This post was originally published on this site

Socially responsible investing is hotter than a dried out riverbed in August.

Pension funds are dumping stocks that go against their environmental, social or governance principles. Now the Biden administration has passed a rule allowing funds in your 401(k) plan to do the same. There has already been a stampede into such so-called “ESG” funds.

But here’s an awkward question.

Let’s consider the environmental issue. Let’s say you’re worried about global warming (as most of us are).

Let’s say you invest in a fund that refuses to own stocks in fossil fuel companies, such as Big Oil.

Here’s the question: So what?

In other words, what does that achieve?

Will it make the global economy greener? Will it reduce global energy consumption? Will it even affect the companies whose stock you dump?

All along there is this unspoken assumption that dumping stocks, “divesting” or in modern parlance “canceling” them, will somehow help.

Will it?

The world doesn’t use a lot of oil because Exxon Mobil

XOM,

say, is a valuable company. Exxon Mobil is a valuable company because the world uses a lot of oil. If we all dump Exxon stock tomorrow, and the stock price plunges, what possible effect would that have on global oil consumption?

These companies are awash with cash anyway. They don’t need our money.

Read: Should your401(k) follow your conscience? What to know before investing in ESG

For instance last year, when the oil industry was walloped by a perfect storm that saw spot oil prices go negative for the first time in history, Exxon Mobil’s cash flow from operations was still nearly $15 billion. In previous years, even as oil prices were depressed, the figure averaged north of $30 billion a year. It’s comparable at, say, Chevron

CVX,

where operating cash flow was north of $10 billion last year.

Not owning their stock isn’t going to stop their business. They will simply use their cash flow to buy back their own stock. The lower we drive the stock by refusing to touch it, the more they will buy. And that will end up benefiting just two groups of people: Big Oil executives, and the investors who ignore the ESG trend and hang on to the stock.

People divested from Big Tobacco 25 years ago. What happened?

Well, take the landmark date of November 1998, when Big Tobacco officially became pariahs. That was when they signed the “master settlement agreement” with the U.S. states, agreeing to pay vast sums over the years to cover cancer and other tobacco-related health costs.

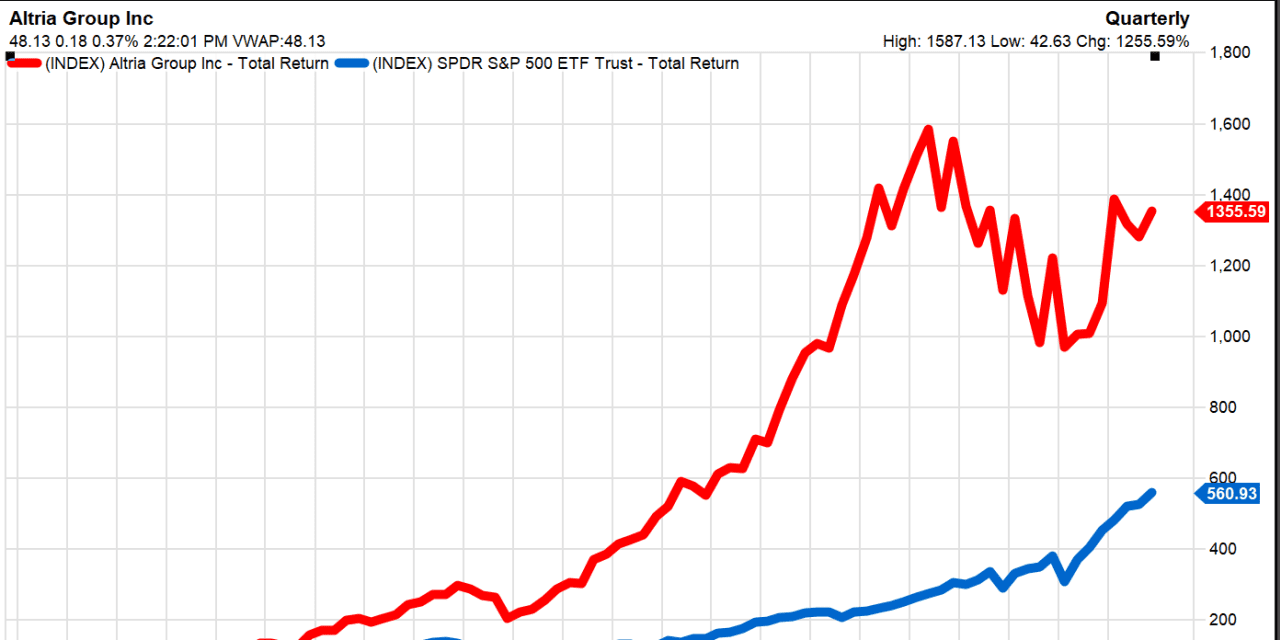

If you’d invested $10,000 that month in stock in Altria

MO,

(aka Philip Morris), according to FactSet, today you’d have about $130,000. That is twice as much as you’d have if you had invested the same amount of money in an S&P 500

SPX,

index fund instead. During almost a quarter-century of divestment by socially responsible investors, Big Tobacco has outperformed the broader stock market by about 100%.

Take that, Marlboro!

How did that help reduce smoking?

I suspect the real reason smoking has declined is because older generations of Americans, who grew up when smoking was common, have died out—either because of smoking, or from natural causes. Meanwhile younger Americans have grown up in a world where smoking is uncommon and unfashionable, so fewer and fewer do it. Public health messaging helped. Bans on smoking in bars and restaurants and offices helped. Anyone who smoked in the late 1990s has been subject to 25 years of pressure and shaming to get them to quit.

Meanwhile the big problem with fossil fuels isn’t that oil companies turn them into energy but that we need them. If we somehow shut down all oil companies around the world tomorrow, the lights would simply go out everywhere. Hospitals and factories would shut down. Homes would go cold. Transportation would collapse. Millions would die. Last year “green” energy—including nuclear power, hydroelectric power, and all other “renewables” from solar panels to wind farms—could only supply 17% of the world’s energy needs. Oil, coal and natural gas provided the other 83%.

If we want to encourage renewables, shouldn’t we focus on directing investment dollars toward green energy startups, rather than worrying about legacy “Big Oil”? And if we want to encourage energy efficiency in the economy, shouldn’t we try to use our power as mutual-fund investors to pressure all companies, not just energy producers, to stop wasting energy? And anyway, isn’t responsible capitalism a job for all mutual funds, including index funds, and not just a small subset labeled “ESG?”

I don’t know if I want a specific ESG fund in my 401(k). I want the funds in my 401(k) to use my money for good.