This post was originally published on this site

Our empire has ruled the world for so long, there is hardly anyone still living who can remember anything else.

Our military power is unmatched. Our currency is the world’s currency. Our financial markets control the world’s economy. Anyone who wants to do business needs to come to us and do business with us, on our terms. We rule the world and we make the rules.

Our recent embarrassment at the hands of a ragtag, rabble army is no big deal in the grand scheme of things. We’re on top, and we’re going to stay on top.

So would have reasoned…any British money manager around about 1900. Back then Britannia ruled the waves, the pound sterling was the bedrock of the financial system, and British per capita income was greater than anyone else’s, including America’s. Not only was the British navy larger than most of the rest put together, but the British ruled directly one quarter of the planet, including India, Canada, Australasia, South Africa and much of the rest. The sun, famously, never set on the British Empire.

That was them, and this is us. The flight from Afghanistan this week (echoing the British Empire’s military reverses not only in Afghanistan but also in South Africa) is not the cause of U.S. decline, only a symptom. And of course China, along with others, has jumped on the opportunity.

We are so used to America being on top we have forgotten how unusual it is, and how temporary. All empires have declines and ours will be no different.

What does this mean for those of us saving for retirement?

In the short term, nothing. The dollar will not fall because the Taliban have taken over Kabul. The stock market will not decline.

In the long term: Almost everything.

Back in 1900, when Britannia ruled the world, the London stock market was 60% bigger by value than America’s, even though the U.S. already had a bigger economy. British stocks accounted for 24% of the value of all stocks in the world, according to CSFB. And half of the British stock market was accounted for by just one industry: Railways.

Hmmm…that looked like a great long-term bet, don’t you think?

No doubt back then there were fans of the efficient market hypothesis reassuring savers that keeping 12% of a global stock portfolio in the British railway sector made perfect sense.

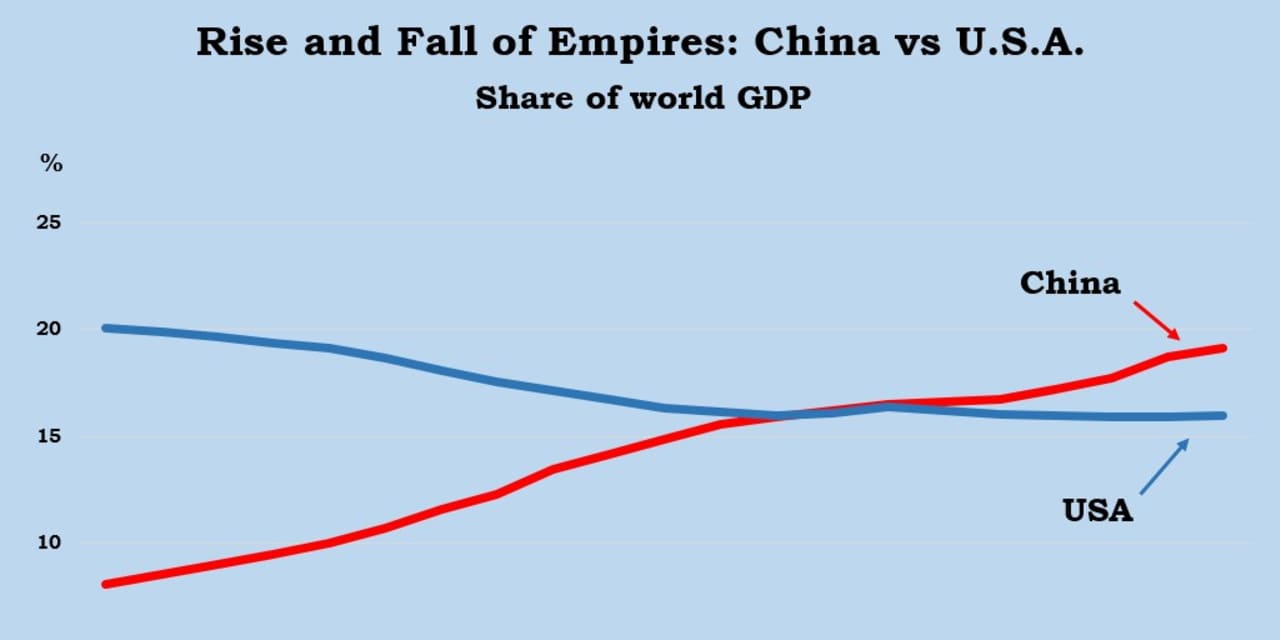

If that look through the archives is ludicrous in retrospect, today is hardly much better. Today U.S. stocks account for nearly 60% of the stocks in the world by value, even though at this point we account for barely 15% of global output. Our economy, according to the International Monetary Fund, now generates 30% less in goods and services than China’s, and the gap is growing every year.

Invest in a simple “global” portfolio like Vanguard Total World Stock

VT,

and 12% of your retirement money goes in just 6 American stocks: Apple

AAPL,

Microsoft

MSFT,

Alphabet (nee Google)

GOOG,

Amazon

AMZN,

Facebook

FB,

and Tesla

TSLA,

I’m not criticizing the Vanguard fund, you understand. It does a good job of tracking a global stock index for a bargain-basement expense ratio of 0.08% a year. My problem is with the underlying index. Stock valuations reflect investors’ demand. U.S. stocks are deemed so valuable because everyone wants to own them. Everyone wants to own them because…they are deemed so valuable.

As I pointed out recently, U.S. stocks have effectively been in a Bull Market Of One for the past decade. Look at stock markets outside the U. S. — Japan, Europe, Singapore, whatever — and there’s no evidence of a mania. Meanwhile the S&P 500 has more than tripled in value in a decade. In the summer of 2011 the State Street S&P 500 ETF Trust

SPY,

was around $130 a share. Today: $440.

According to the stock market’s infinite wisdom, U.S. businesses are worth about one third more today than they were just 18 months ago, before the pandemic.

Measured by any long term standard U.S. stocks are off the charts, even as the sun is already setting on the American empire. Using Tobin’s Q, for example, U.S. stocks overall are more expensive than they were at the peak of the bubble in 1999-2000, much more expensive than they were in 1929, and about three times their average valuation.

You don’t have to be gloomy about America’s future to steer clear of U.S. stocks. You just have to question whether America, at this late stage in our imperial history, is really going to own the world.

In my own 401(k) and IRAs I am almost completely out of U.S. stocks (barring a position in one global sector fund). I did this well before the humiliation in Afghanistan. It doesn’t mean I am necessarily bearish on the U.S., I just wanted the most diversification with the fewest mutual funds. And I asked myself: Why do I need to be in the U.S. at all? Foreign markets are a better value. The odds are in my favor. And international funds are much more diversified than global ones.

For example the Vanguard All-World ex-US ETF

VEU,

(which I do not own) is globally scattered, with about one quarter of the money in various emerging markets, one quarter in developed Pacific economies, and two-fifths in Europe. The biggest country holding is Japan, and that’s just 16% of the entire fund. Compare that to a “global” portfolio with nearly 60% in one country.

I’m influenced by the analyses of the smartest investment thinkers I follow, including Rob Arnott, Ben Inker, and Cliff Asness. Earlier this year Asness, a hedge fund honcho in Greenwich, Conn., worked out that the big “outperformance” in recent years of U.S. stocks (and growth stocks) was mainly just a price effect. In other words, the stocks had become more expensive in relation to their fundamentals. That’s terrific if you already owned them. Not so good now.

So I’m betting on non-U.S. stocks and on “value” stocks. Will that bet pay off? Only time will tell. It’s a gamble I’m willing to take with my own money. No tears.

That’s probably too big a bet for most people. But many may not realize they are already making a big bet — the other way. If you hold a “global” portfolio you’re already 60% invested in U.S. stocks, and many investors go further still. Anyone who just has their money in an S&P 500

SPX,

fund is betting all of their money on U.S. equities. Even in normal circumstances I can’t see any good reason why I’d have even half my money in U.S. stocks, and right now the circumstances look far from normal.

The sun finally set on the British Empire. It is setting on ours.