This post was originally published on this site

https://fortune.com/img-assets/wp-content/uploads/2024/04/GettyImages-2115811299-e1712130256480.jpg?w=2048

The Chinese EV giant BYD only got to be the world’s top EV seller for a single quarter. On Tuesday, following the release of Tesla’s first-quarter deliveries, the U.S.-headquartered carmaker reclaimed its status as the world’s top seller of battery electric vehicles, after losing to the Warren Buffett-backed BYD at the end of last year.

BYD has recently tried to use price cuts and new model releases to spur demand. Last month, it cut the price of its cheapest model, the Seagull, by 5% and marked down its top-selling Qin Plus sedan by 20%. Yet sales still fell: BYD sold 300,114 battery electric vehicles for the three months ending March, compared to 526,409 in the previous quarter. Tesla sold 386,610 cars in the same period, compared to 484,507 in the last quarter of 2023.

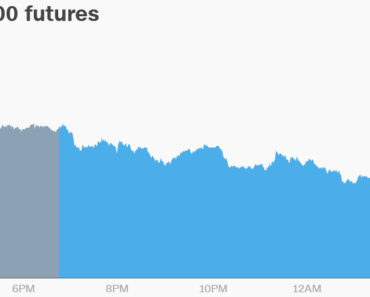

BYD shares fell 2.2% in Hong Kong trading on Wednesday, as the broader Hang Seng Index dropped 1.2%. Tesla shares plunged around 5% in U.S. trading Tuesday following the release of its first-quarter deliveries data.

Slowing sales in China

Sales for both BYD and Tesla dropped quarter-on-quarter as growth in China’s EV market, the world’s largest, slows down. (The weeklong Lunar New Year holiday may also have hit sales, compared to the previous quarter.)

The sector is also locked in a fierce price war between BYD, Tesla, and other Chinese car brands. The China Passenger Car Association has warned that price cuts could lead to consumers delaying their purchases in the hope of future discounts.

BYD previously surged on the back of Chinese consumers flocking to its affordable EVs. Yet the company’s reliance on China, unlike Tesla, could leave it more exposed to changes in the Chinese EV market.

The Chinese market accounted for over 85% of BYD’s automobile-related revenue in 2023, according to figures from BYD’s annual report. By comparison, China accounted for 22% of Tesla’s revenue. (Tesla generates 47% of its revenue from the U.S.)

Tesla has its own issues to deal with. The company’s product line-up is older, and Tesla will only release a new mass market model sometime in 2025. And like in China, battery EV adoption in the U.S. is slowing down, with consumers instead turning to hybrids.

BYD’s overseas expansion

BYD is trying to expand its presence outside of China, particularly in Japan, Southeast Asia and Europe. The company is also building plants in Hungary, Thailand and Brazil, and is considering new manufacturing in Indonesia and Mexico.

Affordable Chinese EVs, including from BYD, are triggering regulatory backlash in some jurisdictions. Last year, the European Union launched an anti-subsidy probe into Chinese EV makers, including BYD, to assess whether the companies benefited from an unfair level of government support.

Yet BYD faces less resistance in markets like Southeast Asia. The carmaker sold 26% of all EVs in the region last year, and was the top-selling EV brand in Thailand, Malaysia and Singapore.