This post was originally published on this site

Influential companies, including retail giants Amazon.com and Target; and tech powerhouses Microsoft and Meta — parent company of Facebook

FB,

bought a record 31.1 gigawatts of renewable energy to run their operations in 2021. That’s a jump of nearly 24% from the previous year’s record of 25.1GW of renewables, mostly solar and wind.

The latest tally comes from research firm BloombergNEF, which said in a release Monday that over two-thirds of these purchases occurred in the U.S. America has trailed Europe and parts of Asia in shifting from coal and natural gas-derived

NG00,

power to renewable alternatives

ICLN,

to create electricity. Within the U.S., the largest technology companies are leading the move, however; they collectively signed over half of the deals.

“‘Big tech faces mounting pressure from investors to decarbonize…’”

Broadly speaking, more than 137 corporations in 32 countries publicly announced clean energy contracts in 2021, according to BNEF’s outlook. This made up more than 10% of all the renewable energy capacity added globally last year, showing the impact corporate sustainability pledges are having on clean energy build.

Companies are tapping alternatives sources even as the most stringent environmental groups and some investors argue major corporations aren’t doing enough toward curbing global warming by rethinking consumption and slowly weening themselves from fossil fuels.

“More corporations are making new sustainability commitments, costs for renewables are plummeting, and regulators around the world are slowly coming around to the fact that clean energy might be a silver bullet in the decarbonization of the private sector,” said Kyle Harrison, head of sustainability research at BNEF.

Fossil fuel combustion for energy accounts for some 74% of total U.S. greenhouse gas emissions.

Solar and wind prices fluctuate like any energy market, including when supply shortages run up component prices like in the current climate and regulatory and legislative uncertainty persists. But an arm’s length view of recent decades show how much cheaper these sources have gotten.

A 2019 report from the nonprofit Rocky Mountain Institute found that it was cheaper to build and use a combination of renewables like wind and solar than to build new natural gas plants. A 2020 report from Carbon Tracker found that in each of the world’s energy markets, it’s cheaper to invest in renewables than in coal.

Don’t miss: Chevron deepens carbon-capture push with Microsoft, Schlumberger linkage

Acting on pledges

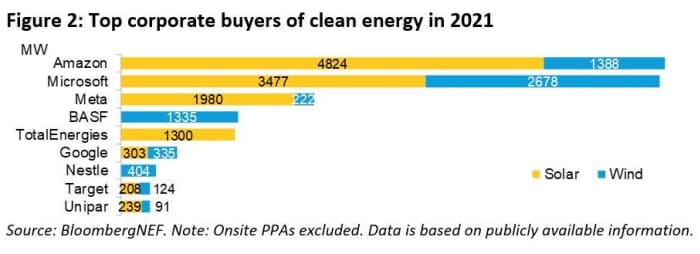

For the second year in a row, Amazon.com AMZN was the biggest buyer globally, announcing 44 offsite PPAs in nine countries, totaling 6.2GW. This brings its total clean energy PPA capacity to 13.9GW, making its clean energy portfolio the 12th largest globally among all types of companies, just ahead of EDF.

Amazon, which has faced social backlash for worker rights and whether its fast delivery is “green” enough even with sustainable actions, has aimed to be carbon-neutral by 2040, a decade sooner than most national pledges.

Microsoft

MSFT,

and Facebook parent Meta have the next largest among corporations, at 8.9GW and 8GW, respectively. Previously, Alphabet’s Google

GOOGL,

held the corporate clean energy crown, but has turned its attention more to sourcing 24/7 carbon-free power through methods outside of PPAs.

“The clean energy portfolios of big tech companies now rival those of the world’s biggest utilities,” said Helen Dewhurst, senior associate at BNEF.

“Big tech faces mounting pressure from investors to decarbonize and this is reflected in the steep increase in clean energy volumes purchased,” she said. “The PPAs inked in previous years pale in comparison to the portfolios announced in 2021.”

Read: U.S. airlines and Amazon Air form alliance to ramp up sustainable fuels, but supply lacks

Corporate sustainability commitments are still a driving force behind the record-breaking clean energy purchases. Some 67 companies set an RE100 target in 2021, pledging to offset 100% of their electricity demand with clean energy, bringing the campaign to 355 members across 25 countries.

These companies collectively consume 363TWh of electricity annually based on their latest filings. By comparison that much power exceeds the U.K.’s entire power generation for the same year.

BNEF estimates that these 355 RE100 companies will need to purchase an additional 246TWh of clean electricity in 2030 to meet their targets.

Purchases by country

The Americas accounted for two thirds of the clean-energy activity, BNEF said, with 20.3 gigawatts of power purchase agreements (PPAs) announced. The U.S. led, at 17GW.

The virtual PPA, which functions in a similar way to a financial hedge, continues to dominate the U.S. market, with 12GW of deals, but green tariffs with regulated utilities also experienced a record year, at 3.2GW.

Europe recorded a record 8.7GW of deals announced, with big years from Spain and the Nordics. Across Asia, just 2GW of PPAs were announced, but there were a number of other developments, BNEF analysts pointed out. For example, legislation for a corporate PPA model in South Korea was introduced in October 2021, while both China and Japan both saw record clean energy certificate issuances.