This post was originally published on this site

The Bank of England on Thursday lifted its key interest rate, its fourth increase of the current cycle.

By a 6 to 3 vote, the Bank of England opted to lift rates by a quarter point to 1%, as it seeks to curb inflation. The minority voted to lift rates by a half point.

The U.K. has seen runaway natural gas prices — the lead UK natural-gas contract has jumped 168% over the last year — as well as rising wages. The U.K. economy however endured a rougher hit from the coronavirus pandemic than either the U.S. or the eurozone.

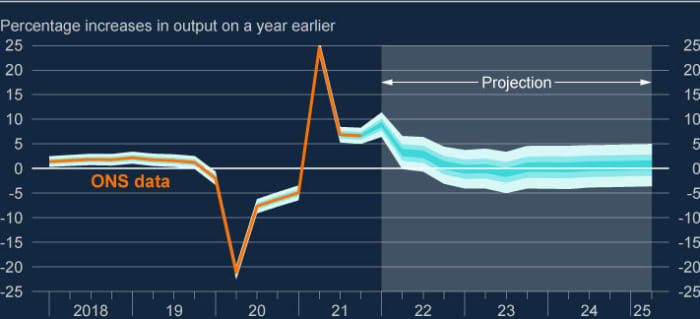

The Bank of England said it expects inflation to reach 10% this year

The Federal Reserve on Wednesday opted to lift rates by a half point, and Australia’s and Brazil’s central bank also have increased rates this week. Norway’s central bank paused but said it’s likely to increase rates again in June.

That backdrop makes it hard for sterling to appreciate against its international rivals.

The pound

GBPUSD,

fetched $1.2474, down from $1.2636 on Wednesday, as traders focused on the somber economic outlook. The Bank of England is forecasting the U.K. economy to contract next year.

Bank of England forecast

The yield on the 2-year gilt

TMBMKGB-02Y,

fell 8 basis points to 1.55%.