This post was originally published on this site

BlackRock Inc., the world’s largest asset manager with almost $10 trillion under watch, says its investors are demanding more of those holdings align with net-zero greenhouse gas emissions. And its clients want clear action toward a net-zero goal in place as soon as the end of this decade.

Investment-minded environmental groups said that coming from the world’s largest institutional investor, the BlackRock commitment could potentially have significant influence on lowering global emissions, if it goes far enough.

BlackRock said Thursday that by 2030, at least 75% of its corporate and sovereign assets managed on behalf of clients will be invested in issuers and companies with science-based emissions-cutting targets. That will be up from 25% currently.

It also said clients have cited the transition to a net-zero economy as a top concern and that many want their portfolios aligned to the goal. The U.S. and most powerful economies have aimed to halve their total emissions by 2030 and reach net-zero by no later than 2050.

Emissions, including carbon and the more-potent, but shorter-lasting methane, are driving the average global temperature higher, raising sea levels and intensifying droughts and other severe weather, costing lives and billions in economic loss. A voluntary pledge set in 2015 aims to hold global warming to no more than 2 degrees Celsius and ideally, no greater than 1.5 degrees. Recent U.N. climate panel reports have chided a too-slow response to reach that goal.

“‘[BlackRock] must use every tool in its toolbelt to achieve these results, including engagement, voting, investment policy and fund capital allocation.’”

About 90% of companies in the S&P 500

SPX,

publish voluntary reports disclosing carbon emissions to some degree as well as renewable-energy use. The Securities and Exchange Commission is mulling formalizing the requirements around reporting climate risk and pushing for a uniform way to report this information.

Environmental groups said Thursday the impact of the BlackRock target depends on whether the asset manager implements guidelines to ensure that the heavy emitters in its portfolio, including oil

CL00,

and gas companies, large shipping interests and others, are explicitly covered by its goal.

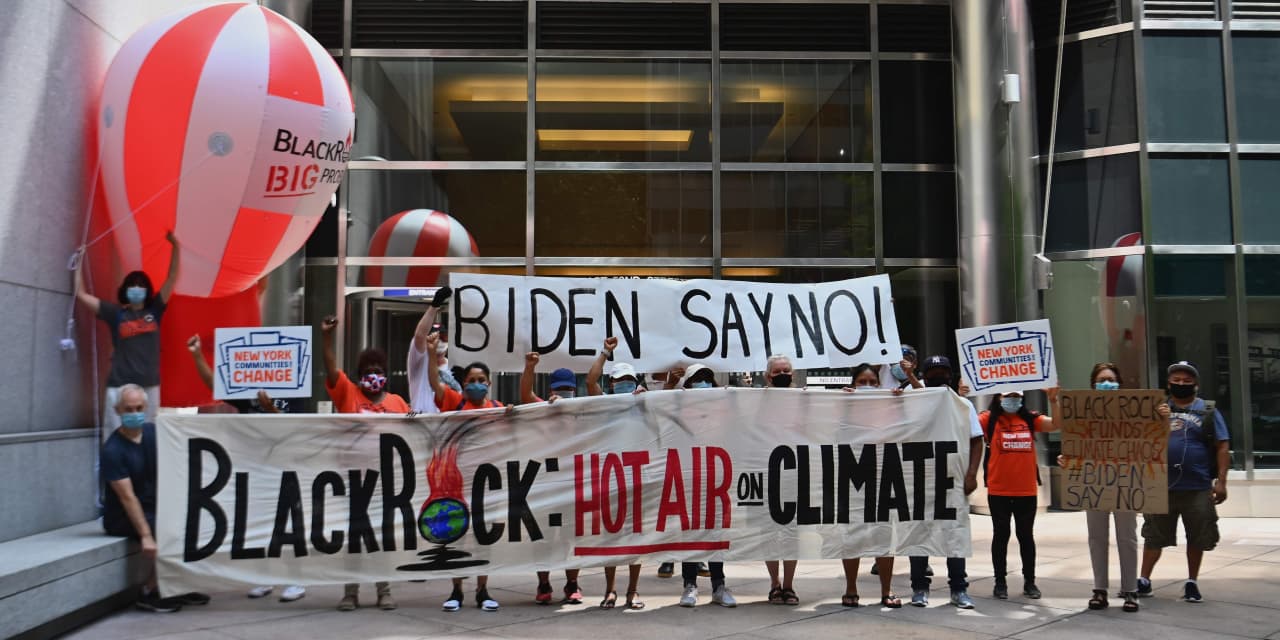

Testament to the asset manager’s influence, one such watchdog is explicitly named BlackRock’s Big Problem Campaign.

Casey Harrell, the group’s senior strategist, said “BlackRock issued an aspirational goal that it has confidence it can achieve. This goal is big enough that it could have the global impact needed. BlackRock must include specific targets and emission reduction goals for heavy-polluting sectors.”

“It must use every tool in its toolbelt to achieve these results, including engagement, voting, investment policy and fund capital allocation,” Harrell added.

BlackRock, for instance, still has some exposure to the global coal sector. Coal use, which has been replaced in many uses with natural gas

NG00,

remains the “dirtiest” emitter among fossil fuels.

Read: Larry Fink says globalization is over — Here’s what it means for markets

“BlackRock must act with urgency, especially with respect to the fossil fuel expansionists in [its] portfolio that are leading us to climate catastrophe,” said Lara Cuvelier, sustainable investment manager with advocacy Reclaim Finance. “After all, BlackRock today holds $34 billion in companies planning to expand their coal business, such as Glencore

GLEN,

”

BlackRock, along with Vanguard Group, Allianz Global Investors and Brookfield Asset Management and others, have formed the Net Zero Asset Managers Initiative, which pledged to reduce greenhouse-gas emissions by 2050.

Last November, think tank Universal Owner, said the firms in the initiative held portfolios that put them on track to cut their CO2 footprint by just 20% this decade. That’s below the 50% cut identified by scientists as critical to reaching a mid-century goal of full carbon neutrality.