This post was originally published on this site

Investment Thesis

BorgWarner (BWA) is an automotive supplier that operates under two segments – Engine and Drivetrain. With the broader decline in the economy and auto sector due to COVID-19, the stock is down 30% since Jan. 2020 and presents a compelling opportunity for medium to long-term investors. Across the entire automotive supply chain, part manufacturers/suppliers are severely beaten down because of OEM production halts, where the supplier had to follow suit with no prior notice. Although BorgWarner operates in a highly cyclical industry, the company is financially well-positioned to tackle the COVID storm and it will emerge stronger from the crisis. Sum of the Parts valuation shows (excluding recent acquisition) BWA share is worth $34 per share (31% upside, using May 14 $24 closing price). The LTM EV/EBITDA (4.5x) indicates BWA is trading 50% lower than its historical 5-year average multiple (8.5x).

Financial Strength

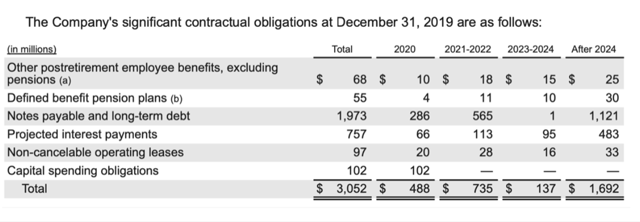

Looking at the year-end obligations, BWA has $488 million in 2020 and $735 million in 2021. With $2.4 billion in liquidity ($900 million in cash and rest in revolver), the company can meet its obligations over the next two years and still be left with plenty of cash (approximately $1.2 billion) for CAPEX ($400-500 million) and funding working capital.

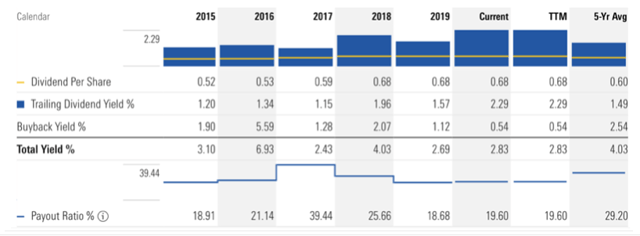

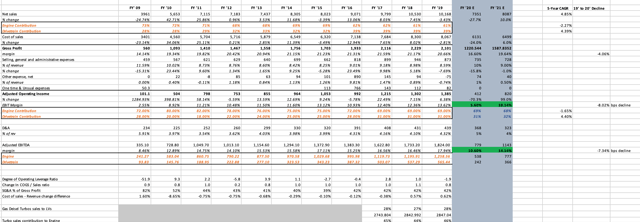

Historically, BWA had negative NWC, even during recessions. Management said – “In this type of an environment – and we all saw this in 2008, 2009, inventory tends to come out of the system much more slowly. But that said, we still run positive working capital when you look at receivables versus payables and that’s the real benefit that we’re seeing at the moment” (Q1 2020 Earnings Call). This should further improve FCF in 2020. Over the past five years, BWA’s weighted average shares outstanding declined only 8%, with an average buyback yield of only around 1-2% (below). Instead of aggressively buying back stock in good times, management prioritised paying down debt and funding growth or M&A activities. In addition, net debt/EBITDA declined from 1.5x to 0.7x by 2020. BWA also generated a 10-15% FCF yield, a healthy 10+% ROIC and maintained a consistent dividend payout ratio at 20%, over the past five years.

(Source: Morningstar)

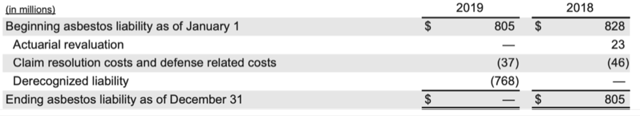

Last year, the company sold asbestos-related liabilities to a third party, reducing $800 million worth of liabilities, further strengthening the balance sheet.

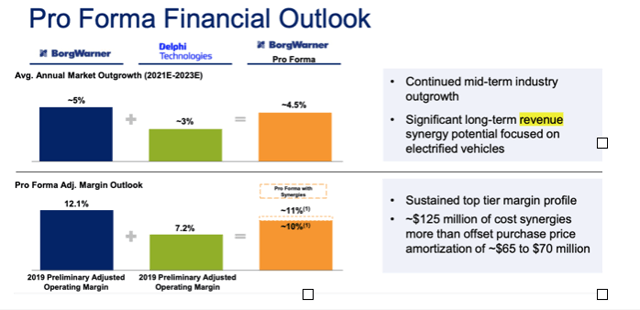

For this year, management indicated an unsurprisingly wide range of FCF guidance – $100-300 million. Even with a zero FCF, BWA has enough cash to cover daily operations and fund CAPEX/NWC. The all-stock acquisition of Delphi isn’t going to have a major impact on leverage and liquidity. Gross debt to Adjusted EBITDA is expected to be 1.6x at closing and BWA will most likely retain investment-grade rating, considering there are no more disruptions related to COVID. Overall, BWA has plenty of cash to tackle the crisis and expects management to start buying back shares in 2021, with BoD authorising a $1 billion share repurchase program over the next three years.

Projections And Assumptions

Revenue

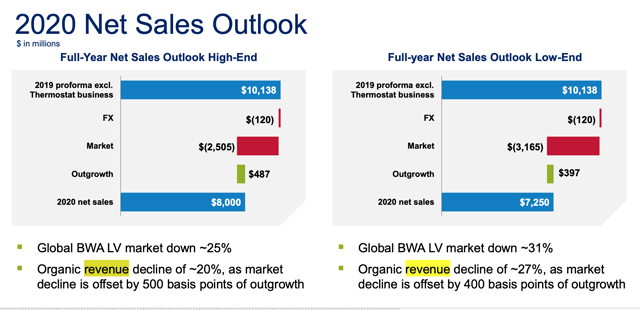

(Q1 2020 Investor Presentation)

Management expects revenue to decline anywhere between 20-27% in 2020, which is close to the previous downturn (2008 to 2009) where revenue declined by 25%. As a conservative estimate, I’ve used a 27.7% decline (in the EBITDA projection model below) in revenue after adjusting for warranty provisions (around 6-7% on 5-year average). Historically, BorgWarner outperformed light vehicle (LV) unit growth and the overall automotive sector in up and down markets, thanks to clean air legislation and technological improvements. For instance, LV unit (BWA’s biggest vehicle revenue segment) – declined 20% from 2007 to 2009 but the firm’s sales declined by only 15%. In 2019 alone, organic revenue grew at 0.7%, outperforming LV production growth (-4.7%). According to CFRA Research and Morningstar, global LV unit sales are expected to rebound by 6% in 2021, from a 22-31% decline, as indicated by BWA management and the sell-side. In the previous recovery (2009- 2010), however, sales jumped by 42%. Although I don’t expect a sudden recovery, a U-shaped upturn across the entire automotive supply chain seems likely at this point (hoping there are a vaccine and no further lockdowns in 2021). Management also expects 5% YoY average outgrowth relative to the auto sector and production growth. With 6% LV production growth in 2021, I believe a 10% revenue growth rebound in 2021 seems like a conservative estimate. I also think that low gasoline prices, low auto loan rates, price concessions and air travel should help improve new vehicle sales (thus, LV production growth), which in turn will impact BorgWarner’s business.

Note: Projections only consider organic growth rate and exclude currency and net M&A impact.

(Company Reports, Management Guidance, Morningstar/CFRA Research Reports, Author’s own estimates)

As you can see from the projections above, the Engine segment’s percentage of revenue declined 11% over the last decade and Drivetrain segment’s increased by the same amount. This change is driven by gaining popularity of Drivetrain segment’s dual-clutch transmission, four/all-wheel-drive torque transfer technologies and electrification. The drivetrain market for four-wheel drive (FWD) is expected to reach 73 million units, growing at 4% CAGR, with most of the growth coming from China. FWD enables better traction, balance and improves fuel efficiency, irrespective of the engine size.

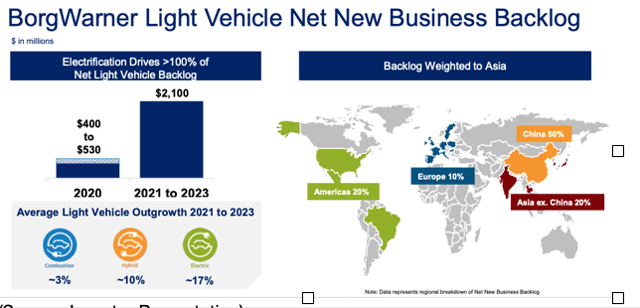

Management expects 10% revenue CAGR from 19’ to 23’ (2018 investor presentation), growth driven by SUV/CUV vehicle unit growth. BWA’s drivetrain products can improve fuel economy by 25-30%. If OEMs choose to meet regulatory requirements through hybrid or electric vehicles, BWA is ready with the technology – cabin heaters, eGearDrive, DualTronic and hybrid fan drives (besides combustion-related products). The recent acquisition of Delphi further adds to the company’s electrification portfolio and it complements BWA’s internal powertrain and combustion products. If the acquisition goes through in Q2 2020 (most likely it will), it will improve BWA’s position within the drivetrain market. Including the revenue and cost synergies, I believe the combined equity could be worth more than BWA stock’s high $38-45 range. This is in line with management’s long-term strategy – “We have been positioning BorgWarner to be slightly overweight in hybrid and electric vehicle revenue by 2023 while maintaining a balanced exposure to the overall industry” (2019 Annual Report).

With the entire auto sector shift towards electrification, SUV/CUV unit growth, regulations and Asian market growth will aid the Drivetrain segment as a percentage of revenue to increase by at least 100 bps per year. Any declines in drivetrain sales across developed markets (NA and Europe) will be offset by the growth in the Chinese market.

Engine segment other, on the other hand, declined slowly as a percentage of revenue by 2.3% on CAGR, while the Drivetrain segment grew at 4.5% CAGR as a percentage of revenue. As I mentioned in my previous article on BorgWarner’s engine segment competitor Garrett Motion (GTX), turbocharger segment outgrew vehicle production by two-fold every year. As a note, “Sales of turbochargers for light vehicles represented approximately 28%, 27% and 28% of total net sales for the years ended December 31, 2019, 2018 and 2017, respectively” (BWA’s Annual Report). BWA shares 60% turbocharger market share with Garrett, operating in a duopoly market. This allowed BWA to gain low to moderate pricing power and provided high barriers to entry. Going forward, declines in rest of the Engine products will be offset by gains in gasoline/diesel turbocharger product.

Gross Margins and EBITDA

Since 2015, gross margin was in 20-21% range, and the cost of sales change was consistent with revenue growth rate changes. This implies there’s high flexibility with COGS and BWA’s ability to pass on extra costs to OEM customers. I’ve talked about the turbocharger industry’s economics in my previous article on Garrett Motion. As one of the largest auto suppliers, this can be applied to BWA. The company has long-term contracts with OEMs, which create a barrier to entry and some pricing power. Due to the complexity of the products and BWA’s expertise with turbos, dual-clutch and torque management products, it keeps the threat of substitutes low across all vehicle types (combustion, hybrid, EV). These long-term contracts across different platforms create repeat businesses (also, high barrier to entry), which is reflected in the firm’s backlogs:

(Source: Investor Presentation)

Since revenue changes are almost perfectly correlated with the cost of sales changes, I’ve used the same growth rates to project out COGS for 2021. However, I’ve used a slightly more pessimistic assumption for 2020 cost of sales (declining less than revenue), since the gross margin was 14% in 2009 compared to 20-21% average. This takes into account extra costs incurred due to sudden production halts, change in supplier contracts and COVID-related expenses. Thus, I believe a 400 bps decline in gross margin this year is a fair estimate.

There’s no info on gross margin contribution rates for engine and diesel segments, other than EBIT contribution for the respective segments. Using that as a proxy, I’ve projected out EBITDA for both segments. Engine segment’s EBIT contribution declined 1100 bps since 2010 and drivetrain gained by the same amount (thanks to electrification and drivetrain’s strong product portfolio). The reason behind the engine segment’s slow decline is the rising popularity of gasoline turbos and diesel slowly going out of fashion (but not completely). Gas turbochargers overtook diesel for the first time since 2009. With stringent clean air legislation, gas turbos are slightly expensive to manufacture. Revenue-wise, it’s a positive outcome for BWA because declines in diesel are offset by increases in gasoline turbos. Both gas and diesel sales for light vehicles not only account for 27-28% of net sales on average, but represent 45% of engine segment’s revenue on average. So, I think gasoline turbocharger growth will slowly eat into the company’s gross margins over time but I think those declines will be offset by tremendous growth from Drivetrain segment’s electrification products.

Back in the day, European governments spent billions subsidising diesel cars, as they emitted less CO2 compared to gasoline. But only realised that diesel fumes are more dangerous than gas (aka petrol) and contain higher levels of nitrogen oxides, which cause cancer. Adding to that, the Volkswagen (OTCPK:VLKAF) emission scandal had ruined diesel’s reputation and consumers were sceptical about buying diesel cars since then. With modern-day technology and equipment, petrol or gasoline engines have about the same CO2 levels, sometimes even lower than small/medium diesel cars. Either way, diesel isn’t expected to go away anytime soon and it’s popular with commercial and heavy passenger cars like SUV and trucks, which are expected to account for 50% of passenger car production by 2023. So, I think this trend should protect BWA’s turbocharger product’s margins going forward (assuming diesel is still around). Based on the historical EBIT contributions, I believe engine contribution will decline by 100 bps YoY and Drivetrain segment will realise those gains. Thus, stabilising gross/operating margins whilst achieving 5% CAGR revenue growth until 2023 (as indicated by the management). Incorporating these assumptions, I’ve arrived at 10% 2021 EBIT margin (from the above EBITDA projection model), which is in par with management’s 21-23 outlook excluding acquisition synergies.

(2018 Investor Presentation)

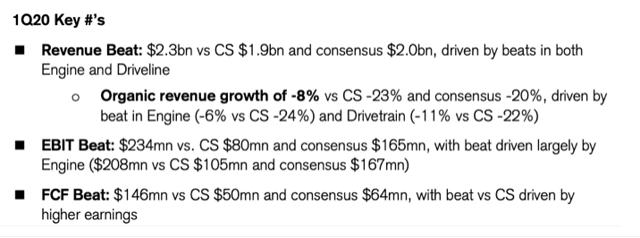

I estimate EBITDA to decline by at least 734 bps in 2020 and increase 360 bps in 2021. In the previous 2009-10 recovery adjusted EBITDA rose 460 bps, so I believe my estimates account for a U-shaped recovery. I also project a 5.60% adjusted 2020 EBIT margin (800 bps decline); the figure is way below sell-side average consensus of 9% EBIT margin. The lowest estimate came from Credit Suisse (NYSE:CS) – expecting BWA to finish 2020 with just 4% adjusted EBIT margin. I believe that’s a draconian scenario considering how Credit Suisse analysts missed the Q1 2020 estimates by two-fold:

(Source: Credit Suisse Equity Research)

Below, I’ve incorporated EBITDA assumptions on a segment basis to build out the SOTP model. I’ve left the same EBIT contribution figures for both segments in 2020/21 and a 100 bps decline in the engine and a subsequent gain drivetrain for 2021. This aligns with the turbocharger industry trends (increase in gasoline revenue share) with drivetrain growing and engine slightly declining as a percentage of revenue and EBITDA.

Sum of The Parts Valuation

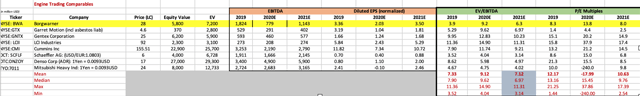

Engine Comps

Note: Engine Peer Group – Garrett Motion, Gentex Corporation (GNTX), LCI Industries (LCII), Cummins Inc. (CMI), Schaeffler AG: (OTC:SCFLF), Denso Corp. (OTCPK:DNZOY), Mitsubishi Heavy Ind (OTCPK:MHVYF)

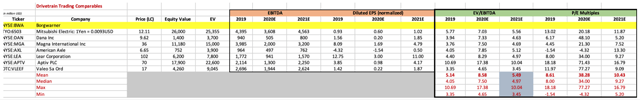

Drivetrain Comps

(Sources: Company Reports, Investor Presentations, Management guidance, Company Reports, Sell-Side Analyst Estimates, MarketScreener.com, Author’s Estimates)

Note: Drivetrain Peer Group – Mitsubishi Electric (OTCPK:MIELF), Dana Inc. (DAN), Magna International Inc. (MGA), American Axle (AXL), Lear Corporation (LEA), Aptiv PLC (APTV), Valeo SA Ord (OTC:OTCPK:VLEEF)

Valuation

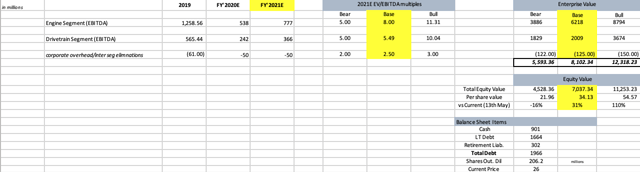

(Source: Author’s estimates, Comps Table)

- I estimate the company’s Engine and Drivetrain segments are worth about $30 and $9.7 per BWA share, as indicated by the base case (TEV/Shares outstanding). Ultimately, if both segments are individual entities, each segment would be worth $5 than the combined entity or $34 per share.

- Bear-case: Assigned BWA’s 10-year lowest multiple for both segments – 5x. I think a min peer group multiple (3.14x and 3.45x) for both the segments is overly pessimistic since the company never traded at that valuation range over the past 10 years. Also, it doesn’t deserve to trade at those levels considering its dominant position within the turbocharger and drivetrain market, along with its disciplined capital allocation and strong management team. The company is also ripe for growing electrification demand with its new acquisition and strong product portfolio. However, I see the bear case playing out (or 16% decline from current price – $26 as of May 13), if there are more customer plant closures due to new COVID cases. In fact, BWA’s major customer Ford (F) shut down its Dearborn plant again in Michigan after two workers tested positive. So there’s a probability of shares declining $18-22 this year.

- Base-case: Assigned peer average multiple for Engine and Drivetrain segment, resulting in $8 billion market cap or $34 per share (31% upside from the current market price $24 per share as of May 14 closing price). Engine segment at $30 and Drivetrain at $9.7 per share each.

- Bull-Case: Using the highest peer group multiple for each segment leaves us with $12.3 billion market cap or $53 per share (110% upside). I strongly think this could play out after the acquisition of Delphi, over the course of two years.

Risks To My Base Case

- Customer concentration: “Our worldwide sales in 2019 to Ford (F) and Volkswagen (VLKAF) constituted approximately 15% and 11% of our 2019 consolidated net sales, respectively” (Company Reports). Further plant closures can affect BWA’s business dramatically.

- Trade tensions between the US and China can weigh on gross margins.

- Commodity price fluctuations due to supply chain disruptions and geopolitical tensions/tariffs can impact the growing turbocharger business.

- Flexible contracts: OEM customers have the ability to change volumes and prices without any prior notice.

- FX Risk: BWA has hedging in place and company “mitigates foreign currency exchange rate risk by establishing local production facilities and related supply chain participants in the markets we serve, by invoicing customers in the same currency as the source of the products and by funding some of our investments in foreign markets through local currency loans.” But the strengthening of the USD or a dramatic decline in euro, renminbi, krona will affect sales.

- Operating Leverage: BorgWarner has a high degree of operating leverage, sudden declines in volume can have a meaningful impact on profit.

- Price reductions: In difficult environments like we are facing right now, OEMs usually put pressure on suppliers for reductions. This will erode ROIC.

- Used vehicles: In a recession, consumers prefer used/off-lease vehicles and spend more repair/servicing existing vehicles (non-discretionary expense) instead of buying a brand new vehicle (as explained in my previous article on CarMax (KMX) here. As a result, declines in new vehicle production could be more than management’s forecast.

To Sum Up

BorgWarner looks like a great buy for medium to long-term investors. The company’s financial strength and solid industry position shall provide enough margin of safety for equity investors if things get worse. As shown by the SOTP model, the standalone segment is worth more than the combined business. With attractive industry economics, positive turbocharger and electrification outlook, buying at the current price level of $24-26 per share (as of May 14) will provide investors with 31-110% upside potential by the end of 2021.

Disclosure: I am/we are long BWA, GTX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: BWA- Initiated position on May 13th at approx $24 per share.

GTX- Initiated position on March 27th at approx $3.30 per share.