This post was originally published on this site

Traditional brick and mortar retailers have been struggling for several years now as more and more consumers shift to online shopping. The current health crisis certainly hasn’t helped matters, and we have already seen several companies declare bankruptcy with a few more hanging on by a thread. There have been a few companies that have been able to maintain or even grow sales as the crisis hit. One such company is Costco (COST). The company is set to report fiscal third quarter results after the closing bell on Thursday and analysts expect earnings to increase by 7.9%.

The consensus estimate from analysts is for EPS of $2.04 and revenue of $37.52 billion. Those figures were $1.89 and $35.4 billion last year. This translates to an increase in EPS of 7.9% and an increase in revenue of 6.0%.

Costco has seen its earnings grow by 18% per year over the last three years and they were up by 4% in the second quarter. Analysts expect earnings to grow by 5% for 2020 as a whole.

Revenue has grown by an average of 9% in the last three years and it was up by 10% in the second quarter. The estimate for the year is for revenue growth of 7.3%.

The management efficiency measurements for Costco are mixed. The return on equity is really good at 25.9%, but the profit margin is below average at 3.2%. As for the current valuations, they are a little higher than the average stock. The trailing P/E is at 35.8 and the forward P/E is at 32.2.

From a personal perspective, I haven’t been shopping at Costco as much lately. It has nothing to do with the health crisis, but rather because my oldest son has his own place now. Feeding two boys rather than three makes a big difference and doesn’t require as much bulk buying.

I will say that I have talked to several friends and neighbors and they seem to be shopping at Costco more frequently since the crisis started. They are impressed with how the stores are going about conducting business in this unique situation. They feel safe and they know they can get the products they are looking for. This process could actually help Costco in the quarter and going forward.

The Stock has Doubled in Price from Its 2017 Low

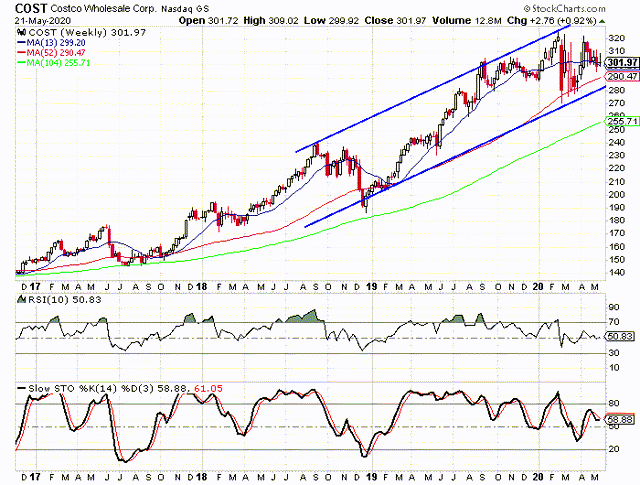

In July 2017, Costco was trading between $145 and $150 and it was in danger of falling below its 104-week moving average. The trend line ended up holding as support and a rally started in the fourth quarter that year. The rally continued through the first three quarters of 2018 before the stock fell with the overall market in the fourth quarter that year.

In December ’19, the stock flirted with its 104-week again, but it was a brief instance and the stock rallied sharply from the low, gaining over 60% in the next nine months. The stock moved sideways in the fourth quarter of 2019. So far, in 2020, the stock has been far more volatile – much like the rest of the market. After moving higher in six of the first seven weeks of 2020, the stock dropped 12.7% in the last week of February.

The big drop in February came just before the second quarter earnings release on March 5. I didn’t write about Costco in March, but I did write about it last September. I gave the stock a neutral rating at the time and it was mostly based on the fact that the stock had just come out of the overbought territory. Costco did lag the overall market throughout the fourth quarter of 2019, but it has outperformed the overall market so far in 2020 and that is mainly due to the fact that the stock didn’t fall nearly as much as the S&P. At its closing low for the year, Costco was only down 4.6%, at least so far.

Looking at the moving averages and the oscillators, the stock is hovering near its 13-week moving average and just above its 52-week. The 104-week isn’t a factor at this point in time. The 10-week RSI is almost right at the 50-level and the stochastic readings are slightly above the midway point of their range.

The Sentiment is Trending Toward a More Bearish Stance

I went back and looked at my article from September to see where the sentiment indicators were then and I also looked at where they were in March. Overall, the indicators are reflecting a shift to the bearish side. There are 31 analysts covering the stock at this time with 17 “buy” ratings, 11 “hold” ratings, and three “sell” ratings. This gives us a buy percentage of 54.8%. The buy percentage was at 59.3% in September and 55.2% in March.

The short interest ratio is at 1.96 and it has increased over the last couple of months. The ratio was below 1.0 at the end of March. The ratio was slightly lower at the beginning of March and it was at 1.74 in September.

Option traders are the one group that has become slightly more bullish. There are 82,965 puts open at this time and 104,346 calls open. That gives us a put/call ratio 0.795. The ratio was at 1.02 in both September and March. Put open interest is down approximately 15K while call open interest is up approximately 9K.

Overall, I would put the sentiment in the neutral range, but it is trending toward a more bearish stance with analysts becoming more skeptical and the short interest ratio increasing.

My Current Take on Costco

Overall, I think Costco is a solid company. The earnings growth is good and the revenue growth is average. Having growth at all is a positive right now as most retailers are seeing declines in both earnings and revenue. The ROE is really good, but the low profit margin is one negative among the fundamentals. The P/E ratios are also a minor concern.

The chart shows that the stock is still in an upward trend and it looks a lot better than a lot of other stocks. I wish the stock was closer to the lower rail or to its 52-week moving average as those two trend lines could act as a catalyst for another move higher. The overbought/oversold indicators are about as neutral as you can get.

I like the fact that the sentiment is shifting toward a more bearish stance because it could mean the expectations are lower. I look at expectations like a hurdle; the lower they are, the easier it is for the company to clear them.

I am a big believer in Investor’s Business Daily’s fundamental ratings, specifically the EPS rating and the SMR rating. Costco scores an 81 on the EPS rating scale and it gets a B in the SMR grading system. Almost all stocks I buy or recommend to subscribers have an EPS score of 80 or higher and an SMR grade of an A. The profit margin is probably the one thing that is keeping the SMR grade from being an A. Profit margins don’t usually change dramatically from quarter to quarter, and under the current circumstances, it might get worse rather than better. The additional measures stores are taking to keep customers safe are adding to costs in most cases.

If I were a Wall Street analyst, I would rate Costco as a buy but not a strong buy. I think the stock continues to trend higher, and as long as it remains within the channel and above the 52-week moving average, I would remain bullish. If the company can improve the revenue growth and the profit margin, I would consider bumping it up to a strong buy.

If you would like to learn more about protecting and growing your portfolio in all market environments, please consider joining The Hedged Alpha Strategy.

One new intermediate to long-term stock or ETF recommendation per week

One or two option recommendations per month

Bullish and bearish recommendations to help you weather different market conditions

A weekly update with my views on the market, events to keep an eye on, and updates on active recommendations

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.