This post was originally published on this site

As inflation stubbornly clings to the U.S. economy, people are increasingly looking for solutions, and at the top of the list is this one: Why not just print more money? And why not do it without telling people, so that it doesn’t backfire with even more inflation?

The idea pops up all over, and the approaches to explaining it range from Jack Corbett on NPR’s popular Planet Money TikTok channel to a discussion on the “ask science” subReddit to various YouTube contributors like Money & Macro.

This isn’t necessarily a practical question, but is probably more about monetary theory at a fundamental level, like why do we even have this financial system? And if our money supply is truly in our control, why don’t we just fix it?

These days, the big imponderables about the world are summed up in short sardonic videos with rights-free soundtracks and clip-art graphics on TikTok, Reddit, YouTube and other social media channels. They are supplemented by copious amounts of comments, and the whole package taken together becomes a form of primary source material that has a wider reach than most textbooks.

Some 60% of young people get financial information from social media, according to the Finra Foundation, which can lead to some pretty risky investing behavior in options, cryptocurrency and meme stocks. In my household, these social media items on financial literacy reach me via texts from my teenagers, who send clips along and ask me if whatever is being said is true. So maybe a little fact-checking is in order, especially because some of the concepts being batted around are not so easy to understand, even for the experts.

So, then, what’s the answer?

Instead of asking an AI chatbot to explain, I turned to economist Larry Kotlikoff, a professor of economics at Boston University. While the answer to this particular question seems easy—printing money is generally what causes inflation, cue images of useless paper money in wheelbarrows—it’s obviously more complicated than that, especially concerning today’s inflation and what to do about it. January’s inflation numbers kicked off 2023 with mixed messages, with the CPI showing inflation easing, but maybe not as quickly as omelet-lovers and others would like.

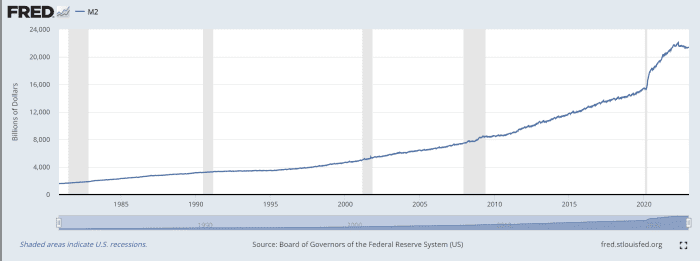

First, with regard to whether or not the printing of money is secret or open, it’s a matter of how you define transparency. The U.S. government releases data about the monetary supply and how much new money it’s printing, but Kotlikoff doubts that most people are going to the Federal Reserve to analyze the latest data on M2, which is the measure of the currency held by the public, plus deposits and shares in retail mutual funds.

“It’s not like millions of people go to the St. Louis Fed website,” to check the monetary supply before heading to the grocery store, he says. So the presumption that knowledge about what the government does influences how people react might be overreaching a little. Even if they are learning about it indirectly through academic or news outlets, it’s still not likely affecting their daily purchasing practices in a way that could swing inflation measurably.

That said, Kotlikoff says that economies that have no public reporting about the monetary supply leave people guessing, and that can be volatile. He points to Argentina, where the central bank prints money and nobody has any idea, so they don’t trust anything.

“Everyone assumes much higher inflation will arise than they should, and you have a self-fulfilling prophecy—I raise prices because I think you’re raising prices, and workers demand more wages. Then it’s off to the races,” says Kotlikoff.

Lots of money is already being inked

For all those suggesting printing more money, Kotlikoff says that we’re basically already doing that. If you do happen to go to the St. Louis Fed website, you can see that the M2 monetary supply has been steadily increasing, with a huge jump in 2020.

Board of Governors of the Federal Reserve System (U.S.)

But that’s not necessarily what’s causing our spike in inflation now, and printing more money is not the only thing that will fix it. “What’s causal is dicey,” says Kotlikoff. “The M2 has increased dramatically since 2008, and for many years, it grew and prices did not go up.”

The big spike in 2020 was because of Covid-relief spending, for the most part, and then prices started to go up. Now prices are coming down, inflation is easing and M2 is coming down as well. “That’s because interest rates are higher and people aren’t borrowing as much,” says Kotlikoff.

There’s also a lot more going on than that, including Federal Reserve action on interest rates, government spending and external political and natural factors like war and weather disasters. So you can’t draw a clean line showing a close connection between the monetary supply and price levels, and that means there’s not a simple solution like printing money to solve inflation.

“If the stock market goes up today and my cat meows three times, there’s a close connection there too,” Kotlikoff says.

Now that’s an explanation my teens can appreciate (but not so much our dog).