This post was originally published on this site

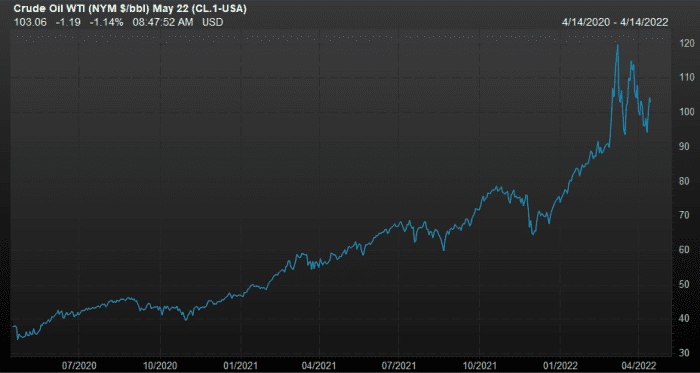

Nearly two years have passed since U.S. benchmark West Texas Intermediate oil settled below zero dollars a barrel. But the shock from the one-day plunge lives on, even as prices recovered to a year-to-date peak above $130 a barrel—the highest in nearly 14 years.

Analysts expect prices to mostly hold above the $100 mark, with the market unlikely to get much help from oil producers who are concerned about another potentially significant decline in prices. They also don’t want to be stuck with too much supply in the event of a drop in demand.

“We should remember that both oil’s sharp drop to negative prices and its rise to 14-year highs are largely the result of the economic fallout of the coronavirus pandemic,” says Matthew Sherwood, global economist at the Economist Intelligence Unit. And no one expected the world to potentially be on the “precipice of a global war, with Russia’s full-scale invasion of Ukraine” sending oil well above $100, he says.

On April 20, 2020, WTI crude

CL.1,

CL00,

saw its front month settle at a negative $37.63 a barrel, down 306% for the session. That marked the lowest futures finish and biggest one-day price plunge on record.

Prices then saw a mostly steady climb to a peak intraday level so far this year at $130.50 on March 7—the highest since July 2008. That represents a nearly 447% climb from the negative price settlement almost two years ago.

What the market saw in 2020 was “unique,” and it was an event “no one could have ever anticipated,” says Scott Sheridan, market expert and CEO of online brokerage tastyworks, which is part of IG Group

IGG,

2-year chart of front-month WTI oil prices, as of April 14, 2022.

FactSet

Even so, from a supply and demand perspective, the range of the price moves “actually makes sense when taken in the context of world events,” he says. “It’s just been a volatile couple of years.”

Oil prices: zero to $100

An economic recovery from the pandemic led to a massive demand shock, and it took “unprecedented cooperation” by the Organization of the Petroleum Exporting Countries and its allies to agree to sharp production cuts in 2020, says the EIU’s Sherwood. The cuts and a slow and steady increase in production since last year put a floor under oil prices, while demand recovered faster than output. That led the market to a supply deficit in 2021, he says.

The deficit largely remains this year, exacerbated by the Russia-Ukraine war, says Sherwood, as Western nations have limited their purchases of Russian oil.

Elevated food prices and sanctions against Russia may place additional pressure on OPEC to raise oil supplies, says Tammy Da Costa, analyst at DailyFX. But OPEC members have so far been unable to lift output enough to meet rising targets.

The U.S. and its allies in the International Energy Agency plan to release 240 million barrels from emergency oil reserves over a six-month period, which may limit the impact of sanctions on Russian oil in the short run, says Da Costa.

Read: What Biden’s historic decision to release oil reserves means for the market

However, “an extension of the war and rapidly depleting reserves” will likely be the key oil driver for the rest of the year, unless producers can make up the shortfall and compensate for rising demand, she says.

That’s a challenge given that volatility over the past two years has made producers wary of sudden price moves.

Producers and traders are “more cautious, given the downside risks,” says Sherwood. That’s likely to be the case for some time, or “until producers are confident that prices will remain elevated more permanently,” he says. Meanwhile, growth opportunities are more limited “given that in many regions, there are few commercially attractive deposits left to exploit.”

Looking ahead, Sherwood expects WTI oil to remain above $100 as long as war rages in Ukraine, but with room for dips below that mark.

Prices likely already hit their peak this year, but spikes above $130 are still a real possibility, given uncertainty in the oil market and global economy, he says.