This post was originally published on this site

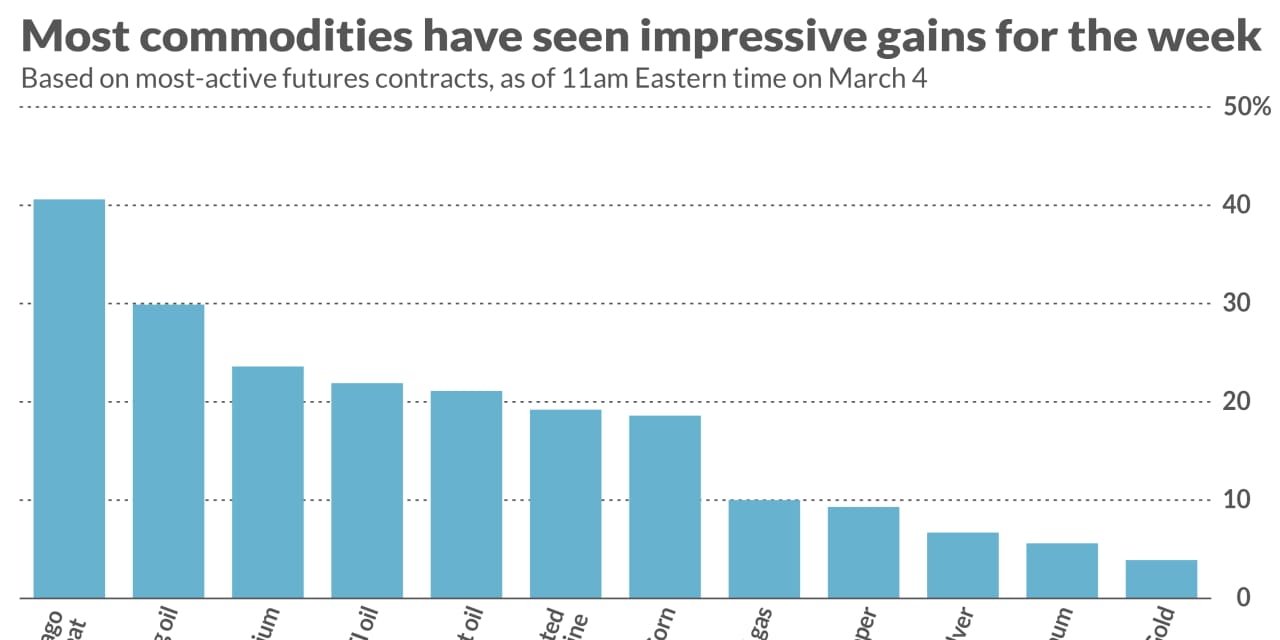

Most commodities saw impressive gains this week on the back of Russia’s attacks on Ukraine, with wheat leading the way as the conflict threatens to disrupt supplies from Russia, the world’s largest exporter of the grain.

“Commodities, and in particular real tangible assets, are starting to come to the fore,” David Russell, director of marketing at GoldCore, told MarketWatch. “This is driven 100% not just by developments in Ukraine, but also the global financial response to it.”

Wheat, oil, gasoline, heating oil, natural gas, palladium, and corn have all seen double-digit percentage gains for the week as Western nations agreed to imposed strict sanctions on Russia for its invasion of Ukraine.

The S&P GSCI

SPGSCI,

a commodity index composed of 24 exchange-traded futures contracts across five physical commodities sectors, is trading around 18% higher for the week during Friday’s session, which would represent the index’s best week based on records dating back to 1970, according to Dow Jones Market Data.

Grains

Wheat futures have climbed by nearly 41% for the week, as of late Friday morning, and are likely to score a record weekly advance, based on data going back to July 1959. Russia is the world’s largest supplier of wheat.

The most-active May wheat contract

WK22,

rose 75 cents, or 6.6%, to settle at $12.09 a bushel, trading at the highest levels since March 2008.

Russia and Ukraine are among the world’s biggest exporters of corn, lifting May corn futures

CK22,

up by 6 1/2 cents, or 0.9%, to $7.54 1/4 a bushel in Friday dealings, with prices up around 15% for the week.

Energy

Given that Russia is among the world’s largest oil producers, prices for the U.S. oil benchmark touched its highest intraday level since 2008, which is the same year it marked its highest price on record.

West Texas Intermediate crude for April delivery

CLJ22,

CL.1,

settled at $115.68 a barrel Wednesday on the New York Mercantile Exchange, the highest finish since September 2008, according to Dow Jones Market Data. May Brent crude

BRNK22,

BRN00,

finished Friday at $118.11, the highest since February 2013.

Petroleum products have also rallied, with April gasoline futures

RBJ22,

settling Friday at $3.544 a gallon and April heating-oil futures

HOJ22,

ending at $3.776 a gallon — both settling at the highest since July 2008.

At the retail level, average U.S. gasoline prices stood at $3.807 a gallon Friday afternoon, according to GasBuddy. That’s up nearly 22 cents from a week ago and up over $1.05 from a year ago. Prices are less than 30 cents away from the highest recorded average in 2008 of $4.103.

U.S. natural-gas prices

NGJ22,

have also climbed, posting a weekly rise of 12.2%. The April contract settled at $5.016 per million British thermal units on Friday. Benchmark Dutch TTF natural-gas prices recently reached record intraday highs, according to the Financial Times. Russia’s the biggest natural-gas supplier to Europe.

“The threat to global [oil] supply probably has not been more acute since the Arab oil embargo” in the 1970s, said Phil Flynn, senior market analyst at The Price Futures Group, in a Friday note.

“On the downside, the potential of an Iranian oil deal could cause an unwinding of positions, bringing the market down quickly,” he said. News reports have said that Iran and world powers are close to an agreement to revive to 2015 nuclear deal, which would likely lead the U.S. to lift sanctions on Iran, allowing more oil onto the global market. “On the other hand, if it appears that the deal is going to fall apart, then the upward trajectory of prices will continue,” said Flynn.

Metals

Silver has outpaced gold for the week as precious metals have found support as investment havens, as Russia’s attacks on Ukraine led to volatility in global stock markets, and supply risks have rallied prices for palladium and copper.

Russia is among the biggest producers of palladium, gold, silver and copper.

“Global stock markets are showing their vulnerability to this geopolitical shock and there is a flight to safety and relative sanctuary in gold,” said GoldCore’s Russell. At the same time, U.S. Federal Reserve Chairman Jerome Powell’s “inability to…tackle the inflation genie and the stock market woes” are going to underpin gold’s current uptrend, he said.

April gold

GCJ22,

GC00,

settled at $1,966.60 an ounce on Friday, for a weekly advance of 4.2%, while May silver ended at $25.79 an ounce, up 7.5% for the week. May copper ended at nearly $4.938 a pound, scoring the highest most-active contract settlement on record.

Palladium settled at an all-time high of $2,981.90 an ounce Friday.

Read: Palladium hits a record high as Russia-Ukraine war looks to deepen supply deficit

Copper had been “waiting for its invitation to the commodity rave,” said Adam Koos, president at Libertas Wealth Management Group. “It’s now outpacing gold.”

Both copper and gold prices “look like they’re at the beginning of something bigger and better,” said Koos.