This post was originally published on this site

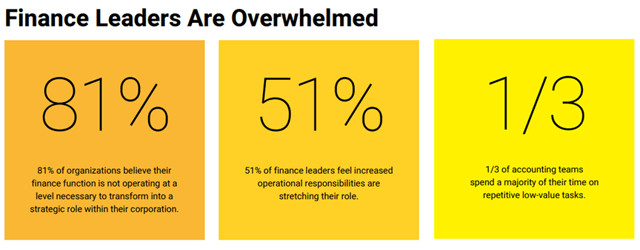

BlackLine, Inc. (BL) is in the thick of the digital revolution, offering a modern solution that provides control, transparency, efficiency, and confidence over the financial close process.

(Source: BlackLine)

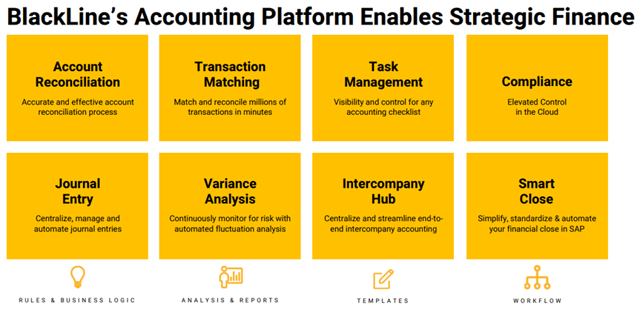

BlackLine is one of the only, if not the only, company that provides SaaS-based financial close management, real-time account reconciliation, intercompany accounting, controls assurance, and accounting automation. The competition is, for the most part, MS Excel and Oracle (NYSE:ORCL).

(Source: BlackLine)

BlackLine has only made a small dent in their total addressable market (TAM) and I believe that the long-term outlook is pretty rosy. But what is of most concern is the short-term outlook. The digital transformation of the financial close process is not a top priority for most companies during this difficult time. The company’s management has provided caution regarding its results during the pandemic based on March sales:

Globally our new logo business was off to a good start in the first two months, but was hit the hardest near the end of the quarter. In EMEA we saw a meaningful decline in deals closing before the end of the quarter. We experienced delay in large deals and we saw a slowdown in the mid-market in North America. Our SOLEX performance was also strong at the start of the quarter and then saw deals get postponed in March.

They have indicated that 25% of revenue comes from “customers in the verticals most impacted by COVID-19.”

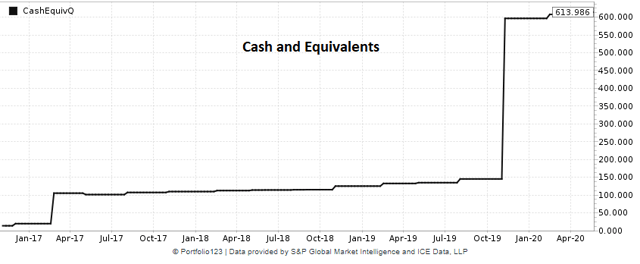

On the bright side, BlackLine has a strong balance sheet and intends to provide relief to customers that require extended payment terms.

BlackLine’s historical Cash and Equivalents ($ millions)

(Source: Portfolio123)

The customer financial support initiatives will impact Q2 results, including free cash flow, revenue, and calculated billings.

But the most important indicator of all is the stock price movement. Like many other digital transformation stocks, BlackLine’s stock price is breaking out to an all-time high.

(Source: Yahoo Finance/MS Paint)

The market is calling this one, and you should never disagree with the market. Therefore, I am giving BlackLine a bullish rating. This company will be around and in good shape once the pandemic scare subsides and global growth restarts.

The Rule Of 40

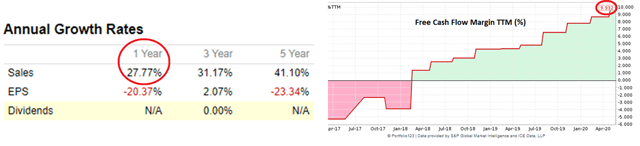

One industry metric that is often used for software companies is the Rule of 40. The rule provides a single metric for evaluating both high-growth companies that aren’t profitable and mature companies that have lower growth but are profitable. Revenue growth and profitability (expressed as a margin) must add up to at least 40% in order to fulfill the rule. Analysts use various figures for profitability. I use the free cash flow margin.

The rationale for the Rule of 40 is as follows. If a company grows by more than 40% annually, then you can tolerate some level of negative free cash flow. But if a company grows by less than 40%, then it should have a positive free cash flow to make up for the less-than-ideal growth. This rule accommodates both young, high-growth companies as well as mature, moderate-growth companies. The 40% threshold is somewhat arbitrary but typically divides the digital transformation stock universe in half, separating the best stocks from the so-so ones.

For a further description of the rule and calculation, please refer to a previous article I have written.

The two factors required for calculating the Rule of 40 are revenue growth and free cash flow margin. BlackLine’s annual revenue growth for the last year is 28%. The company’s TTM free cash flow margin is a strong and growing 10%.

(Source: Portfolio123/MS Paint)

Therefore, the Rule of 40 calculation for BlackLine is as follows:

Revenue Growth + FCF margin = 28% + 10% = 38%

BlackLine’s score, although just slightly shy of 40%, is close enough, in my opinion. Free cash flow margin and revenue growth are going to take a significant hit this year, but long term, I expect that BlackLine will be right up there based on the needs of large corporations.

(Source: BlackLine)

Stock Valuation

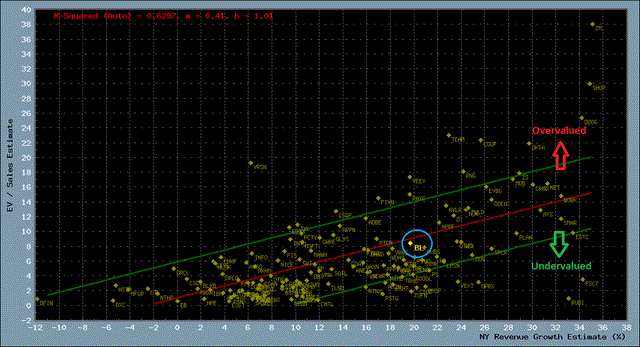

There are numerous techniques for valuing stocks. Some analysts use fundamental ratios such as P/E, P/S, EV/P, or EV/S. I believe that one should not employ a simple ratio, and the reason is simple. Higher-growth stocks are valued more than lower-growth stocks, and rightly so. Growth is a significant parameter in discounted cash flow valuation.

Therefore, I employ a technique that uses a scatter plot to determine relative valuation for the stock of interest versus the remaining 152 stocks in my digital transformation stock universe. The Y-axis represents the enterprise value/forward sales, while the X-axis is the estimated forward Y-o-Y sales growth.

The plot below illustrates how BlackLine stacks up against the other stocks on a relative basis based on forward sales multiple.

(Source: Portfolio123/private software)

A best-fit line is drawn in red and represents an average valuation based on next year’s sales growth. The higher the anticipated revenue growth, the higher the valuation. In this instance, BlackLine is positioned ever-so-slightly below the best-fit line, suggesting that the company is fairly valued on a relative basis relative to its peers.

Conservative investors could wait for a pullback and/or scale into a position. More aggressive investors should jump in now. The stock market is speaking, and you should listen!

Investment Risks

There are several risks that investors should consider before investing in BlackLine. First of all, I view the current stock market action to be somewhat reminiscent of the Dot.com era, immediately prior to the crash starting in 2000. Back then, I quadrupled my investments in a few months. Technology stocks were hopping. But it didn’t take long before the market turned into a disaster.

While BlackLine is not overvalued in my opinion, there are many stocks that are way overvalued, stocks such as Zoom (ZM), Shopify (SHOP), Atlassian (TEAM), and Coupa (COUP). A new software bear market would likely cause BlackLine to get swept away along with its extremely overvalued software peers.

While I believe that the long-term picture is rosy for BlackLine, the short-term outlook is murky. Depending on how the pandemic plays out and the depth of the global recession, the company’s fortunes good be dragged down for an extended period of time.

Summary and Conclusions

BlackLine has recently broken out to an all-time high. When a breakout occurs, it usually signifies more bullishness to come. BlackLine is a strong company with TTM revenue growth of 28% and a positive free cash flow margin of 10%. Although it shyly missed on the Rule of 40, the miss wasn’t significant enough to dismiss the thought of investing in this company.

Although BlackLine performed well in Q1, its performance noticeably deteriorated in the final month of the quarter and this deterioration is expected to continue into Q2. The company management has withdrawn guidance for the remainder of the year due to the uncertainty of the virus and economy.

The stock movement is strong and so are the company’s fundamentals. The company’s market valuation is fair and I believe that an investment is still warranted based on long-term vision and the stock price breakout.

Conservative investors may want to wait for a pullback or scale into a position. Aggressive investors should take note of the breakout and consider getting in now.

Panning for gold is so much work, and so last millennium! There is an easier way. Sign up for Digital Transformation, a Seeking Alpha Marketplace, and learn all about investing in the 21st century.

Panning for gold is so much work, and so last millennium! There is an easier way. Sign up for Digital Transformation, a Seeking Alpha Marketplace, and learn all about investing in the 21st century.

Tap into three high-growth portfolios, industry and subindustry tracking spreadsheets, and three unique proprietary rating systems. Don’t miss out on the digital revolution.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.