This post was originally published on this site

Cigna Corp.’s use of adjusted revenue in its quarterly earnings does not conform with the Securities and Exchange Commission’s guidelines on how companies are allowed to use nonstandard numbers in their financial reporting, according to experts.

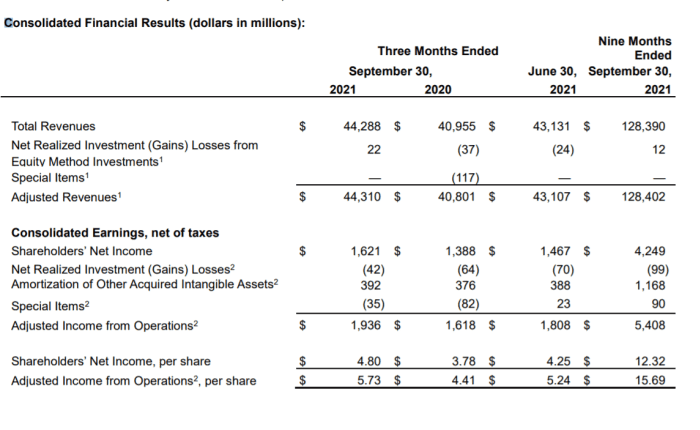

The company offered the metric in its recent third-quarter earnings report and provided full-year guidance on that basis. Cigna has been adjusting revenue every quarter for at least the past several years.

The SEC issued new guidelines for corporate reporting in 2016 in an effort to slow the proliferation of non-GAAP numbers — that is, financial figures that are not in accord with generally accepted accounting principles — and rein in the worst offenders. The SEC allows companies to use non-GAAP numbers to supplement their reporting, but they must give equal or greater prominence to GAAP numbers and explain how the two are reconciled.

Since then, it has issued comment letters to many companies for adjusting their revenue and for using what it calls “individually tailored recognition and measurement’ methods, because they substitute the company’s own interpretation of accounting standards for GAAP.

See now: SEC may be set to crack down on companies that adjust revenue

Cigna defines adjusted revenue as total revenue excluding “special items and Cigna’s share of certain realized investment results of its joint ventures reported in the International Markets segment using the equity method of accounting.”

Those investment results added $22 million to total revenue in the latest quarter, after removing $37 million in the year-earlier period. The equity method of accounting is how the company records gains or losses in investments in other companies in which it has significant stakes. It adjusts the value based on the percentage of an equity investment.

The company reported third-quarter total revenue of $44.29 billion, up 8.1% from a year ago, but, after the exclusion of special items, adjusted revenue rose 8.6% to $44.31 billion.

“We exclude these items from this measure because management believes they are not indicative of past or future underlying performance of the business,” it says in a footnote to its numbers.

But experts say that’s not allowed under SEC rules.

“Making adjustments to revenue and net income for the impact of equity investments, but especially to revenue, seems inappropriate, since Cigna has no control over these specific line items for its equity method investments,” said Francine McKenna, an accounting expert and adjunct professor of international business at American University. (McKenna is a former MarketWatch reporter.)

Ed Ketz, a professor of accounting at Penn State University, agreed. “Adjusted revenues and adjusted income are not compliant with GAAP,” he said. “Management may or may not have control over these items, but the point is irrelevant; they do affect the real income and the real value of the company and so should be included, not omitted.”

Paul Chaney, a professor of accounting at Vanderbilt University, told MarketWatch the adjusted item should not be reported in the revenue line in the fist place. “I was confused to see it as that is not an item that has anything to do with revenue,” he said.

In addition to adjusting revenue, Cigna’s reconciliation of its GAAP and non-GAAP numbers does not follow the format that the SEC requires:

Source: Cigna press release

“It’s a prohibited non-GAAP financial statement rather than the required reconciliation of non-GAAP to GAAP,” said McKenna.

“It does seem they are not giving equal or greater prominence to the GAAP numbers,” said Chaney.

Cigna offered this comment by email: “The integrity of our financial reporting is paramount for our company, and our presentation of Other Revenues and non-GAAP measures is in full compliance with SEC rules and related SEC staff interpretations. Our company’s reporting on adjusted revenues has been consistent and fully transparent for the past several years and enables investors to better analyze and assess the underlying performance of our business, as a supplemental measure to GAAP revenue.

“SEC staff interpretations on individually tailored revenue recognition methods are focused on prohibiting the improper acceleration of revenues from future periods into current periods, which is something we unequivocally do not do. Our calculation of adjusted revenue excludes items that are not reflective of the run rate of our business, and in fact, in many periods result in our adjusted revenue being lower than GAAP revenue. It is our firm belief that this metric does not constitute use of an individually tailored revenue recognition method.”

Cigna’s most recent proxy shows that the adjusted revenue metric is also one of three used to determine executive compensation, along with adjusted income from operations and strategic priorities.