This post was originally published on this site

Investment Thesis

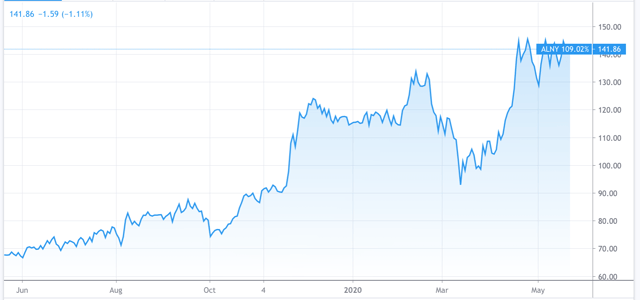

Alnylam 1-year share price performance. Source: TradingView

Alnylam 1-year share price performance. Source: TradingView

Alnylam (ALNY) is arguably the best known and most advanced developer of RNAi therapeutics – using small interfering RNA (“siRNA”) to identify messenger RNA (“mRNA”) and disrupt the process by which it encodes disease causing proteins. This is also often referred to as gene-silencing, or “switching off” the production of mutant proteins.

RNAi therapeutics is enjoying a strong “second wind”, after the initial promise of the 2006 Nobel Prize-winning science fizzled out as companies such as Alnylam, Dicerna (DRNA) and Sirna – who attracted significant big-Pharma funding in the mid-to-late noughties – struggled to overcome the difficulty of safely delivering siRNA to target cells without damaging healthy ones. As a result, Alnylam was forced to lay off 25% of its workforce in 2010, and despite a spike in its stock in 2015 – to a price of $133 – traded at lows of $43 at the beginning of 2017.

It was Alnylam that made the significant breakthrough, discovering that binding siRNA to a sugar molecule known as N-acetylgalactosamine (“GalNAc”) allowed it to safely penetrate the cells of the liver. This led to a renewed surge of interest in RNAi therapeutics and eventually – after a decade of trying – the first commercialized RNAi treatment – Alnylam’s Onpattro.

Onpattro – approved in August 2018 for the treatment of hATTR Amyloidosis with Polyneuropathy – got off to a slow start sales-wise, but the drug (called Patisiran – Onpattro is the brand name) earned Alnylam ~$160m in the full-year 2019, and $67m in the first quarter of 2020.

Although it is not the best-selling RNA-therapeutic on the market (that honor goes to Ionis Pharmaceuticals (my note here) / Bayer’s antisense drug Spinraza – indicated to treat spinal muscular atrophy – which made global sales >$2bn in 2019) peak sales have been estimated as high as $1bn, making Onpattro a potential blockbuster in the making. To date, Onpattro’s sales have comfortably outshone those of Tegsedi – a rival RNAi treatment released by Ionis for hATTR.

Givlaari is the company’s second commercialized treatment, approved in November last year to treat the genetic disorder acute hepatic porphyria, which causes painful neuro-visceral attacks that often require hospitalisation. Fierce Biotech has estimated that peak sales of $500m may be achievable with Givlaari – which has a list price of $575,000.

One of the drawbacks of current RNAi treatments is their very high cost, whilst another is the challenge of delivering treatments to organs other than the liver. This is a problem that the industry is struggling to overcome, but also one that will handsomely reward the solver with likely blockbuster treatment sales and exponential share price / market cap growth.

In terms of its share price Alnylam has enjoyed a strong start to the year. Starting at $115, the price rose to $134 in late February before dropping to a low of $92 at the height of the coronavirus-induced market sell-off. Since that point the stock has gained 53% to reach $141 at the time of writing.

Clearly, RNAi therapeutics has enormous potential as a treatment, and it would be reasonable to conclude that most RNAi drug-developers ought to have their best years ahead of them, as more drugs are approved for a wider range of treatments with larger addressable market sizes, and as the science becomes more accepted by physicians and wins wider-ranging reimbursement – both in the US and globally.

Balanced against that are several potential headwinds such as the rare nature of many of the diseases RNAi can treat, which may lead to overcrowded markets with numerous competing treatments (this is already beginning to happen), the struggle to progress the treatment away from the liver to treat, for example, solid tumors, or diseases affecting the central nervous system, and the success of alternative medicines in development such as monoclonal antibodies, mRNA vaccines and stem cell therapies.

Still, Alnylam’s management has a knack of outperforming expectations and delivering when it counts, and putting the share price on an upward trajectory despite the fact the company has been heavily loss making (-$500m, -$800m, -$939m) in each of the past 3 full years with no signs that profitability is imminent.

This does not seem to put the market or big Pharma concerns off however, raising the possibility either of a lucrative acquisition (such as the $9.7bn recently paid by Novartis (NOVN) to acquire the Medicines Company and its promising cholesterol-lowering treatment Inclisiran – licensed from Alnylam), or of Alnylam achieving its stated goal of becoming a “top 5 biotech concern”, and a “multi-product global commercial company with a deep clinical pipeline for future growth and a robust and organic product engine for sustainable innovation.”

For that reason, despite its recent gains I make Alnylam a buy with a good chance of pushing towards a price of $175 or higher by the end of 2020, based on the progress and positive news flow the company is likely to generate in 2020. Analysts have set a consensus 1-year price target for the stock of $159, with a high of $202, and a low of $74.

In the rest of this article I will look at Alnylam’s Q120 results, assess the company’s promising pipeline which includes 4 drugs progressing rapidly towards commercialization, the recent $2bn funding deal signed with Blackstone, and attempt to assign a fair value based on forecasting revenues up to 2025.

Q1 results – 2020 expectations lowered on Coronavirus disruption but progress encouraging

Q120 results exceeded analysts’ expectations in terms of top-line revenues with the company generating $99.5m – up 200% year-on-year, and $9m ahead of consensus – but missed marginally (by $0.01) on EPS of -$1.52. Overall the company made a $182m loss for the quarter – compared to a loss of $181m in Q119.

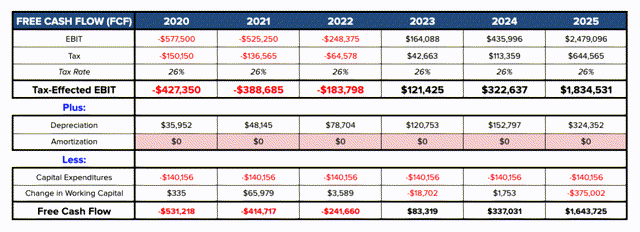

Sales of Onpattro were encouraging, earning Alnylam $66.7m in net revenues, which represents 19% sequential growth and 154% year-on-year, although the company has revised full year sales estimates down from $285m-$315m, to $270-$300m owing to the COVID-19 pandemic.

Onpattro launch update. Source: company Q120 results presentation

Onpattro launch update. Source: company Q120 results presentation

Despite a gross-to-net sales margin of ~20% (Alnylam CFO Jeff Poulton informed analysts on the Q120 earnings call) the overall data is encouraging with >950 patients using commercial Onpattro at the end of the quarter, >250 prescribing physicians and >90% adherence rates. Sales performance outside the US was impressive, with revenues increasing 47% sequentially and 202% on an annual basis to $29.5m in the quarter. Onpattro is approved in the EU (recent launches include Sweden, Israel, Turkey and Spain) Japan, Canada and Switzerland, and during the quarter Alnylam secured approval to market Onpattro in Brazil, whilst continuing to chase approval in the Middle East and Africa.

If Alnylam achieves the midpoint of its 2020 sales forecasts of $285m, representing 71% year-on-year growth, it will be on track (at such a growth rate) to reach $1bn in sales by 2023. Since the company has another candidate, Vutrisiran, currently undergoing 2 separate phase 3 studies for treatment of hATTR and wild-type ATTR amyloidosis, however, Onpattro may end up losing a chunk of its market share. The 2 drugs together, if approved, may well generate in excess of $1bn, however.

Alnylam also released sales figures for Givlaari. Having earned the company $0.2m in Q419, sales revenues increased by >2,500%, to $5.3m – with an estimated >50 patients on commercial therapy and >60 start forms received during the quarter. The company hopes to launch Givlaari in Germany in Q220, and has also introduced an innovative reimbursement strategy whereby the drug’s list price of $575,000 per patient ($39,000 per vial) will be subject to larger rebates based on “prevalence-based adjustments” if the number of AHP patients is higher than currently estimated. Analysts are expecting sales of Givlaari to reach $47m in 2020, with peak sales estimates around the $550m mark.

Net revenues from collaborations came in at $27.5m for the quarter whilst operating expenses increased 40% year-on-year to $310m, although management say they expect net losses to decrease going forward, forecasting operating expenses to come in at ~$1bn in 2020, and strong top-line growth in the second half of the year.

Blackstone deal ensures Alnylam remains well-funded despite losses

For a company that posted an accumulated deficit of $3.7bn at YE19, Alnylam has an impressive current ratio of 4.68x and debt to equity ratio of 0.7x, thanks in part to a financing arrangement sealed with Blackstone, the private equity group, which will eventually be worth $2bn to Alnylam.

By the terms of the deal, Alnylam will receive $1bn for a 50% share of its milestone payment and revenue sharing agreement with Novartis related to Inclisiran, the drug that Alnylam licensed to The Medicines Company before Novartis acquired that company in a $9.7bn deal, and which analysts say could reach $1.5bn in peak sales. Blackstone will also purchase $100m of Alnylam stock, provide a loan of $750m, and potentially acquire Vutrisiran and another candidate, ALN-AGT, targeting hypertension.

The Blackstone deal provides another endorsement not only of the strength of the market’s goodwill towards RNAi therapeutics and their future potential, but also of management’s ability to anticipate and solve issues (such as funding) as it progresses its multiple candidates towards approval and ramps up its sales operations.

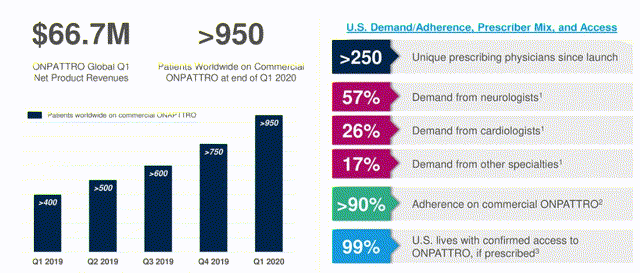

Alnylam current treatment pipeline. Source: company website.

Alnylam current treatment pipeline. Source: company website.

Alnylam has now submitted regulatory filings in the US and Europe for Lumasiran with management sounding bullish on the Q1 earnings call that approval for the drug – which is indicated for treatment of Primary Hyperoxaluria (“PH1”) – can be secured in 2020, based on Lumasiran meeting its primary endpoint in a phase 3 study of percent change from baseline, versus placebo, in 24-hour urinary oxalate excretion averaged across month 3 to month 6.

Alnylam believes Lumasiran can achieve peak sales of ~$500m. PH1 is a rare disease that affects between 3,000-5,000 patients in the US and Europe – a niche market within which the company is likely to face fierce competition from the likes of rival RNAi drug developer Dicerna and Oxthera, who are both expected to launch treatments within the next 1-2 years, provided approval is secured. Still, Alnylam believes that many patients suffering with PH1 remain undiagnosed, and intends to launch an awareness campaign which may well increase the addressable market size. Lumasiran is likely to come with a list price somewhere between $375,000 – $575,000 per annum.

The next cab-off-the-rank is likely to be Inclisiran – the hypercholesterolemia treatment which is in registration in both the US and EU, with NDA and MAA filings accepted, and approval likely to be secured in 2020. Whilst this represents a significant coup for Alnylam, its earnings from global sales and commercialisation payments will be mostly swallowed up by Blackstone and Novartis with Alnylam earning a small share of revenues that have been forecast to exceed $1.6bn, provided Inclisiran can secure market share in another competitive market, albeit one where current treatments have been underperforming.

Vutrisiran is also nearing the approval stage as 1 of its 2 phase 3 trials is now fully enrolled with results expected early next year. Vutrisiran could be approved for both hATTR patients with polyneuropathy and wild-type ATTR amyloidosis patients with cardiomyopathy – the focus of the second pivotal trial.

Finally, Fitusiran – in development for treatment of hemophilia A or B with or without inhibitors, in partnership with Sanofi, is now fully enrolled in 2 phase 3 trials, with Sanofi forecasting that results will be available in early 2021. Peak sales forecasts for Fitusiran have been estimated to be in the region of ~$300m

Is Alnylam a buy? Assessing a fair value price for the stock.

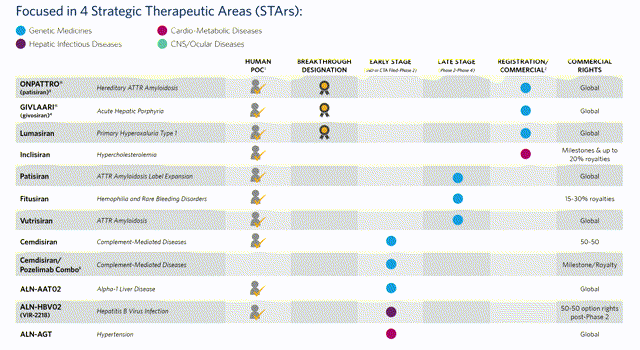

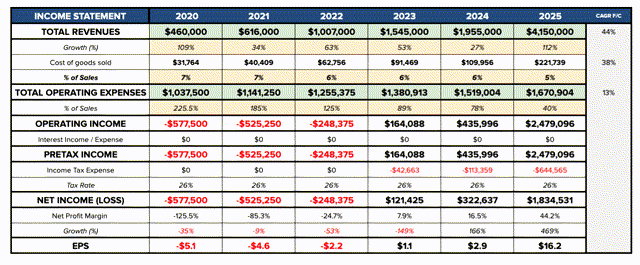

Alnylam financial forecasts to 2025. Source: my table using company estimates, researched peak sales volumes, and other assumptions.

Alnylam financial forecasts to 2025. Source: my table using company estimates, researched peak sales volumes, and other assumptions.

If we plug all of the above treatments and their estimated peak sales volumes (assuming they are reached in 2025) into a financial model, and assume sales revenues grow steadily to their 2025 peaks, by my calculations the company could achieve profitability by 2023, and deliver a free cash flow of ~ $1.6bn in 2025, displaying strong momentum and certainly justifying the faith placed in the company by its financial backers, investors, and development and commercial partners.

Alnylam free cash flow estimates. Source: my table and assumptions.

Assuming a WACC of 9.5% (expected market return =8%) we arrive at a present day firm value of $18.2bn (compared to today’s market cap of $16.4bn) and a fair value price of $154 – a 6% premium to today’s price.

Of course, these are ballpark figures only but they do serve (I believe) to underline the strength of the company’s potential forward momentum. Some of Alnylam’s drugs may not be approved, whilst others, Onpattro for example, currently being advanced for the potential treatment of the cardiomyopathy of both hereditary and wild-type ATTR amyloidosis, may secure further approvals and increase their addressable markets, or gain a larger share of a particular market than expected.

Conclusion

Alnylam has a pivotal year ahead of it which will go a long way towards determining whether it can deliver CEO John Maraganore’s goal of becoming a “top five” biopharma concern.

Should the company secure 2 new approvals this year it may well emerge as a clear leader within the field of RNAi therapeutics, which is likely to propel the company’s fortunes (and share price) to new heights. The company has endured many ups and downs over the past decade but has the experience, funding and pipeline to justify its current high valuation.

Furthermore, given that my fair value estimates do not factor in the significant goodwill the company is likely to generate if it continues along its path to progress, I can see the share price eventually climbing past $200, buoyed by multiple approvals, new candidates, partnerships and enthusiastic investors.

Whilst all clinical trials carry a high risk of failure, and Alnylam could face serious financial woes if peak sales estimates fail to materialize, meaning there is a significant downside risk to be considered ahead of making an investment, it is not hard to make a bullish investment case for Alnylam as a best-in-class RNAi drug developer.

My main caveat around selecting Alnylam as an investment in a biotech portfolio would be not to overload a portfolio with RNAi developers, which is a temptation since all of these companies are enjoying a “purple patch” with the market and scientists converging on a very optimistic RNAi take.

Gain access to all of the market research and financial analytics used in the preparation of this article plus exclusive content and pharma, healthcare and biotech investment recommendations and research / analytics by subscribing to my channel, Haggerston BioHealth.

Disclosure: I am/we are long ALNY, IONS. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.