This post was originally published on this site

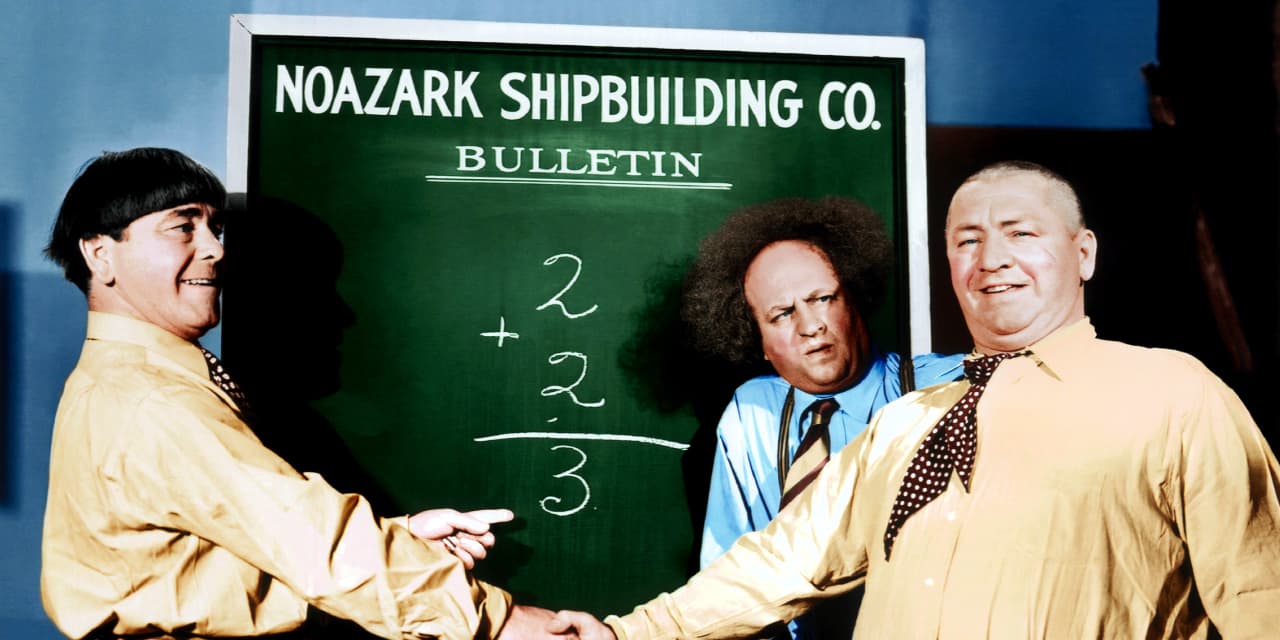

Moe, Larry and Curly have been watching stock markets plunge in the past two weeks in response to the Ukraine invasion. Each wants to invest, say, $100,000 in European stocks—for example through Vanguard’s European Stock

VGK,

ETF—because they figure prices have fallen so far they look like a bargain.

Read: How do you invest in Europe without Russia?

But here’s where they disagree.

Moe thinks he should make the investment using his regular after-tax brokerage account. He figures that this way he’ll pay only favorable capital-gains tax rates on any profits, rather than higher income-tax rates. And if he loses money he can write it off against future income tax.

Larry thinks he should make the investment in his after-tax Roth individual retirement account. He figures this way his future gains will be entirely tax-free.

And Curly wants to make the investment using his traditional, pretax IRA—even though if he makes a profit he will end up having to pay hefty ordinary income-tax rates on any gains, and those are usually higher than capital-gains rates.

So Moe and Larry are the smart guys and Curly’s the dummy, right?

So says a lot of personal finance conventional wisdom.

But the CW may be wrong.

Actually in this case there is an argument that Curly could be making the really smart move.

Read: Worried about inflation? Here’s how investments did in the 1970s

Before I go any further let me introduce the tedious but important disclaimers, lest I get angry emails from the kind of person who drives down the highway (at the start of the Memorial Day weekend) at 54 MPH. No, there isn’t a definitive answer. Yes, there are multiple assumptions and moving parts. We don’t know if the stock fund is going to keep falling, or if it’s going to start rising (and, if so, when). We don’t know what tax rates our stooges are paying now, or what they’ll be paying in retirement. We don’t know what is going to happen to marginal tax rates. And so on. Bear all these caveats in mind. For that matter the past is no guarantee of future results, global stock markets could enter a 100-year bear market tomorrow, or the world could end.

But here’s why Curly’s move isn’t as dumb as it sounds.

Contrary to what they seem to think in personal finance theory school, we don’t actually know if, say, European stocks (or any stocks) are going to go up and up from here. If we did, investing would be really, really easy. Investing always involves an element of a gamble.

But because he is investing with pretax money in his traditional IRA, Curly is taking some of his gamble with other people’s money.

Those other people? Uncle Sam—or, more accurately, other taxpayers, like you.

Curly didn’t pay any tax on his money before he put it into his IRA. And he won’t owe any tax on it unless he makes a profit.

Meanwhile Moe and Larry are gambling with after-tax dollars. They’ve already paid tax on the money, no matter what happens to their investment. They had to earn $120,000 (or $150,000, or whatever) in their jobs before tax in order to have $100,000 left over in order to bet. So even if their investment tanks, they have lost that tax money.

Anyone who has followed Wall Street long enough knows that one of the key secrets to striking it rich in the markets—maybe the key secret—is to gamble whenever possible with other people’s money. Heads you win, tails someone else loses.

Curly, alone of our three stooges, is gambling with OPM.

And while yes, he’ll probably pay higher taxes than the others if the bet pays off, that may be a rational trade-off. He may figure that his No. 1 retirement goal isn’t to die as rich as possible, but to minimize the risk that he runs out of money when he’s old. So he may be willing to accept higher, progressive taxes if he makes bank in exchange for the promise of a much bigger tax break if he doesn’t.

Oh, and clever Curly has a second way to win here as well.

Let’s say markets continue to fall, the investment tanks and loses, say, 50%, so the original $100,000 stake is down to $50,000.

Curly can take advantage of the plunge…by converting his traditional, pretax IRA to a posttax Roth. Sure, he’ll have to pay ordinary income tax on the conversion. But after investing $100,000 of pretax money, he will only have to pay income tax on the $50,000 converted. And now, if his investment goes back up, all the gains are completely tax-free in a Roth.

Heads he wins, tails he wins.

Moe or Larry? They’re right out of luck.

Larry, by investing with his Roth, has no tax break opportunities whatsoever if his investment goes down. His tax money has gone to money heaven and is never coming back, even though he’s lost half of what he had left.

Moe, who used his taxable account, isn’t much better off. Technically he can claim his $50,000 losses against other capital gains. But that assumes he has other capital gains. And although he can claim any remaining losses against his annual income tax bill, he is limited to claiming just $3,000 of those losses a year.

It’s a derisory sum. Congress set the limit decades ago but never updated it for inflation. (If you were a rich hedge-fund manager, of course, it would be a different matter. You’d get the sweetheart tax deal known as the “carried interest loophole”.)

Bottom line? Conventional wisdom says take your biggest bets with after-tax money. But conventional wisdom may not always be right.