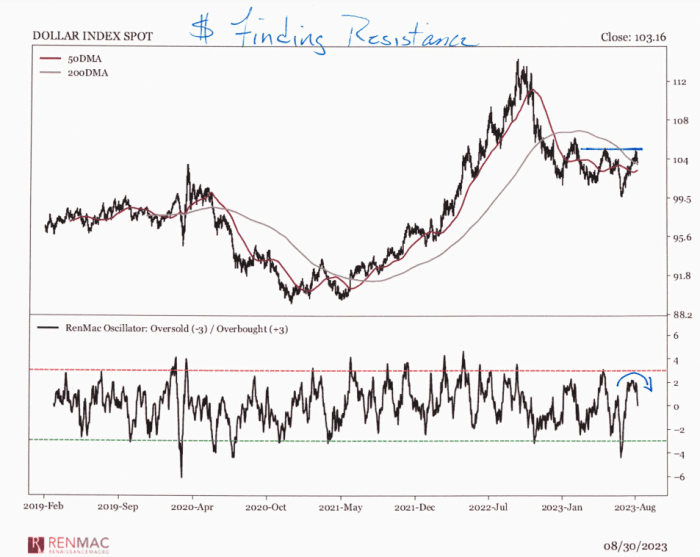

Time will tell whether resilient U.S. economic data continues to surprise. Meanwhile, one of Wall Street’s most closely followed technical analysts wasn’t terribly impressed with the dollar’s August rise, which lost some momentum as Treasury yields pulled back.

“The contraction in yields has taken some steam out of the dollar, which has now failed at resistance,” said Jeff deGraaf, chairman and head of technical research at Renaissance Macro, in a Thursday note.

Renaissance Macro

The dollar’s gains came as strong economic data fueled a rise in U.S. Treasury yields, as investors bumped up expectations for further interest rate rises by the Federal Reserve.

The 10-year Treasury yield

BX:TMUBMUSD10Y

earlier this month traded near a 16-year high above 4.30% before pulling back. Currencies tend to be most sensitive to short-term rates — and the differentials between those rates between countries. The 2-year U.S. Treasury yield

BX:TMUBMUSD02Y

edged back above 5% last week before falling back.

The dollar trend, meanwhile, is still lower, deGraaf wrote, “and while the latest rally did not push us into overbought levels, the risk/reward for FX traders looks to be for weaker dollar.”

Stocks, meanwhile, suffered in August as Treasury yields jumped.

Major indexes were on track Thursday to end the month with a five-day winning streak, however, as yields retreated. The S&P 500

SPX

was still on track for its first monthly loss since February, but has pared its decline to around 1.3%. The Dow Jones Industrial Average

DJIA

was off 1.6% for August, with the Nasdaq Composite

COMP

declining 0.8%.