This post was originally published on this site

It’s true that the big 5 Canadian banks – TD (TD), Royal Bank of Canada (RY), CIBC (CM), Bank of Montreal (BMO) and Bank of Nova Scotia (BNS) – haven’t missed a dividend payment in eons and that these banks slipped through the 2008/2009 financial crisis relatively unscathed. It’s also true that Canadian banks were well capitalized upon entering the COVID-19 economic catastrophe.

These truths have created a mythical aura of invincibility with respect to Canadian banks. People speak about Canadian bank stocks like they’re the next best thing to government bonds in the 1990s. I’ve been guilty of this too, but recent events have crushed my hubris.

Over the long run, I think the Canadian banks are fairly well insulated. After all, they are systemically important institutions that operate in an oligopoly – effectively, they are implicitly back-stopped by the Government of Canada and they have a wide moat. But let’s be clear, this doesn’t mean Canadian banks – and shareholders – can’t feel a lot of pain.

We might soon discover exactly how much pain, as TD, RY, CM, BMO and BNS are set to report Q2 earnings this week.

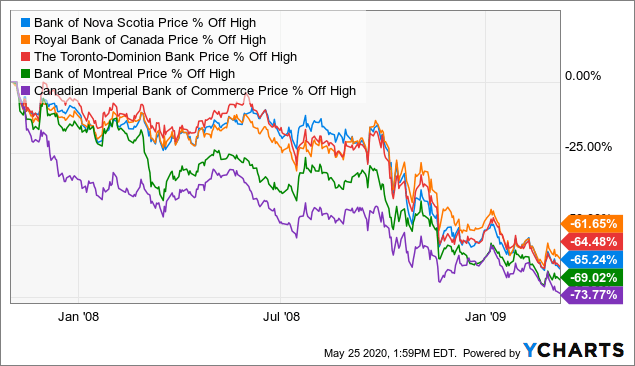

Despite all the advantages, during the 2008/2009 crisis Canadian banks still fell between 62-74%:

Data by YCharts

Data by YCharts

Keep in mind the 2008/2009 experience occurred when Canadian real estate held up relatively well. The damage to Canadian banks was in many ways collateral at the time – the knock-on effects of a global financial crisis that was not specific to domestic Canadian economic issues. Also, in 2008/2009 the Canadian consumer was in a much stronger financial position compared to many other consumers around the world, who were at the tail end of a housing boom.

Now the situation is reversed. The Canadian consumer is up to their neck in debt and the Canadian household entered the COVID-19 recession in a very weak position.

Source: BetterDwelling.com

Unfortunately, these over-indebted Canadian households are now experiencing massive unemployment. The chart below shows the Canadian unemployment rate skyrocketing to double digits. This likely underestimates the true unemployment rate, as many employees of virtually defunct businesses aren’t counted in the numbers. As businesses shut permanently or operate with fewer staff I expect the unemployment rate in Canada to continue to climb.

Source: TradingEconomics.com, Statistics Canada

The implication is simple: Canadians with extremely tight finances are suddenly facing a loss of income and can no longer pay their mortgages. Currently, over 20% of borrowers in Ontario, Alberta and Quebec are unable to make their mortgage payments. The chart below illustrates this using mortgage deferrals as the determining factor.

The problem with these deferrals is they’re only a temporary pain-killer. The payments, interest and interest-on-deferred-interest must be paid later. The success or failure of this deferral strategy is completely dependent on Canadian employment recovering very quickly over the next few months. If people continue to defer, there will be a point of reckoning in the future.

Real estate around the world is under pressure, so this isn’t a distinctly Canadian story. What separates Canada from the rest of the world is the fact that the Canadian housing market was extremely stretched as it entered the COVID-19 recession. On a price-to-incomes basis, Canadian real estate – especially Toronto and Vancouver – is among the most expensive in the world. For years, Canadian families took on extreme leverage and lived on tight budgets to buy real estate. Many who owned real estate during the boom years borrowed more using their homes as collateral.

Now, with unemployment skyrocketing and affordability already at record lows it looks like we are witnessing the beginning of the end of the Canadian housing bubble. This is going to be very problematic for Canadian bank balance sheets and earnings.

Already, prices across Canada have fallen on average by 10% since February. In parts of Toronto, prices have fallen by 18%! Three months is a very short period for such a decline to occur.

Source: Zoocasa

The massive mortgage deferrals suggest more price pressure is to come. As unemployment persists, deferrals will become defaults and defaults foreclosures. With this comes a flood of new listings. At this rate, it wouldn’t surprise me to see Canadian housing prices decline by 20-30% by year-end.

Those who can recall the US housing collapse of the late 2000s (or even the Canadian housing collapse of the early 1990s) know that the second and third-order economic effects are enormous. By the time a housing market is primed for collapse, so much of the economy is dependent, in one way or another, on the real estate industry. So as housing prices decline, so too does the web of economic activity that is closely and distantly attached to it.

Unfortunately for Canada – and the Canadian banks – this isn’t a plain vanilla housing collapse. This is a Canadian housing collapse within a global economic collapse. Employment and economic activity have already plummeted. As the housing crisis worsens the situation, employment and economic activity in Canada will deteriorate further. This is bad news for the Canadian economy, for Canadians and for Canadian banks.

Only a fast economic recovery will stop the bleeding. As of now, despite emerging ‘back to work’ movements, this doesn’t look like a possibility and Canadian banks are highly exposed.

The following chart shows the exposure of each bank to uninsured residential mortgages. Keep in mind, these banks also hold insured mortgages (insured by Canadian Mortgage and Housing Corporation), pooled mortgages and reverse mortgages. Not to mention, other various loans secured by residential property.

Source: OFSI, DumbWeath.com

As I mentioned at the start, the big 5 Canadian banks will likely get through this crisis and will probably maintain their dividends. That doesn’t mean it won’t be a painful journey. If you like the banks now, you’ll love them if they decline by another 20-30%.

I think if an investor is holding a Canadian bank as a long-term investment, they’ll need intestines made of steel for what could be an unexpected ride. For anxious investors like myself, it might be best to wait on the sidelines to see how the next two quarters unravel.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not advice. Please contact a registered investment professional to discuss your personal financial circumstances. While every effort was made to ensure accuracy, the information in this article contains no warranties with regards to accuracy.