This post was originally published on this site

Investing.com — Albemarle (NYSE:ALB) stock soared 9.8% on Thursday after the lithium miner raised its guidance for the years in the wake of a stellar first quarter.

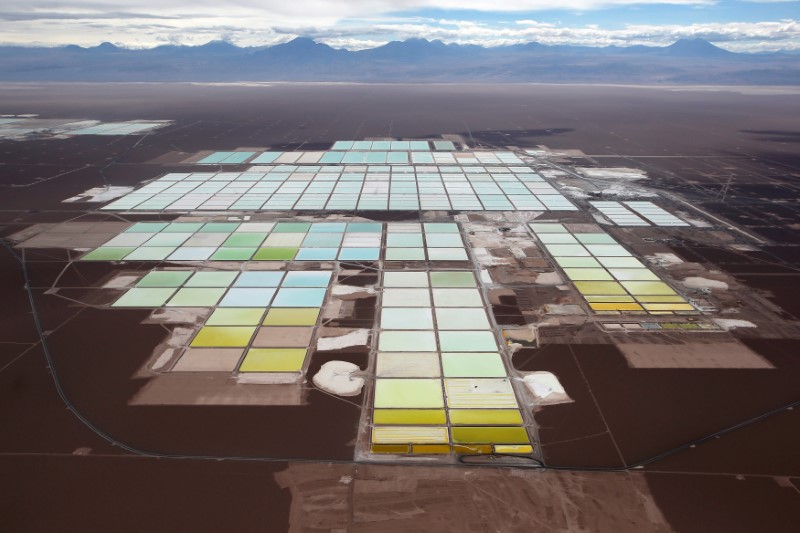

Tight supply and fast-growing demand from the electric vehicle sector for lithium, the key element for most EV batteries, drove the company to an adjusted profit of $2.38 a share in the first quarter, nearly 50% above consensus forecasts, while sales at the key lithium unit nearly doubled to $550 million.

Albemarle said it expects strong pricing conditions to continue through the year, leading average prices to double from 2021 levels. As regards volume, it stuck by its previous guidance of an increase in output of between 20% and 30%, as it ramps up production at its Wodgina mine in Australia. It then expects lithium output to double between 2023 and 2025 to around 200,000 tons, with a slight preponderance of lithium hydroxide over lithium carbonate.

The company now sees full-year earnings per share at between $9.25 and $12.25, up from a prior estimate of $5.65 to $6.65. Net cash from operations is now seen as high as $800 million this year. That cash flow is on course to cut the company’s net debt to less than two times EBITDA from a multiple of 2.3 times at the end of 2021. It will also fund an increase of over 40% in capital expenditure to around $1.4 billion.

Net sales, meanwhile, are now expected between $5.2 billion and $5.6 billion, well above a prior consensus of around $4.4 billion.

Albemarle stock stood out on a morning when the broader market was again in a retreat after a sharp rally in response to the Federal Reserve’s press conference on Wednesday.