This post was originally published on this site

Ares Capital (ARCC) is a big-dividend business development company (“BDC”) that has sold off hard during the pandemic because of its exposure to small (“middle-market”) businesses (i.e. the business than have been hit particularly hard). In this article we review the business (including important sector exposures), the balance sheet liquidity (to deal with the crisis), dividend safety, valuation and risks, and then conclude with our opinion on why this particular BDC stands out like a sore thumb.

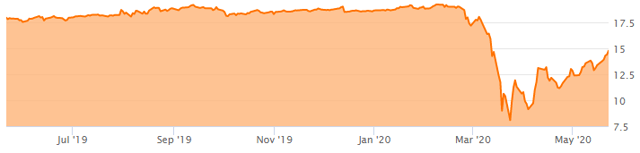

Ares Capital Share Price:

Overview:

Ares Capital Corporation is an externally-managed business development company primarily focused on providing debt and equity financing to middle market companies (annual EBITDA between $10 million and $250 million) and power generation projects in the US. As of March 31, 2020, ARCC is the largest BDC in the United States with ~$14.4 billion in total assets.

For a little more color, Ares middle-market portfolio investments generally range in size from $30 million to $500 million, and consist primarily of senior secured debt investments, mezzanine debt, and equity in some cases. Also, Ares “Power Generation or Project Finance” investments are in the range of $10 to $200 million, consisting primarily of debt instruments.

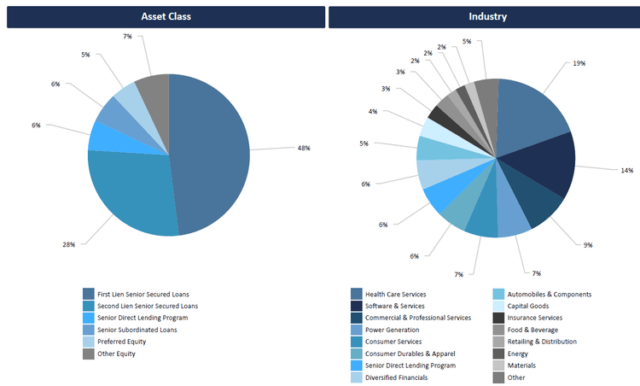

ARCC’s portfolio is highly diversified across 354 companies with senior secured (first and second lien) accounting for ~80% of total investments. This adds to safety as first and second lien senior secured loans rank ahead of subordinated debt. Ares’ portfolio is more diverse than its peer average, with the top 15 investments accounting for 28.3% of portfolio at Q120, thereby limiting the loss exposure to any individual investment. In fact, no single borrower accounts for more than 3% of the portfolio at fair value.

(source: Company Presentation)

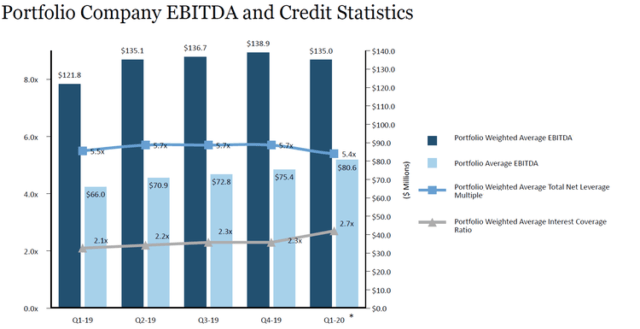

Further, ARCC’s portfolio credit metrics are strong. For example, the weighted average interest coverage ratio for portfolio companies is a solid 2.7x, providing ARCC reasonable cushion in downturn (i.e. like the current downturn). The portfolio average EBITDA has been increasing sequentially every quarter for the past one year (bearing in mind the last report date was as of the end of Q1—when the pandemic was just beginning to ramp).

(source: Company Presentation)

Defensive Portfolio and Ample Liquidity Should Minimize COVID-19 Impacts

Ares will be impacted by the COVID-19 pandemic, however it’s well-positioned (especially relative to peers) thanks to its strategic industry exposures. Firstly, a large portion of its portfolio is in defensive industries, such as healthcare services (~14% of portfolio), software (~9%) and professional services (~7%). Secondly, Ares is underweight the industries that will be most impacted by the pandemic, such as energy, travel, restaurants, hospitality and retail. Notably, 81% of the S&P Leveraged Loan Industry defaults (over the last 12 months) were in cyclical industries undergoing structural shifts (e.g., media, energy and retail). We believe ARCC’s focus on defensively positioned companies in less cyclical industries gives it an advantage in the current environment.

In terms of liquidity, we believe that Ares is well positioned (with a strong balance sheet) to weather the current market. As of Q1-20, ~56% of Ares funded debt capital was in unsecured term notes, and these loans give ARCC significant unencumbered assets and provide meaningful over-collateralization of secured credit facilities. Notably, ARCC has ~$2.6 billion of available liquidity as of May 2020. Further, Ares management noted that this deep liquidity position is very important in allowing Ares to support its portfolio companies and to invest in the recovery. For example, per CEO Kipp deVeer, during the Q1-20 earnings call:

“we believe we have a strong balance sheet that provides a unique advantage in today’s market. We have access to all of our undrawn liabilities, and this provides robust solutions to support portfolio companies. We view liquidity in this market as a strategic asset that allows us to remain supportive of our existing sponsor relationships and portfolio companies while many others are retrenching. We also have no near-term debt maturities to satisfy, so we can focus our capital investing to support portfolio companies.”

Stable Dividend

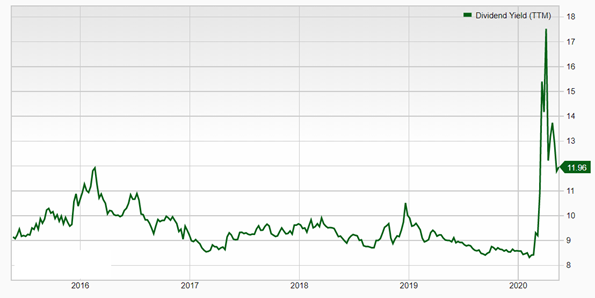

Ares recently declared a second quarter dividend consistent with the first quarter dividend, which is encouraging to many investors in this highly uncertain market environment. Also encouraging, Ares estimates that it carried forward excess taxable income of ~$408 million or $0.96 per share from 2019 for distribution to stockholders in 2020. This significant spillover will help support a steady dividend through varying market conditions. Also worth mentioning, ARCC’s current dividend yield compares favorably to the industry average (see data: CEFdata) considering ARCC’s significantly lower risk profile relative to peers (i.e. the yield is slightly lower, but the risk is significantly lower).

Adding to ARCC’s ability to support the dividend, the company’s debt maturities are well laddered, and it has no maturities until 2022. Importantly, total 2022 maturities are less than 12% of its current total debt outstanding. Also important, Ares has ~$2.6 billion of available liquidity as of May 2020. Even after factoring in a cautious outlook for a possible slow and an uneven recovery, we believe Ares has enough dry powder support a steady dividend level for the foreseeable future.

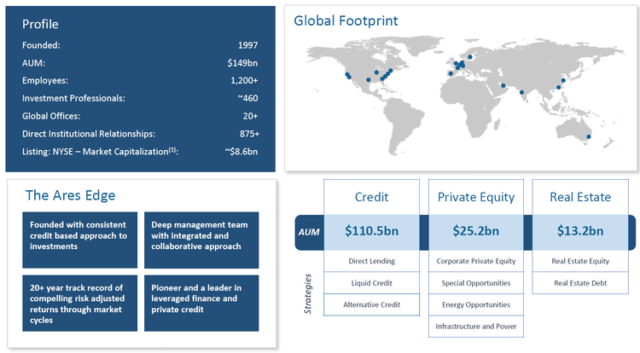

Marquee parent provides sustained advantages

Another advantage worth noting, Ares Capital Corp is part of the $149 billion asset manager Ares Management, L.P. (ARES) that operates in multiple asset classes including high yield bonds, alternative credit, private equity and real estate. A diversified, multiple asset class based platform provides ARCC synergies in the form of valuable investment origination leads as well as investment intelligence from other parts of the business.

(source: Company Presentation)

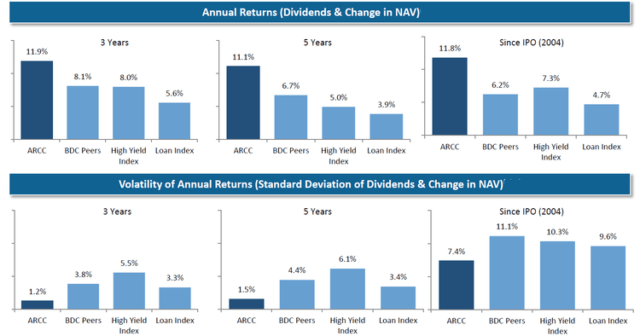

High return track record, relatively lower risk

Since ARCC’s IPO in 2004, its net asset value (“NAV”) has increased at a compound annual growth rate (“CAGR”) of 15% and the stock has returned close to 13% annually. Additionally, the company’s realized ROE is the highest in the industry on a five-year basis, ~437 bps greater than its peer average. Finally, as evident in the chart below, the company has outperformed the industry in terms of annualized returns (NAV change + Dividends) since its IPO, as well as over the last three and five years. And these attractive returns have been achieved at much lower risk levels. For example, the five-year volatility of annual returns generated by ARCC is just 1.5% vs. 4.4% for BDC peers.

(source: Company Presentation)

The strength of ARCC’s investment team has contributed to the successful long-term track record. For example, the team has invested ~$57 billion across 1,300 deals since 2004 and boasts an average 24 years of investing experience. The long tenure of the team provides an added layer of support for ARCC’s ongoing success.

Valuation:

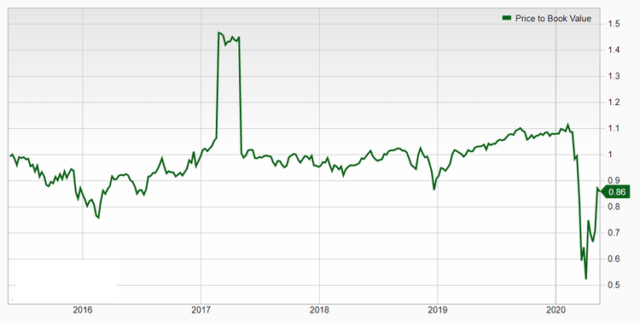

Ares currently trades at an attractive price-to-book value. For example, the shares have historically traded in a range of 0.9x-1.1x. However, the COVID-19 sell-off dragged the shares below 0.6x in late March. The shares have since rebounded somewhat, but still trade below the historical range, and given ARCC’s strong financial position, we believe this presents an attractive investment opportunity. Specifically, we believe Ares will likely get through this mess, and come out stronger on the other side.

Also worth mentioning, Ares may be undervalued from a dividend yield standpoint (see chart below). The current yield is above the normal range, suggesting there is potential for price appreciation as the pandemic passes (or at least slows), whereby a price increase would return the yield to a normal level, especially considering Ares financial strength.

(source: Zacks Investment Research)

(source: Zacks Investment Research)

Risks:

Underwriting risk: Ares invests primarily in debt instruments of middle-market companies which makes its inherently risky (i.e. if they weren’t risky, the yields wouldn’t be as high as they are). Thus, it’s exposed to underwriting risk. Poor underwriting on the part or Ares could lead to heavy losses in its portfolio. However, as mentioned previously, the team is well tenured with a track record of success.

Prolonged recession risk: Again, BDCs are inherently more risky than many other types of investments (considering their business is to provide financing to middle market companies—which are less established and more risky). Should the current coronavirus pandemic impact the economy more dramatically, and for a longer period of time than expected, Ares business would likely be negatively impacted.

Low interest rates: Are a risk factor for Ares as they negatively impact investment income. The majority of the company’s portfolio investments have yields tied to market interest rates such as LIBOR. At the same time, a large portion of the company’s liabilities are fixed in nature and as such the company’s interest payments on its debt do not see a commensurate decline. As a result, a rapid decline in interest rates (which seems quite unlikely given the Fed’s near zero policy) can lead to compression in the company’s net interest margin (worth mentioning, ~79% of ARCC’s floating rate investments have interest rate floors, which helps minimizes earnings erosion from interest rate declines).

Conclusion:

Ares sticks out like a sore thumb within the BDC space because of its attractive big dividend and relatively lower risk as compared to other BDCs. Ares doesn’t have the highest yield in the BDC space, but it’s one of the safest, most-well established and liquid BDCs, and the risk-reward trade-off makes it a highly compelling investment opportunity during this coronavirus sell-off. In our view, Ares is worth considering for a spot in your prudently-diversified income-focused investment portfolio.

We currently own shares of Ares Capital, and we have ranked it no. 8 on our recent members-only report: Forget FAANG: Top 12 Big Dividends (the report covers BDCs, REITs and preferred stocks).

*Memorial Day Sale: Offer Expires Tuesday, May 26th.

Whether you’re retired, soon to be retired, or just like high income, we’ll help you build a steady high-income portfolio, that you can use like paycheck, and with an account balance that grows. Big Dividends PLUS. Better. Smarter. More Profitable.

Disclosure: I am/we are long ARCC.