This post was originally published on this site

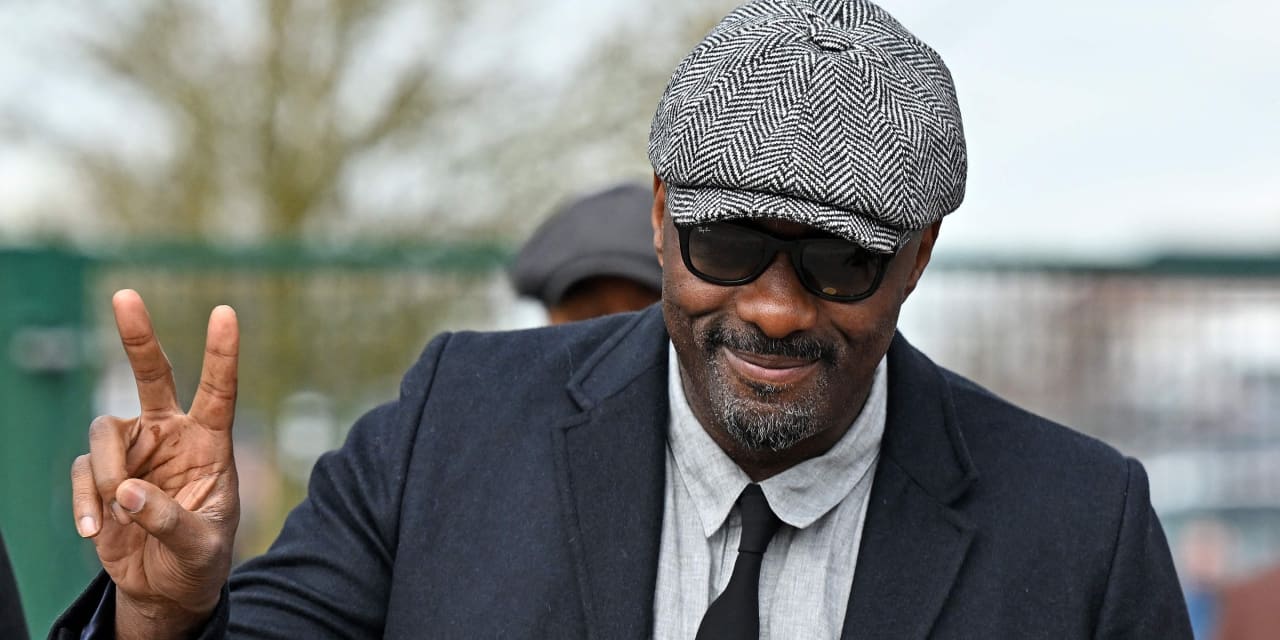

Well, it’s not Goldfinger. But British actor Idris Elba, once widely tipped for the role of James Bond, has just made a movie about gold in partnership with the gold mining industry.

And I’ll say this about “Gold: A Journey With Idris Elba,” released today on YouTube: It’s no worse than, say, Daniel Craig’s Spectre. And it’s less than half the length, which is a plus.

I’ve been trying to reach Elba’s publicist or agent, so far without success. I wanted to know how much the famed British actor got paid for making this movie, and whether he got paid in gold. I also wanted to know how Elba would respond to the inevitable accusations that he is whitewashing the industry’s environmental record.

The U.S. Government Accountability Office says gold mining has been environmentally damaging. So does the Smithsonian Magazine, the Yale School of the Environment, and researchers at Oxford and Cambridge Universities.

But you wouldn’t know that from watching Elba’s movie. The references to the environment merely showcase a few cases—in South Africa, the Congo, and New Zealand—where gold mines have gone green, by using renewables and by cleaning up after a mine has closed.

In an emailed statement, Terry Heymann, the chief financial officer officer of the World Gold Council, which made the movie, said: “All members of the World Gold Council are required to adopt the Responsible Gold Mining Principles, which sets out an over-arching approach to managing the material sustainability risks associated with gold mining. As such, we are confident that modern-day, responsible gold mining supports the many remote communities located close to these mines and is a critical catalyst to support socio-economic development, an important topic addressed in the film.”

The interesting parts of this movie—Elba visiting Ghana and India, traveling down a mine, or eyeballing the gold vaults under the Bank of England—are interspersed with lots of stuff about the mining industry.

No surprise: The World Gold Council, represents the miners. But it’s a pity. Partly because this is mostly the kind of corporate-marketing video that anyone who has attended a big company event knows all too well. Partly because Elba is far less interesting when reading out a script as a voice-over. Forget golden, his delivery at times is leaden.

And partly because there is a much more interesting story to be told about gold, and I’d have been genuinely fascinated to see an actor of Elba’s talent make a movie about it.

In a nutshell: Why is gold still working as a financial investment?

Nobody really has an answer. It makes no rational sense. Yet here it is. Gold is currently about $1,830 an ounce, after breaking $2,000 earlier this year.

True fact: Gold has been a better investment than bonds over the past one, three, five, 10 and 15 years. You would have been much better off owning a gold-based exchange-traded fund like State Street’s SPDR Gold Shares

GLD

than one that invests in the supposed safety of U.S. bonds, such as the iShares Core U.S. Aggregate Bond ETF

AGG.

This, even though nearly every accredited financial adviser in America would have told you, at each and every one of those points in the past, that bonds were a much safer and better place for your money than gold bullion, which they would have panned (no pun intended) as speculative or risky.

When you adjust for inflation, gold has yet to match the peak values set briefly in 1979 (by my math, nearly $3,000 an ounce in today’s money) or 2011 (about $2,400). On the other hand, when you smooth out short-term fluctuations and track, say, a rolling three year (36 month) average, gold is back at or near its peak. The 36 month average is higher than it was in the late 1970s or early 1980s, and not far short of where it was 12 years ago.

Long-term? Even adjusted for inflation, gold today is worth more than three times as much per ounce as it was in 1913, when it was valued at $570 an ounce in today’s money. It’s worth four times as much as it was in 1870, when it was worth about $460 an ounce in today’s money (for fans of the all-time greatest Western, The Good, The Bad and the Ugly, the “$200,000 in gold” the trio are hunting would have been worth about $4.8 million in today’s money).

What can account for this? It’s not the usefulness of gold. About 10% of the world’s demand is for things like dentistry, electronics or other practical uses. And we don’t use it to buy and sell things any more.

The main practical thing that gold can offer, and which no other asset can do as well, is financial independence from the banking system.

It’s the number one go-to asset if you need to do things you don’t want anyone to know about.

Or if you’re facing financial sanctions from the rest of the world. (If Vladimir Putin had converted all of Russia’s foreign reserves into bullion before invading Ukraine, brought them back into the country, and stored them underneath the Kremlin, he’d have saved himself a lot of money, and trouble).

Is this the reason gold remains in demand as a financial asset? Is this why it defies reason? That’s a movie I’d like to see.