This post was originally published on this site

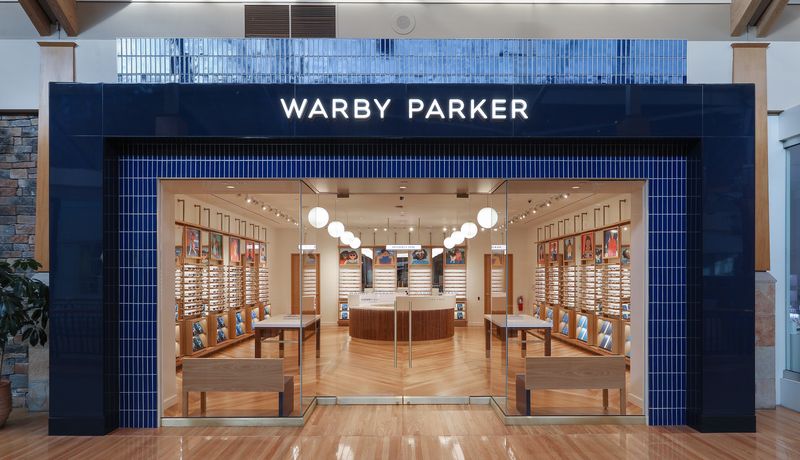

BTIG analysts said in a note Tuesday that they have assumed coverage of retailers Deckers Outdoor Corporation (NYSE:DECK), Revolve Group (NYSE:RVLV), Rocky Brands (NASDAQ:RCKY), and V.F. Corporation (NYSE:VFC) and have initiated initial coverage of Allbirds Inc (NASDAQ:BIRD), Boot Barn Holdings (NYSE:BOOT), Duluth Holdings (NASDAQ:DLTH), Foot Locker (NYSE:FL), Lulu’s Fashion Lounge Holdings Inc (NASDAQ:LVLU), and Warby Parker Inc (NYSE:WRBY).

The analysts said the firm expects the first half to be “challenging and noisy” for consumer retail and lifestyle brands companies.

They initiated coverage of Allbirds, Duluth Holdings, and Warby Parker at Neutral and Boot Barn, Footlocker, and Lulu’s Fashion Lounge at Buy. LVLU was assigned a $5 price target, with FL’s price target set at $55 per share and Boot Barn’s at $110 per share.

Meanwhile, the analysts assumed coverage of DECK at Buy with a $515 price target and RVLV at Buy with a $35 price target. RCKY and VFC were assumed with a Neutral rating.

“We expect the first half to be choppy, as many companies face the concurrent headwinds of challenging compares from the last several years (driven by stimulus, pent-up demand) against the backdrop of a more cautious consumer,” said the analysts.

However, the firm is more bullish on the back-half setup as they expect fundamentals to inflect significantly by H2 as “multiple tailwinds are set to coalesce.”

These tailwinds include easier top-line comparisons, lower YoY markdown levels as inventory is reset, and multiple cost benefits, including inbound freight, domestic transportation, and raw materials.

“Importantly, we expect a much more stable operating environment than the extremes that characterized the last three years, which should allow management teams to better plan and execute. We expect 2023 to represent a new baseline for underlying fundamentals,” the analysts stated.