This post was originally published on this site

The U.S. dollar, which continued to rally to its highest level in about two years on Monday, may be set to strengthen against more currencies besides the yen as the around-the-clock currency market readjusts to the reality of higher U.S. interest rates to come from the Federal Reserve.

The U.S. Dollar Index

DXY,

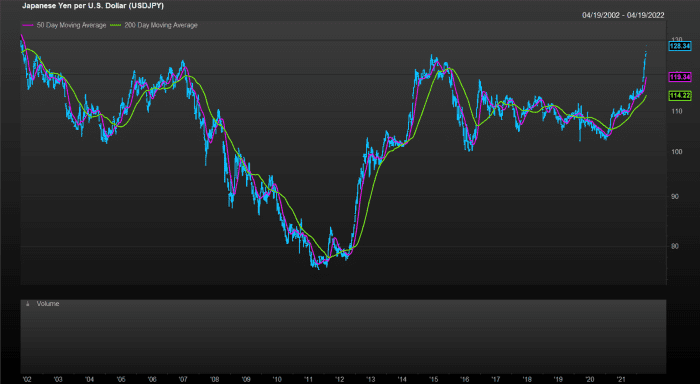

broke above the 100.9 level for the first time since March-April 2020. Meanwhile, the greenback continued to pummel the yen for a 13th straight session, with Japan’s currency weakening to as little 128.625 yen per dollar — the weakest level since May 14, 2002, according to FactSet.

Source: FactSet

Currency markets, like financial markets as a whole, are readjusting to the prospects that U.S. interest rates could rise by more than in other parts of the world, such as Japan. St. Louis Fed President James Bullard, speaking on Monday, reinforced that view by saying that he “wouldn’t rule out” a 75-basis point hike, even though he doesn’t expect one. He also said he remains on board with a series of 50-basis-point increases, reiterating that inflation is “far too high.”

Hikes of 50 basis points each “may become a `baseline,’ and the bond market will be pulling forward Bullard’s wish of a fed funds rate at 3.5% by year-end,” said Ben Emons, managing director of global macro strategy at Medley Global Advisors. “The dollar could accelerate against major and EM currencies as a result,” defining majors as G-10 currencies and EM currencies as those of Brazil

USDBRL,

Russia

USDRUB,

India

USDINR,

China

USDCNY,

and South Africa

USDZAR,

Based on Monday’s comments by Bullard, a voting member of the Federal Open Market Committee this year, “the trial balloon of a 75-basis point hike is not priced in” to either the yen or the bond market, Emons wrote in a note. That means within the next few days, the 10-year Treasury yield “could reach the important psychological barrier of 3%” and the yen could weaken to 130 to the dollar.

On Tuesday, Treasury yields were mostly higher, with the 10-year yield

TMUBMUSD10Y,

climbing to 2.91%. Meanwhile, all three major stock indexes

DJIA,

COMP,

were also moving higher in morning trade.

U.S. stocks were solidly higher, with the Dow Jones Industrial Average

DJIA,

advancing 400 points, or 1.2%. The S&P 500

SPX,

was up 1.1%, while the Nasdaq Composite

COMP,

gained 1.3%.