This post was originally published on this site

Bond yields fell on Tuesday amid building expectations that a slowing economy will cause the Federal Reserve to slow the pace of rate hikes.

What’s happening

-

The yield on the 2-year Treasury

TMUBMUSD02Y,

4.223%

slipped by 2 basis points to 3.012%. Yields move in the opposite direction to prices. -

The yield on the 10-year Treasury

TMUBMUSD10Y,

3.504%

retreated 1.8 basis points to 2.984%. -

The yield on the 30-year Treasury

TMUBMUSD30Y,

3.674%

fell 1.7 basis points to 3.172%.

What’s driving markets

Investors have become increasingly certain in recent sessions that the Federal Reserve will ease its pace of rate rises as signs emerge the U.S. economy is slowing.

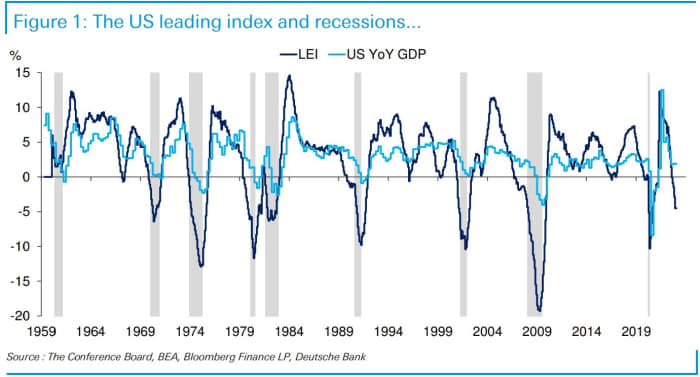

The U.S. leading economic index was shown on Monday to have dropped 1% in December, a signal that a recession is looming, said Jim Reid, strategist at Deutsche Bank.

Source: Deutsche Bank

Economic updates set for release on Tuesday include the ‘flash’ S&P U.S. manufacturing and services PMIs for January, due at 9:45 a.m. Eastern.

Markets are pricing in a 100% probability that the Fed will raise interest rates by another 25 basis points to a range of 4.50% to 4.75% after its meeting on February 1st, according to the CME FedWatch tool. The central bank is expected to take its Fed funds rate target to 4.9% by June 2023, according to 30-day Fed Funds futures.

In the U.K. 10-year gilt yields

TMBMKGB-10Y,

fell 5 basis points to 3.309% after a survey of the country’s manufacturing and service sector purchasing managers showed activity contracting by more than expected.

Earlier data showed that U.K. government borrowing more than doubled to hit the highest ever level for a December, as payments were made to support households and businesses facing surging energy costs.

What are analysts saying

“Fed officials are still saying, for the most part, that they expect to raise rates several more times this year…Behind the tough talk, though, officials have signaled that the February 1 hike will be 25bp, a clear shift from early December, when Fed policymakers—and the data—had convinced markets that the Fed would hike by 50bp in both February and March,” said Ian Shepherdson, chief economist at Pantheon Macroeconomics.

“No FOMC member has said explicitly that they expect to pause after the February meeting. But markets are now pricing-in a 20bp tightening in March; one-fifth of investors, therefore are choosing to ignore the public statements of policymakers. That has been a losing proposition over the past year, but what’s happening now, in our view, is that investors have flipped from hanging on every word of Fed officials to trusting instead the evidence in front of their own eyes.”

“Specifically, three straight good CPI reports, slowing wage growth, back-to-back grim retail sales and manufacturing output reports, the sudden drop in the ISM services index, and the recession-level NFIB index have convinced many investors that the Fed cannot keep raising rates until core inflation is almost back to 2%. We agree,” Shepherdson said.