This post was originally published on this site

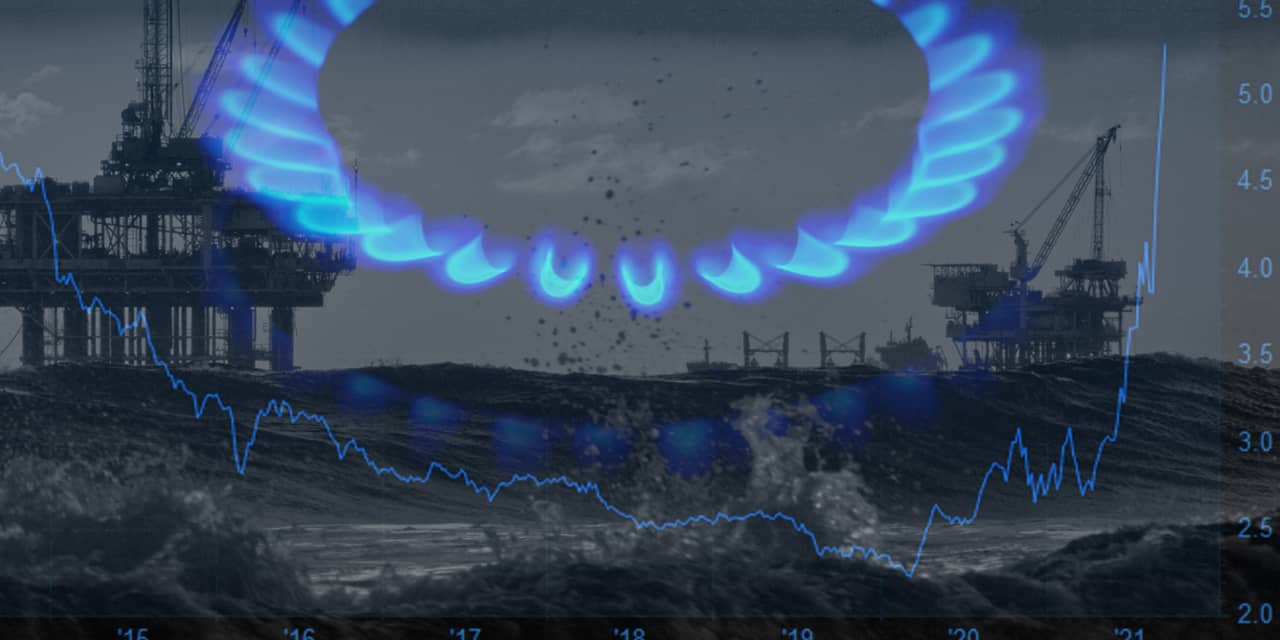

Natural-gas prices reached their highest levels in more than seven years thanks to a slow recovery in Gulf of Mexico production after an August hurricane, and strong U.S. exports and tight supplies.

A global effort to limit carbon emissions has meant more demand for natural gas and renewable energy, says Troy Vincent, market analyst at commodity market data provider DTN.

Recent weakness in wind generation in Europe, coupled with low natural gas inventory ahead of winter, has caused natural gas and electricity prices “across the continent to shoot to record highs,” he says. That follows months of high temperatures in East Asia and delays in bringing nuclear generation back online in Japan.

Surging demand in Europe, Asia and Latin America for liquefied natural gas (LNG) has led to record high U.S. exports this year, helping push U.S. natural gas futures to their highest since February 2014, he says.

Front-month natural-gas futures

NGV21,

NG00,

settled at $5.46 per million British thermal units on Sept. 15, the highest since February 2014. Prices have more than doubled for the year, trading 115% higher year to date.

The record pace of U.S. LNG exports this year shows just how tight the global natural-gas market is, and “how fearful Eastern Asian and European nations are of running short of supply this winter amid heating season,” Vincent says.

In 2020, U.S. natural gas exports reached a record high, according to the Energy Information Administration. Exports may increase by 20% to 25% this year, says Bryan Benoit, national managing partner, energy, at Grant Thornton.

Meanwhile, warm 2021 summer months “resulted in a more significant increase in demand and the price of natural gas,” he says. There’s also a need to replenish inventories to prepare for the winter heating season.

Working gas in U.S. storage, the amount available to the marketplace, has fallen to its lowest level for this time of year since 2018. As of the week ended Sept. 10, working gas in storage stood at 3 trillion cubic feet, well below both a year ago and the five-year average.

U.S. inventories may peak in October at around 3.4 trillion cubic feet, which would still be about 10% below the prior five-year average for the period, says Vincent.

Extreme weather remains an issue with over two months left in an Atlantic hurricane season that’s already disrupted Gulf energy operations.

Hurricane Ida hit the Gulf Coast on Aug. 29. As of Sept. 15, 39% of the region’s natural-gas production remained offline, according to the Bureau of Safety and Environmental Enforcement.

Steve Craig, chief energy analyst at Elliott Wave International, refers to events like Ida as “exogenous”—outside factors that can have a temporary impact on price that’s “irrelevant to the larger price trend.”

Based on technical analysis known as the Elliott Wave Principle, Craig says the “big picture” outlook for natural-gas futures is for significantly higher prices.

In spite of some periods of downward consolidation and changes in weather, he says he’ll remain “big-picture bullish” until the price wave pattern “dictates a change,” as it did in July 2020, when prices traded above $1.896, triggering Elliott Wave International’s forecast for a rally that could take prices to $4.929.

Vincent, however, says that while global demand will remain strong heading into winter—drawing more LNG shipments from the U.S. and leading to smaller-than-normal seasonal inventory builds—natural-gas prices may fall from current highs if there’s a shift from natural gas to coal and fuel oil.

Prices will still likely hold above $4, however, before easing lower amid rising production next spring, he says.