This post was originally published on this site

Investment Overview

The current environment is confusing. Without a coronavirus (COVID-19) cure, uncertainties will likely linger throughout the year. It makes sense for government and corporate entities to be cautious in spending.

Experts have revised their forecasts. International Data Corporation projects a 2.7% decline in global IT spending this year due to the pandemic. Having said that, I examined the sector to find a stock that can thrive in this environment. CDW Corp. (CDW) appears to fit the bill.

CDW is a reseller of technology products to both government and corporate clients. If you’re a technology provider, you want to access the company’s large clientele. Conversely, an institution wants to buy from one reliable seller with a huge offering.

The investment thesis is simple. CDW is a cash-generative business that can deliver shareholder returns. Free cash flows, while bumpy, will be higher in the future. Near term, the company’s diversified revenue source will help cushion the pandemic blow. Also, its operational scale is a critical advantage to capture market share gains.

I project FY’21 EPS at $6.40 per share, based on sales recovery next year. This implies that shares are only trading at 16X P/E. I am sure you will agree with me that a quality business should be valued higher. It looks like CDW is a cheap route to benefit from the IT sector’s growth. Using a 5-year historical P/E multiple of 22X, the company is worth $140.8 per share – a 33.1% upside from current levels.

(Source: Wikipedia)

Resilience and Scale Are Keys to Higher Market Share Gains

1Q’20 financial results were solid. The ongoing pandemic is a boon. Institutional clients increased their orders to implement WFH and Business Continuity immediately. Indeed, CDW reported quarterly revenues of $4.4 billion, an 11% YoY growth from the prior year. This trickled down to a net profit of $168 million, up 9.8% YoY, or diluted earnings of $1.16 per share.

These strong trends will likely continue in a couple of months, albeit transitory. If the U.S. experience a prolonged economic downturn, customers will cut their spending. IDC said that it expects global IT spending to decline by 2.7% this year due to the economic impact of the COVID-19 pandemic.

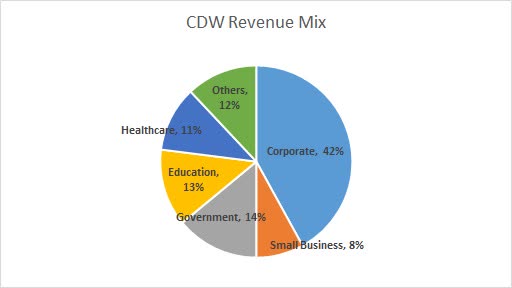

CDW’s large clientele may help cushion the economic impact. For instance, IT spending in the corporate and small businesses will be vulnerable, as these segments are likely to respond to macroeconomic changes. On the other hand, more counter-cyclical industries like the government will partially offset weak commercial demand. Also, the education segment’s move to remote learning will provide an added boost.

Chart 1: CDW FY’19 Revenue Mix

(Source: CDW FY’19 Financials)

Here’s a contrarian view. Call it anti-fragile. An economic downturn will be beneficial to CDW. The company’s cost structure is mostly variable. If sales will decline, it can easily trim down its working capital and compensation to ensure continued cash flow generation. This will allow management to pay dividends, repurchase discounted shares, pay down its bank debt, or even acquire companies on the cheap – all in the name of enhancing shareholder value.

In the 1Q’20 conference call, the company’s SVP and CFO Collin Kebo highlighted this scenario:

“As you know, we have a variable cost structure, given that sales commissions are paid on a percentage of gross profit, and growth in co-worker count is one of our biggest investments. We have implemented hiring restrictions and are letting attrition run for a while as we closely monitor the macroeconomic and demand environments.

Looking ahead, our working capital metrics could be impacted as we strategically invest in inventory or due to pressure on receivable collections as customers are impacted by the macroeconomic environment.

CDW’s critical advantage is its scale and scope compared to smaller local players. This allows the company to have above-normal inventory levels to ensure sufficient supply amid logistics interference. It also allows the company the opportunity to support its customers through flexible financing and repayment terms. It’s noteworthy to mention that CDW has a strong balance sheet with a cash balance of $814 million, including the proceeds from senior notes of $600 million in April. CDW could build on this financial strength to deploy its funds strategically to acquire companies or invest in sales and engineering capabilities to grab market share.

Strong Competitive Position Will Lead to Higher FCF Generation

CDW is the single-largest player in a fragmented IT hardware industry. It will remain so in the foreseeable future. New entrants will be unable to grab market share from CDW. Its long-term relationship with vendors and customers, distribution capabilities, and scale of products and services thwarts competition. These factors will drive sustainable and profitable growth for the company in the future – at least matching the 10-year sales growth of around 10% a year.

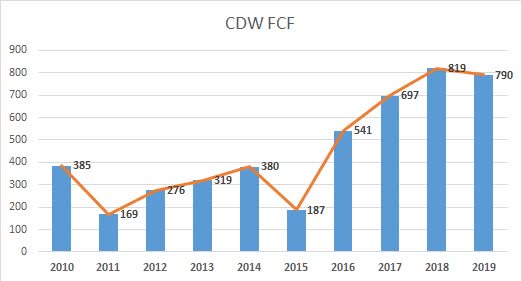

Over the past years, FCF increased more than two-fold, from $385 million in 2010 to $790 million in 2019. The considerable FCF rise is attributed to CDW’s low capital expenditure needs and its efficient management of working capital. Going forward, increased investment in capabilities, further innovation, or possibly the acquisition of companies, FCF should continue to grow higher.

Chart 2: CDW 10-Year Free Cash Flow

(Source: CDW Financials)

Moderately Priced at Attractive Growth Prospects

ICT spending will grow in the long run. Traditional tech spending is channeled to cost savings through the cloud, mobile, and Big Data analytics. Meanwhile, new technologies are aimed at focusing on the Internet of Things and robotics. IT will become more complex and integral to organizations in the future. These technology companies will roll out new products and services to address organizational needs.

CDW will be able to capture the IT sector’s growth. Its key drivers include scale and key partnerships with leading technology providers, distribution capabilities, and growing trends towards value-added resellers.

Despite the attractive growth prospects, CDW shares are modestly priced. Shares are trading at 16X FY’21 EPS, historically lower than the 5-year historical P/E multiples of 22X. Relative to other traditional competitors, CDW shares trade higher than the average IT hardware P/E multiples of 11X: Insight Enterprises’ (NSIT) 7X P/E, PC Connection’s (CNXN) 13X P/E, and ePlus’s (PLUS) 14X P/E – growth prospects justify the premium valuation.

Risks to the valuation include reduced government spending from political or government uncertainties, customers’ changing technological preferences, and a drastic slowdown in IT spending.

Conclusion

CDW’s diversified revenue source will allow the company to survive amid reduced IT spending. Its variable cost structure provides the flexibility to trim down its working capital and compensation to ensure continued FCF generation. Also, CDW’s scale is a critical advantage considering its access to supply and capacity to continue its investment in sales and engineering capabilities. Finally, these factors will likely result in market share gains in the long run.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.